The Barbell Asset Allocation

Post on: 22 Июль, 2015 No Comment

I have been thinking about the twin challenges faced by intelligent investors at this point in the recovery cycle. On the one hand, we all want to participate in the surprising stock market rally and the continuing recovery. On the other hand, there are nagging doubts, fears of a double dip recession and about half the pundits still predicting doom and gloom and a falter in the rally. What is the intelligent response to this situation? Consider following the wealthy and creating a barbell asset allocation.

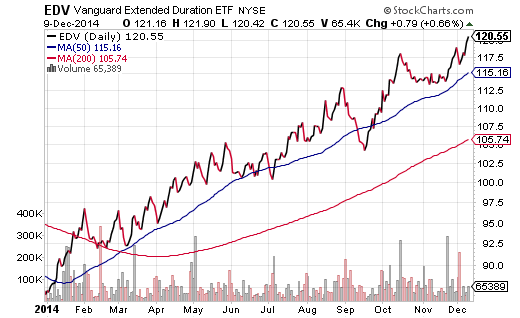

I am privileged to work with some of the wealthiest individuals on the planet, and I think that their response to this dilemma can apply to all investors. I like to call the approach “Barbell Asset Allocation.” You may know that the term barbell investing originally applied to fixed income investing, and it meant constructing a bond portfolio with very short term bonds, perceived as very low risk, and very long term bonds, perceived as high risk. Today, the description “barbell” is used to more generally describe an investment strategy that combines very low risk and high risk investments. I see wealthy investors applying a barbell approach to their overall wealth in response to the current market conditions.

Throughout this year, there have been several extensive surveys done of high- net-worth investors on their current investment strategy. The Family Wealth Alliance surveyed 79 family offices in their annual survey (you can purchase it at www.fwalliance.com ). The Economist Intelligence Unit was commissioned by Barclays Wealth to survey 2,000 wealthy individuals around the globe and published a paper called “New Horizon, New Behavior” in September 2009 (I was quoted in the research, and you can download it from my Web site). Most recently, the Family Office Channel, an exclusive group of advisors and wealthy families (www.familyofficechannel.com ) surveyed 100 advisers on current investment attitudes.

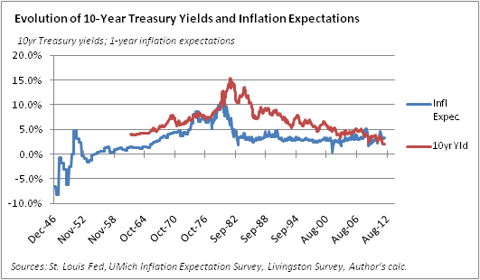

The findings across all surveys were consistent–wealthy clients are returning to a much more conservative money management style and plan to stay that way. They are more skeptical of highly engineered products (like structured notes and hedge funds) and are concentrating on plain vanilla liquid investments like bonds, stocks, commodities and ETFs. Rather than use complicated option strategies to hedge the risk of a financial meltdown, they were turning to an old favorite–cash. They are not as bothered by the low yields on cash as the professionals are and see it as an inexpensive way to hedge risk, particularly while we remain in a low inflation environment.

Practically, wealthy individuals are looking closely at their cash flow, and many are actually setting up a portfolio of cash and short-term bonds large enough to cover all needs for living expenses, which with this group is quite high (inflation for high-end goods and services is closer to 10% than to 2%). Only after they are very sure that their spending needs are met do they turn to investing in the markets. For many investors, their portfolios are not large enough to set aside enough money to cover all expenses forever. However, all investors can consider creating a barbell of very low-risk investments and high-risk investments as a legitimate approach to risk management.

To create a barbell asset allocation, investors should first allocate 50% of their investable assets to cash and very short-term fixed-income instruments. This would then allow them to invest the remaining 50% of assets in a more aggressive, equity oriented portfolio, with a higher emphasis on emerging markets and commodities. If the market does well, the aggressive end of the barbell will perform well (it certainly has this year). If the rally fades and the market starts to correct, investors can take comfort in the fact that the conservative end of the barbell is protecting their principal. As I have said repeatedly, older investors should follow John Bogle’s advice and subtract their age from 100 and put no more than that percentage in the markets; the barbell approach means younger investors may want to consider limiting their overall equity exposure to control risk. Having a maximum of 50% in the market is not an overly conservative asset allocation, even for a younger person.

It is also interesting to note that most wealthy investors are no longer strictly “buy and hold” investors. They are realizing that the markets are choppy, and it may be prudent at times to simply step out of the markets and sit on the sidelines if the waters get too rough. This explains their current focus on highly liquid investments without lock-up periods. They are no longer trusting money managers to make the decisions whether to get in or out of the markets; by remaining in liquid investments, they are preserving the right to pull the trigger and get out if things start to look stormy. All intelligent investors should retain this right and be wary of handing over too much control to the professionals.

Carol Pepper is CEO of Pepper International , a family office in New York City. She has managed high-net-worth clients for over 25 years. Carol just published her first novel, Beyond Blood , a thriller about the wealthy; visit for more details or purchase the book through amazon.com (in paperback and Kindle).