The Alternative Portfolio Diversifying Away From a Traditional Allocation

Post on: 11 Апрель, 2015 No Comment

by Charles Rotblut, CFA

How can I construct a portfolio that is capable of producing returns different than those of the S&P 500 and long-term Treasuries and that is also capable of warding off the threat of inflation? This is what many AAII members have asked me for.

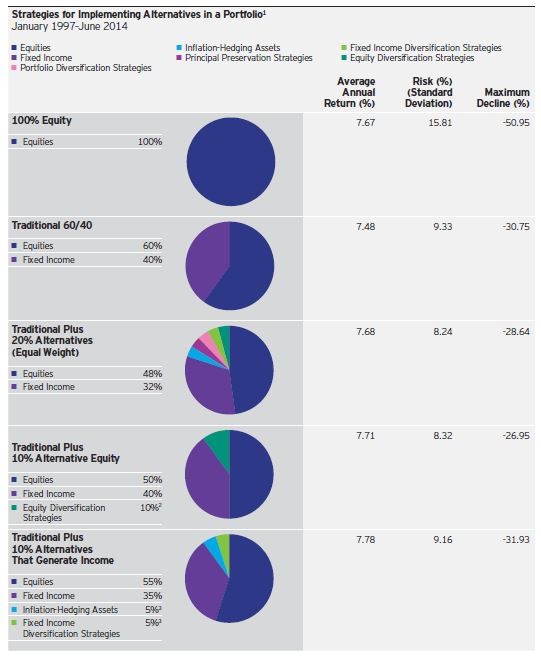

The good news is that I was able to create such a portfolio. In fact, over the time period tested, its performance topped that of a traditional large-cap/long-term bond portfolio. The portfolio can be replicated using exchange-traded funds. Unfortunately, this alternative portfolio is more volatile than a traditional portfolio comprised of large-cap stocks and long-term bonds. Furthermore, the time period used to test the portfolio may not be long enough to show whether its performance advantage will last well into the future.

The alternative portfolio does complement a more traditional portfolio. It includes a mix of assets that provide diversification benefits to a traditional portfolio and enhanced returns over the time period studied. The benefits come at the cost of increased volatility, however. Thus, the alternative portfolios best use may be as a supplement to, rather than as a replacement of, a more traditional portfolio.

It Starts With Correlation

One of the most basic building blocks for any portfolio is correlation. In terms of investing, correlation shows how similar the returns of two asset classes are. Correlations of, or near, +1.00 imply that assets experience the same type of return characteristics. Correlations of, or near, 1.00 imply that assets tend to have completely opposite return characteristics. Correlations of, or near, 0.00 imply that the assets have different return characteristics. Two assets with a correlation near +1.00 will typically move in the same direction and will experience similar magnitudes of change in price. Assets with correlations near 0.00 will have different returns: As one asset moves up in price, the other may move up in price, move down in price or stay unchanged. There is no relationship between the return characteristics.

Historically, large-cap U.S. stocks and long-term government bonds have had a correlation of 0.06, according to the 2012 Ibbotson Stocks, Bonds, Bills, and Inflation (SBBI) Classic Yearbook (Morningstar, 2012). This implies that simply combining the two asset classes in a portfolio gives diversification benefits. Including other asset classes increases the level of diversification benefits, but only to varying degrees. Small-company stocks have a 0.09 correlation with long-term government bonds, but a 0.72 correlation with large-cap stocks. Long-term government bonds have a 0.06 correlation with large-cap domestic stocks, but a 0.89 correlation with long-term corporate bonds. In other words, small-cap stocks experience similar, but not the same, types of returns as their large-cap counter parts. The same holds true for long-term government bonds and long-term corporate bonds.

As you can see, once you move beyond two asset classes, it becomes more difficult to construct a portfolio completely out of assets that are not highly correlated with at least one other asset. Leveraged strategies, hedge fund strategies, currencies and derivatives can help. The downside is that these investments are often more complex and harder to analyze, can be more risky, and may be more expensive to use.

It is also important to realize that during periods of financial distress, correlations tend to move toward 1.00. This is what occurred during the 2008 financial crisis, when global stock prices fell, as did prices for other asset classes. These types of movements are tied to the human tendency of wanting to sell all risky assets when a bear market roars. Once a crisis ends, correlations widen, meaning they pull away from 1.00. This is why, when constructing a diversified portfolio, it is important to pay attention to long-term correlations.

