Taxable Tax Advantaged Tax Deferred and Tax Free

Post on: 7 Июль, 2015 No Comment

Income taxes, while not popular, are an important part of everyone’s financial life. They are a complicated issue that many just accept as part of the cost of living in America. While the top marginal federal income tax rate dropped from 70% in the early 1980s to 35% in 2004, almost everyone feels they pay more in tax than they would like.

And, it is not just federal income taxes. Your income ends up being subject to state, Social Security, Medicare, and, in some cases, local or city tax taxation. All in all, most Americans end up paying from one-fifth to one-half of their income to some governmental body.

Be tax wise, not tax driven

Making financial decisions based only on the income tax implications is almost always a bad idea. The key is to have an understanding of the tax implications and factor them into your decision-making process.

Tax advantaged

The most common form of tax advantaged investing is using the beneficial income tax rates applied to long-term capital gain. If you have owned stock for more than one year and sell the shares for a gain, the maximum income tax rate on that gain is 15%. This compares with the top rate of 35% (for 2008) on other types of regular income and on gains on investments held for less than one year. Be sure to remember this if you are considering selling shares close to that one-year anniversary of your purchase.

Tax free

The most common type of tax-free investing is with the purchase of bonds issued by a municipal, state, or local government agency. The tax laws provide that most types of these bonds are exempt from federal income taxes. However, they may be subject to state or local income taxes. Be sure to ask your financial advisor about this. Because interest from these types of bonds is not subject to federal tax, they often pay a lower interest rate than other taxable bonds of similar quality and duration. Compare your after-tax returns to make sure tax-free bonds are right for you.

Tax deferred

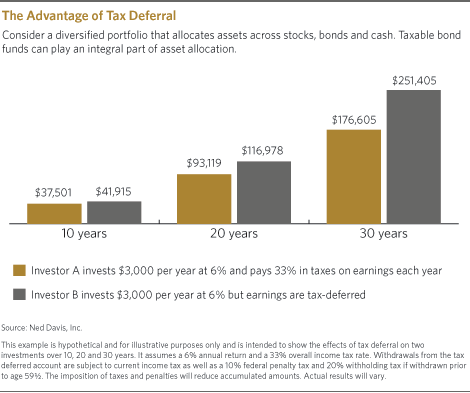

Another lesser known, but very powerful, tax-reduction strategy is to position your funds so any tax on earnings or appreciation is deferred until later. This results in your ability to continue to earn returns on money that would have otherwise been paid in taxes. With a tax-deferral strategy, you still have to pay the tax some day, but you control when that day is, and the power of compounding results in more money in the long run.

Two of the most common ways to take advantage of income tax deferral are through the use of Individual Retirement Accounts (IRA) and certain insurance contracts called annuities. Below is an example that demonstrates this point with an IRA.

Example. Robin is 30 years old and wishes to save for retirement. In this example, her combined federal and state income tax rates are 28% (25% for federal and 3% for state income taxes). She is evaluating the benefits of $5,000 annual contributions to a regular IRA compared to simply saving $5,000 each year in a bank account.

In this example, let’s ignore any aspects of deductibility of her IRA contributions and assume the same earnings rate of 6% for the IRA and the bank account. For the IRA option, there are no taxes due annually, but they must be paid when money is withdrawn. For the bank account option, income taxes are paid annually, reducing her after tax return to approximately 4.3%. The example assumes the additions to the IRA and the bank account take place at the end of the year.

The key question is how much money Robin will have at age 60 after all taxes are taken into account.

Total Contributions