Tax Implications for Foreign MLP Investors Martin Midstream Partners L P (NASDAQ MMLP)

Post on: 16 Март, 2015 No Comment

I have been asked before by foreign investors, Can I buy MLPs? I knew that they could buy them, but didnt have a cohesive answer on what the tax implications would be to a foreign investor directly investing in a publicly-traded partnership or MLP. So, I tried to find out on the internet and by going through SEC filings of MLPs or FAQ sections of MLP websites. I didnt find a definitive answer, so I had to go directly to one of the pre-eminent tax lawyers in the MLP space, someone who advises MLPs on tax implications of their IPOs and other offerings.

This expert gave me the whole tax story when it comes to foreigners and MLPs, which I will now transmit here, so that others with the same question I had will be able to find it somewhere with a simple search of MLPs foreign investors tax or something like that. With all of that said, please do not take my word for any of the tax information written here, and please always consult a knowledgeable CPA before acting on this information.

The summary is that if a foreign investor is paying US taxes, then at the end of the day his taxes paid (and after-tax return) will be equivalent to that of a domestic investor, with two caveats. First, the US will over-withhold taxes from MLP distributions that you can get back when you file taxes. Second, in each country foreign investors may have different local taxes to pay on investment gains made abroad. I wont get into those taxes.

The more common occurrence for a foreign investor in MLPs, however, is to suffer the over-withholding and not file a tax return in the U.S. thereby avoiding paying taxes on gains from MLPs. So, in that situation, a foreign investor would have less short term income from his MLPs, but higher after-tax returns on the sale.

Example Using Real Numbers

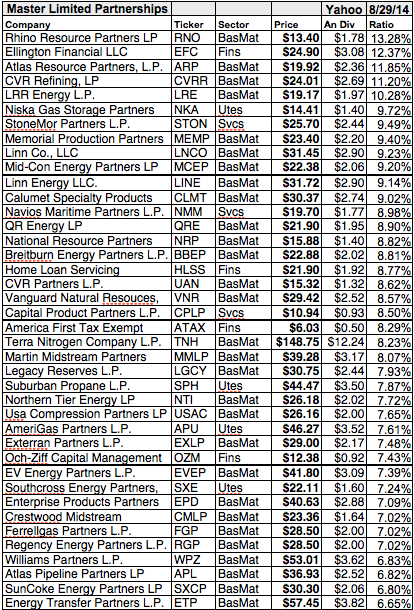

Lets take a real life example, more like a word problem for a CPA exam. An an example, Ill use Martin Midstream Partners L.P. (NASDAQ:MMLP ), which is currently making quarterly distributions of $0.75, or $3.00 annually (makes the math simple).

Lets assume German investor Heinz bought 100 shares of MMLP at the beginning of 2010 for $32.00 a share. During the course of the year, Heinz received $300 in distributions from MMLP, and then sold all 100 shares on December 31 st for $37.00. What are the tax implications?

To solve this problem, we need to understand a few things about how the US taxes foreigners generally. Foreign investors are fully responsible for federal income tax liabilities stemming from effectively connected income (ECI), or income derived from a U.S. trade or business. Foreign owners of MLP units will have all of their distributions subject to withholding at the highest marginal tax rate. This differs from a U.S. investor who is subject to taxes (payable after the fact) on their allocated net income, which is typically substantially less than the distributions earned (see first column below).

The result of this excess withholding is that Heinz is subject to more taxes than Hinds is on an annual basis, and must file a U.S. federal tax return to get his credit back on the excess withholding. This credit goes towards paying the Heinzs taxes on gains, resulting in an after-tax return equivalent to his U.S.-based cousin (see second column below).

Now, Heinz could choose not to file the federal tax return announcing his gains and live with the excess withholding. If he were to do that and keep his gains, Heinz could end up paying less tax than a typical U.S. investor would (see third column below), he just wouldnt be following the rules. From what I understand, that is the route many foreign investors take.

When investing in a corporation, foreigners have taxes withheld on dividends and are supposed to file a tax return to report and pay capital gains. Investing in a regular corporation does not generate ECI, so withholding is based on dividends, and is much more manageable.

I guess the point of this analysis is to say that if they are willing to put up with the additional hassle, foreign investors can invest in MLPs. And if the historical track record of returns in the sector were to continue (notwithstanding that past results are not an indication of future results), then a foreign investor could potentially see value in MLP investing.

This is not dissimilar to the argument for non-profits: they can invest in MLPs, but are subject to UBTI. Many non-profits have decided that UBTI is not a big enough deterrent to keep them from investing in MLPs because the sectors assets and value proposition are attractive even after those extra filings and tax-headaches.