The Best DividendPaying Stocks

Post on: 16 Март, 2015 No Comment

Other People Are Reading

Follow the Cash

A company pays dividends out of the profits or cash flow it generates from operations. Evaluate dividend safety by comparing the dividend rate to the cash available. For corporations, the dividend payout ratio, the dividend percentage to net income per share, is a popular metric. For example, a stock that earned $2 per share in net income and pays a $1 dividend has a 50 percent payout ratio. Companies using tax-advantaged business structures, including real estate investment trusts and master limited partnerships, must pay out 90 percent or more of net income as dividends. For these companies, compare the dividend rate to free cash flow per share. REITs report funds from operations to show the cash available for distribution, and MLPs call it distributable cash flow. FFO and DCF are often much higher than the reported net income per share, providing a margin of dividend safety.

The Yield vs. Growth Spectrum

Buying Dividends for the Long Term

References

More Like This

List of High Dividend Stocks

Highest Dividend Stocks in S&P 500

The Best Dividend Stocks for Under Ten Dollars

You May Also Like

Utility stocks are well-known for being among the highest dividend-paying stocks. For investors looking for stability and ongoing income. high-yield stocks.

10 Best Dividend-Paying Stocks. Dividend-paying stocks are usually purchased as a long-term investment, which qualifies the dividends for a lower tax rate.

There are a ton of publicly traded companies that pay a quarterly or monthly dividend. But how do we go about finding.

You also should review the terms that apply to cards to select the one that best fits your. while the company's.

Stock clerks play a key role in the dynamic manufacturing and retail industries. like assisting co-workers and paying attention to small.

Dividends are an important component of the total return from stocks, especially for long-term investors. For the 30-year period from 1980 through.

The Best Investments for Income for Seniors. Seniors have unique needs when it comes to income and cash flow. Dividend Paying.

10 Best Dividend-Paying Stocks. Dividend-paying stocks are usually purchased as a long-term investment, which qualifies the dividends for a lower tax rate.

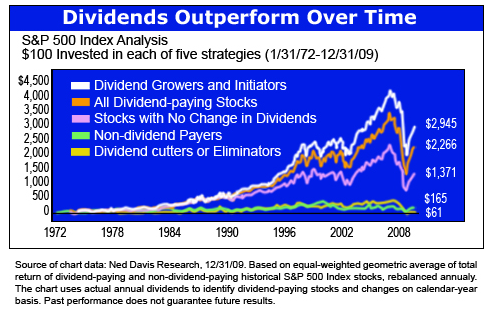

Dividend paying stocks provide current income and a potential for capital appreciation. Stocks that increase dividends over time have the best total.

Check out websites such as Yahoo Finance, MSN Money and Motley Fool under the Investing tabs. Most of these websites have lists.

10 Best Dividend-Paying Stocks. Dividend-paying stocks are usually purchased as a long-term. Cash dividends are paid from a company's after-tax net.

Investors with the primary goal of income look for assets with the highest yield. Dividend-producing stocks and bonds are among the possibilities.

The pledgor may also receive income from the dividends paid out from the stock, unless those stock dividends are. for paying.

10 Best Dividend-Paying Stocks. Dividend-paying stocks are usually purchased as a long-term investment, which qualifies the dividends for a lower tax rate.

How to Avoid Losing Money Investing in Top Dividend-paying Stocks.

The Best Long-Term Stocks to Invest in. 10 Best Dividend-Paying Stocks. Dividend-paying stocks are usually purchased as a long-term investment.