Targetdate funds sound easier than they are

Post on: 15 Апрель, 2015 No Comment

You can chose a fund that targets your retirement date, but can still get a wide — and sometimes unpleasant — range of outcomes.

Story Highlights

- Government bond funds have gained 29% since the financial crisis started in 2007 Worst 12-month period since Sept. 2007 for bonds: a 3.5% loss Best 12-month period since Sept. 2007 for stocks: 52.7% gain

You’re tired of worrying about your retirement portfolio. Should you have 5% in emerging markets? Or maybe 10%? What about high-yield bonds? Small-company stocks? International small-company stocks? International small-company stocks with high yields that do business in emerging markets?

So you’ve decided to go with a target-date fund. Pick the fund with the date closest to when you retire, and you’re done, right?

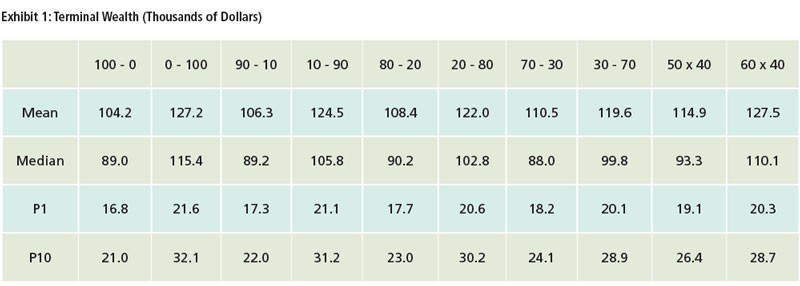

Ha, ha! Of course not. Retirement date funds vary vastly according to the investments they use and, more important, how they view retirement. Case in point: 12-month returns for funds aiming at 2020 retirees vary from -5.4% to 16.1%. Some of the difference in returns, of course, has to do with managerial skill. But a large part, too, is the fund’s investment philosophy.

Target-date funds are the newest iteration of an old concept: the hybrid fund. The stock market tends to be overly optimistic, rallying on good earnings and economic news, and falling when economic activity disappoints. Bonds are only happy when it rains. Bond prices rise when a recession looms, and fall when economic activity rises. Stirring in bonds to a stock portfolio can make stock downturns less unpleasant, albeit at the cost of making stock rallies a bit less profitable.

The hybrid strategy works. Balanced funds, which are typically 60% stocks and 40% bonds, have gained 23.9% since the financial crisis began in October 2007, according to Lipper, which tracks the funds. Large-company core funds, have gained 22.3%, and with greater downdrafts. The worst 12 months for large-cap core funds was a 42.8% loss the 12 months ended February 2009. Balanced funds lost 31% the same period.

Target-date funds take the hybrid strategy a step further. General financial theory argues that as you approach your retirement date, you should reduce your risk. If you hit a big downdraft in the first few years of your retirement, you won’t have additional income to make up for your losses. And withdrawing money from your fund when it’s at a loss simply makes your loss bigger.

Most target-date funds reduce risk by adding bonds or cash to the portfolio. The rate at which a fund does so is called its glide path, presumably less terrifying than gradual descent into geezerhood. The glide path is one of the first things you should investigate about a target-date fund. Let’s look at two 2020 target-date funds — a particularly interesting year, since they have about seven years before they hit their target dates. Most target-date 2030 or 2040 funds would be north of 70% in stocks.

But a 2020 fund requires some judgment, and the range of outcomes for the group is broad. Let’s start with T. Rowe Price Retirement 2020 fund (ticker: TRRBX) which gained 16.1% for the 12 months ended July, vs, 10.6% for the average 2020 target-date fund. The fund currently has 47% of its portfolio in U.S. stocks and 21.3% in foreign stocks, or 68.3% total in stocks. Another 30% is in bonds, with the rest in a smattering of cash, convertible bonds and preferred stock.

The T. Rowe Price Retirement 2020 fund assumes that you will live past your retirement date. Most people live 20 years or more in retirement, which means that you probably shouldn’t sell all your stocks and invest in bonds at 65. So in 2020, the fund will be about 50% in stocks, and gradually reduce that to about 20% stocks by 2050.

The T. Rowe Price fund, as you might expect, tends to fare best in a bull market. Wells Fargo Advantage DJ Target 2020 fund (STTRX) takes a more conservative approach: It’s now about 41% in stocks, 50% in bonds and 6.3% in cash, so its 7.7% gain the past 12 months shouldn’t be surprising. (That figure doesn’t include the fund’s 5.75% sales charge, or load. The T. Rowe Price fund is no-load). By 2020, the Wells Fargo Advantage DJ Target 2020 fund’s glide path would put it at nearly 80% bonds and cash, according to fund-tracker Morningstar.

Nothing wrong with that: It just depends on your risk tolerance and your plans for the future. But as a cautionary tale, consider the the SunAmerica 2020 High Watermark fund (HWKAX), which has fallen 5.38% the past 12 months, a figure that doesn’t include the fund’s maximum 5.75% sales charge. According to Morningstar, about 93% of the fund’s assets are in bonds.

Part of the SunAmerica 2020 fund’s problem was a gimmick: The fund included a guarantee that shareholders would receive an amount equal to its highest share price, or high watermark, during the life of the fund. That guarantee included certain triggers to close the fund and, mercifully, one of those triggers was met. The fund is now closed to new investors. To get the fund’s high watermark price, investors must hold shares until 2020.

A fund’s glide path isn’t the only thing to look at closely. Many target-date funds invest in other funds, and you’ll pay the freight for those funds, as well. In the case of the T. Rowe target-date fund, the fund itself charges no ongoing expenses. Investors do bear expenses for the underlying funds, which amounts to 0.70% a year. For Wells Fargo, the expense ratio is 1.05%, according to Morningstar.

And because fund companies tend to invest in funds of their own making, you must realize that most fund companies have biases in how they invest. Some prefer to take the value-oriented approach to stocks and bonds, seeking beaten-down, undervalued issues that they hope will recover. Others tend to look for stocks of companies that are set to soar. Those biases will have an effect on your target-date fund, too.

But look at it this way: A target-date fund is probably easier than trying to periodically juggle a dozen funds yourself. And it’s certainly better than just ignoring your portfolio altogether.