Target Date Funds Should You Trust Them with Your Money

Post on: 16 Март, 2015 No Comment

Target date funds, which hold a combination of stocks and bonds, have recently been attacked in publications like SmartMoney and DailyFinance. Learn Bonds decided to investigate and here’s what we found:

How Target Date Funds Work

A target date fund is a mutual fund or ETF which adjusts its investment allocations based on the fund’s stated target date. Investors choose funds with target

English: The Mutual Fund Store office, 37308 Six Mile Road, Livonia, Michigan (Photo credit: Wikipedia)

dates that are the close to the year they plan to retire. Target funds tend to have many different types of assets in the funds, including US Stocks, International Stocks, US bonds & money-market type investments. The secret sauce of target date funds is how they allocate funds to each asset type.

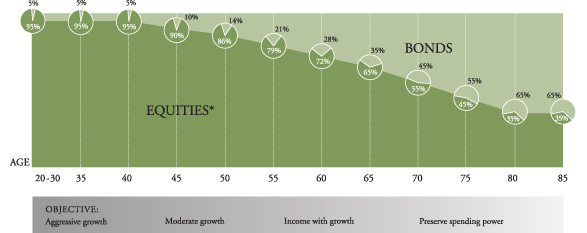

Although the allocation process will differ depending on which target date fund you choose, they should all follow a similar pattern: as the fund moves closer to and eventually past its target date, its investments will become increasingly more conservative. For example, a fund with a target date of 2050 will likely have a much larger percentage of its portfolio in riskier assets like stocks, than the same type of fund with a 2020 target date. Below are two screenshots from Fidelity’s website showing how the asset allocation in their 2050 target date fund will look in the year 2020 vs. the year 2045.

Fidelity’s 2050 Target Date Fund Allocation in the Year 2020

Fidelity’s 2050 Target Date Fund Allocation in the Year 2040

The target date of the fund is not meant to be the end date of the fund (where all the money is paid out to investors) but rather the retirement year of the investor of the fund. In most target date funds the fund manager will continue to make changes to the allocations in the portfolio after the target date for several years before shifting into income generating investments like Treasury Bonds only.

Target Date Fund Advantages

- Simplicity: Its easy for individual investors to get overwhelmed with all of the different investment options out there. The goal of a target date fund is to simplify the investing process with one fund designed for retirement saving, that automatically adjusts for you as you age.

- Diversification: Target date funds provide you with the diversification of a normal mutual fund + the added diversification benefits that come with investing in different asset classes (both stocks and bonds for example).

- Designed for the Long Term: Target date funds are by definition designed to be long term investments. While you can sell most target date funds at any time, their “set it and forget it” style makes investors less likely to allow short term market fluctuations to adversely affect their investment decisions.