Tax Free Municipal Bonds Should you invest

Post on: 16 Март, 2015 No Comment

March 11, 2014 Kevin Mulligan

No matter where you turn in the investing world you end up paying tax.

Funding a Roth IRA? You pay tax today in hope that tax rates in the future are higher than what you paid.

Funding a Traditional IRA? Avoid paying tax today, but you risk higher tax brackets in the future and have to pay taxes on the full amount.

Earning interest from a savings account or certificate of deposit? Yup, you get hit with regular income tax each year.

There is but one place we can turn to invest while still generating some investment income: tax-free municipal bonds .

What is a Tax-Free Municipal Bond?

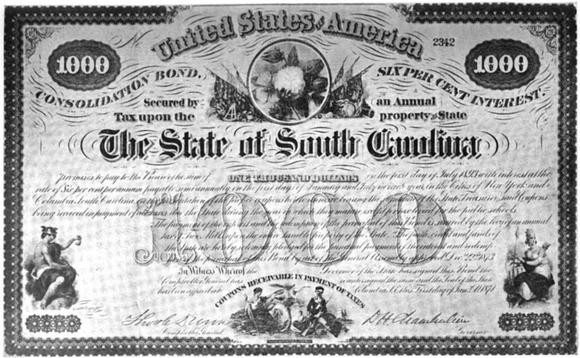

A bond is a debt-based investment where investors provide funding to the company or government issuing the bond. In return they generate interest to be repaid with the principal of the funds.

A municipal bond is one for a government entity like a city, county, or state. The municipality uses the funds to build roads, repair core infrastructure, or other projects that have high costs and long-term payoffs associated with them.

Tax-free municipal bonds are the same thing with one great kicker: you pay no tax on the interest generated by the bond.

Do You Ever Pay Tax on a Municipal Bond?

If you buy and hold the bond until maturity that is, until the municipality pays back the bond you wont pay any tax. All of your investment gain will be from the interest generated each year by the bond.

However, there are some instances where you do have to pay tax on investing in municipality bonds.

Dont worry, youre going to want to have this reason.

A bond is a tradable financial instrument just like a stock. If you buy a bond at $100 and later sell it for $150, youve generated a gain of $50. That same bond may have paid you $10 in interest in the time period you held it and that gain would be tax-free.

But the gain on buying and selling the bond can generate tax (or a tax write-off) if the price you sell differs from the price you bought the bond at.

Should You Invest in Municipal Bonds?

As with any investing decision it truly depends on what bond and what your overall investment strategy is.

Lets compare two bonds:

- a tax-free municipal bond with a 4% return

- a taxable bond with a 4.5% return

At first glance the taxable bond looks like the best deal since it has the higher rate of return.

Now lets apply a 25% tax to the rate of return:

- tax-free municipal bond: 4% return

- taxable bond: 3.375% return

As you can see the taxable bond falls below the tax-free municipal bond due to taxes on the gain. In fact for these two bonds to provide an equal return the taxable bond would have to return 5.33% before taxes to equal the 4% tax-free return.

Final Thoughts

If you are looking to diversify your retirement plan by investing in tax free muni bonds, you might want to consider setting up a self directed ira.