The Barbell Approach To ETF Portfolio Allocation Continues To Shine

Post on: 22 Июль, 2015 No Comment

Summary

- I did not invent the barbell strategy.

- At the start of the year, I simply offered readers a glimpse into the way that I would be managing ETF assets in the late-stage bull market.

- It is instructive to view how the assets that I have been using throughout 2014 have performed year-to-date.

- The barbell approach is not perfect, nor is it intended for everyone.

I did not invent the barbell strategy. At the start of the year, I simply offered readers a glimpse into the way that I would be managing ETF assets in the late-stage bull market.

First, let me take you back to January when I explained that long-term rates would fall, not rise. The contrarian call had been met with ridicule at the time. Allocate a percentage of portfolio assets to long-term investment grade debt? Ludicrous! cried fans of ProShares Ultra-Short 20+ Year Treasury (NYSEARCA:TBT ). Rates can only go one direction. Up!

However, there were thousands of folks who did appreciate my premise. Specifically, foreign governments and institutional money would be clamoring for a dwindling supply of intermediate- and longer-term U.S. bonds. Then, mix in the uncertainty of the Federal Reserves exit from quantitative easing (QE) during a period of extraordinary weakness in the global economy. Suddenly, safety seekers would be contributing to the demand side of the equation. Last, but certainly not least, U.S. Treasuries were (and still are) relatively attractive when compared to the yield on the debt of less stable countries.

My prescription in 2014? Exchange-traded trackers like Vanguard Long-Term Bond (NYSEARCA:BLV ), Vanguard Extended Duration (NYSEARCA:EDV ) and PIMCO 25+ Year Zero Coupon (NYSEARCA:ZROZ ). Those who valued my analysis expressed gratitude in comments, e-mails and hypertext links back to my articles. In contrast, when bonds pulled back sharply two weeks ago, a belligerent stalker of financial authors sarcastically admonished my choice of extended duration treasury bonds.

It is important to note that the long-term bond holdings were not my solitary conviction. More accurately, they have always been a component of a barbell approach.

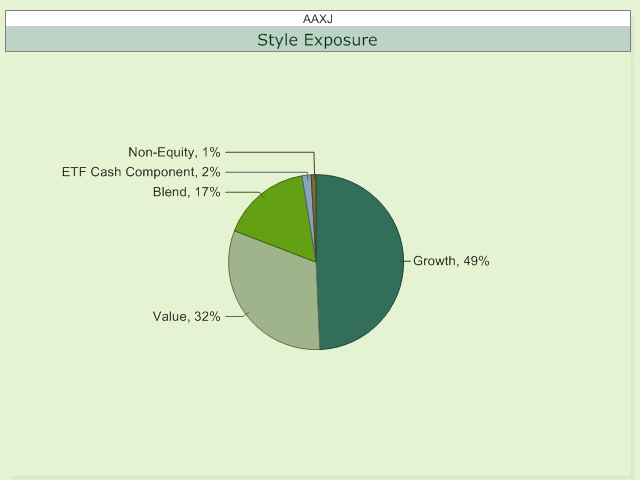

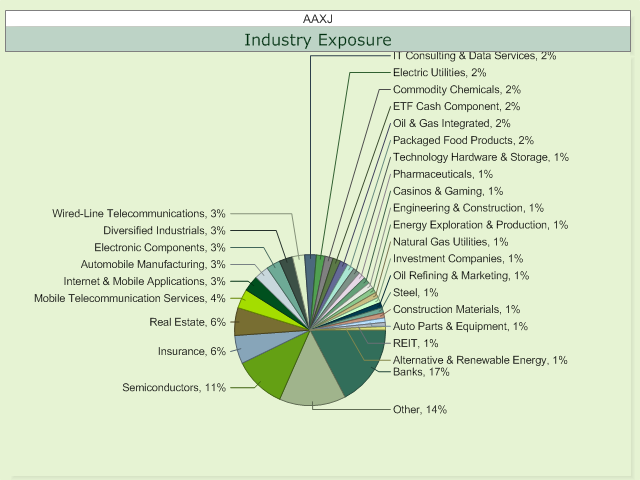

For example, a number of my clients have 60% in lower beta risk stock assets such as Vanguard High Dividend Yield (NYSEARCA:VYM ), iShares USA Minimum Volatility (NYSEARCA:USMV ), iShares S&P 100 (NYSEARCA:OEF ), First Trust Technology Dividend (NASDAQ:TDIV ) and/or SPDR Select Sector Health Care (NYSEARCA:XLV ). I even incorporated emerging market Asia via iShares MSCI All Country Asia Ex Japan (NASDAQ:AAXJ ) into many portfolios. The 40% allocated to intermediate- and longer-term bond funds include those ETFs mentioned in the above-mentioned paragraph, as well as funds like SPDR Nuveen Muni (NYSEARCA:TFI ), iShares Intermediate Term Credit (NYSEARCA:CIU ) and Market Vectors Long Muni (NYSEARCA:MLN ).

Whats noticeably missing from the barbell is a significant allocation to the middle-of-the-risk-spectrum assets along the handle. This includes assets like higher yielding bonds, preferreds and REITs. (Note: Another antagonistic commenter who hides under the cloak of his anonymity believes that I missed the REIT boat, failing to understand the risk-reducing goals for a barbell-oriented portfolio.)

My clients have a variety of different risk profiles income, conservative growth and income, moderate growth, moderately aggressive growth, etc. It follows that not every family has the same assets, let alone a mix of 60/40 growth-to-income. Nevertheless, it is instructive to view how the assets that I have been using throughout 2014 have performed year-to-date:

Year-To-Date Results For Barbell Assets