Correlation only measures the similarity in returns, not whether one asset has a higher or lower return than another. It does not tell you how risky any particular asset is, either. Financial goals, time horizons, the emotional ability to withstand losses, and other factors impact an investors risk tolerance and influence the level of returns desired and the type of assets held. Thus, a portfolio designed solely to be well diversified from the standpoint of correlation without taking into consideration other factors may be completely unsuitable for many investors.

The Basic Rules

My goal was to create an alternative portfolio that is diversified and investable and that avoids complex strategies and assets. I wanted this portfolio to be accessible to individual investors who were comfortable buying and selling exchange-traded funds (ETFs) .

To accomplish this goal, I started with a few basic rules for building the portfolio. First, the selected assets had to have low, or at least reduced, correlations with the S&P 500 index (which is comprised of domestic large-cap stocks) and long-term Treasury bonds. Secondly, the assets had to have low correlations with the other assets held in the portfolio. Third, it had to be easy for the average individual investor to buy and sell investments in those assets. Finally, the investments had to be easy to understand and track, and they could not use any type of leverage.

These rules might seem simple, but they have large implications. Requiring all investments to be easy to buy or sell by the average investor made annuities, non-public real estate, hedge funds and private equity off limits. The requirement that investments be easy to understand and that they not use leverage eliminated convertible bonds, option strategies, futures, exchange-traded notes, inverse and leverage (e.g. ultra) funds, currencies, and funds that mimic hedge fund strategies.

Why be so seemingly strict? Costs were one reason. Liquidity was another: I wanted a portfolio with investments that are easy to buy and sell through a traditional brokerage account. Doing so enables rebalancing and helps those investors facing required minimum distributions. Simplicity reduces risk. An easy way to lose money is to buy an investment you dont understand.

Creating an Alternative Portfolio

Working within these restrictions still gave me a quite a bit of leeway in choosing what to add and what to restrict. I felt a bit like a mad scientist walking into a laboratory. I knew what I wanted to create, but wasnt completely sure what type of portfolio I would end up with once I started tossing assets into a beaker.

So, I started with a bit of brainstorming to figure out what assets would make sense. On the equity side, I chose master limited partnerships (MLPs). real estate investment trusts (REITs) and micro-cap stocks. On the bond and income side, I chose Treasury inflation-protected securities (TIPS). high-yield corporate bonds and preferred stocks. Finally, I selected gold to provide exposure to commodities via a physical asset.

A few notes of explanation about these asset classes:

- MLPs are limited partnerships that primarily own oil and gas pipelines. Their shares have higher yields than common stocks because MLPs pass through earnings. MLPs do have the potential to create tax headaches, particularly if unrelated business income exceeds more than $1,000 a year from securities held within an IRA. (The specific tax that could be triggered is referred to as UBTI.)

- REITs are trusts that invest in real estate. They too have higher yields.

- Micro-cap stocks are companies with market capitalizations typically below $600 million (the maximum value allowed by our Model Shadow Stock Portfolio.) Because of their small size, these stocks tend to be overlooked and are more often mispriced than their larger peers.

- TIPS adjust to increases and decreases in the rate of inflation, whereas traditional bonds pay a fixed amount of interest.

- High-yield bonds are issued by companies with weaker credit ratings. These so-called junk bonds pay higher interest rates as compensation for the increased default risk.

- Preferred stocks are hybrid securities that give investors priority to dividends, but only offer limited voting rights. Their prices can be impacted by changes in interest rates and changes in the earnings power of the companies that issue them. A company can suspend dividends to preferred shareholders if business conditions deteriorate.

- Physical gold avoids the transaction costs and use of leverage involved with investing in futures contracts or funds that invest in futures contracts. It can also provide a hedge against the deterioration of a currencys purchasing power.

Past issues of the AAII Journal discuss most of the aforementioned investments. Links to these articles are included below .

SPECIAL OFFER: Get AAII membership FREE for 30 days!

Get full access to AAII.com, including our market-beating Model Stock Portfolio, currently outperforming the S&P 500 by 4-to-1. Plus 60 stock screens based on the winning strategies of legendary investors like Warren Start your trial now and get immediate access to our market-beating Model Stock Portfolio (beating the S&P 500 4-to-1) plus 60 stock screens based on the strategies of legendary investors like Warren Buffett and Benjamin Graham. PLUS get unbiased investor education with our award-winning AAII Journal. our comprehensive ETF Guide and more – FREE for 30 days