Teaching Financial Literacy To Teens Investing

Post on: 16 Март, 2015 No Comment

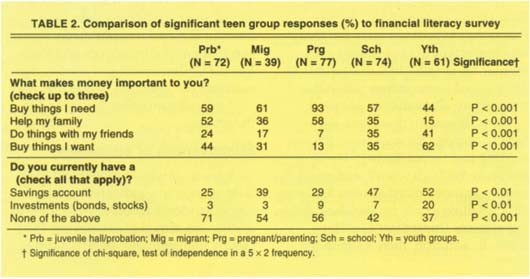

There are lots of ways to invest money, but the goal is always the same: to grow your money. Many teens are interested in learning about the various types of investments they might make, these can include:

- Bonds — A debt investment where you loan money to a government or a business for a defined amount of time and at a fixed interest rates. Bonds are issued by companies, municipalities, states and federal governments to finance a variety of projects.

Risk

An essential concept to discuss with your teen is risk. Risk deals with the possibility that an investment could lose some of its value. Investments with the most risk also tend to have the highest returns; conversely, investments that are low-risk tend to have low returns. Finding the appropriate balance between risk and reward is important in developing an investment strategy or portfolio. That balance will differ from person to person, depending on factors such as risk tolerance, account size (how much money you have to invest) and age (younger people can withstand greater risk that people nearing or in retirement).

Diversify Your Investments

One of the best ways to reduce your overall risk is to diversify your investments (the proverbial, Don’t put all your eggs in one basket.) Diversification is a risk management technique that mixes a variety of investments within one portfolio (a portfolio is a combination of stocks, bonds, and cash savings). The goals of diversification is to balance riskier investments with safer investments to limit overall risk.

Fundamental and Technical Analysis

Investors use fundamental and technical analysis to making buying and selling decisions for stocks and certain other investments. While most investors subscribe to one method over the other, there are some who use a combination of fundamental and technical analysis to evaluate investments.

Fundamental analysis uses data to evaluate a security’s (such as a stock’s) value. Fundamental analysts will look at figures and financial ratios including earnings, earnings-per-share (EPS), price-earnings ratio (P/E) and dividend yield. A company’s fundamentals can be found on various financial news sites. The following example shows information for Microsoft (Nasdaq:MSFT ) found on Yahoo! Finance: