Synthetic Convertible Bond Arbitrage The Perfect Investment Strategy 1 of 2

Post on: 19 Сентябрь, 2015 No Comment

Synthetic Convertible Bond Arbitrage — The Perfect Investment Strategy? 1 of 2 1 comment

Each day I am absolutely amazed at the number of traders who have created their own unique way of trading using a wide variety of investment tools. I guess that I would consider myself to be one of these people as well; with only one caveat — I think that there is an amazing difference between having a unique strategy and just guessing on trades. Listen as I explain.

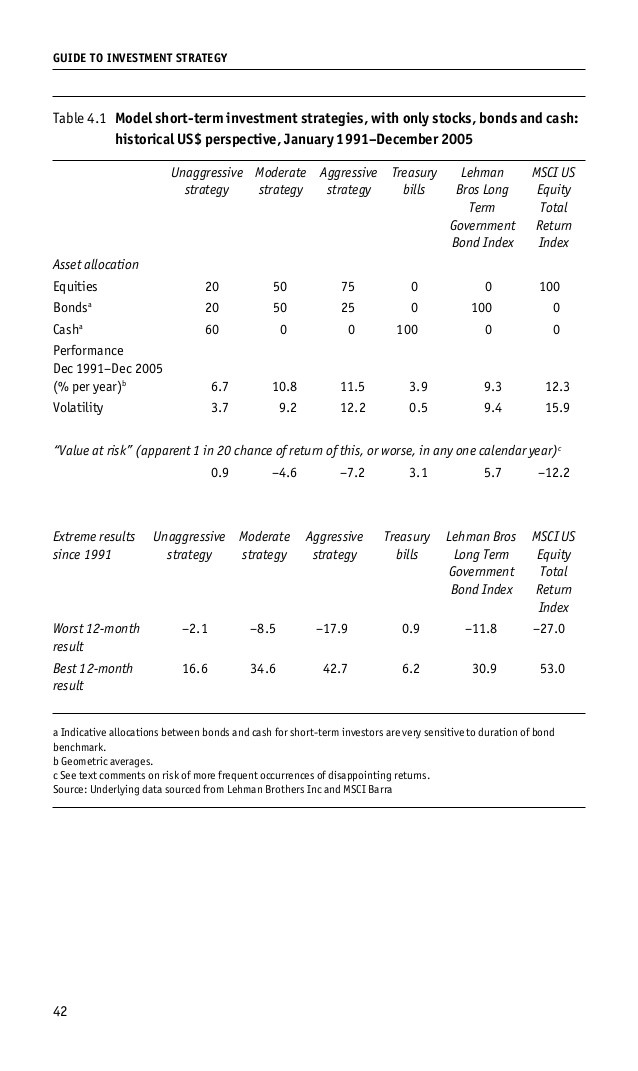

Convertible bonds have been around since the early Romans as then entrepreneurs would use a convertible bond as a way to entice wealthy patrons to invest in their venture. Not much has changed these days about convertible bonds and the basic structure is still the same. Some form of a corporate bond with the opportunity to reap the benefits of stock price appreciation if the company does well in lieu of cashing in the bond. As an investor in convertible bonds you do well if the company does well and if the company’s stock does not perform, well then the investor still had a corporate bond to rely on and redeem. A more recent advent has been the emergence of hedge funds who specialize in convertible bonds and convertible bond arbitrage. Convertible bond arbitrage is simply taking both sides of the move in the underlying stock price by essentially short selling an appropriate amount of the stock of the underlying company that issued the convertible. This strategy, in my opinion, is one of the seven wonders of the world. Just think about it for a minute. An investing style that gives you the safety of a fixed income instrument in the bond AND allows you to benefit whether the company’s stock increases OR decreases in value! The standard deviation on most hedge funds of this style is so amazing small. The only real issue with this strategy is that the issuance of new convertibles in recent years has fallen dramatically and you need to be an accredited investor to find a great hedge fund.

What if there a way that the average day trader or investor could benefit from such a strategy and have the same risk/return profile as the large convert arb traders? Let’s take just a minute to begin to de-construct a convertible bond. As I mentioned earlier the basic convertible bond is nothing more than a corporate bond with some attached option that allows the investor to convert their bond into shares of the company stock. Sound familiar? Well it should because this is simply an embedded call option on the underlying security. So no we can see that we could replicate a convertible bond by purchasing a straight convertible bond and the purchasing a call option on the stock. In essence this is correct however for a day trader this is equivalent to trying to fly with a 787 strapped to your back. So let’s move forward and think about a straight corporate bond. From bond theory from grad school we all know what a corporate bond really is — it is a liability that the company creates and then secures with some form of assets. From a trading perspective bonds are rated based on their underlying risk and risk of repayment. This risk, or credit spread as most of us know it, is based on the company’s ability to pay and is a spread above what a comparable Treasury would yield. So the risk is just a small piece of the yield and is comprised solely a spread that can be incorporated by the next concept.

The best way to explain this next concept is to possibly put it into a scenario that we can all understand — a home mortgage. Those of us who still have mortgages (still working mine off) know that we owe the bank money and we secure that loan with our home. Each month, as a homeowner, we have a simple choice; either pay our principal and interest or give the house back to the bank. This is equivalent to the bank being short a put option on the house. The bank has given the homeowner the option to pay or put the house back to the bank. This is the same type of OTC options that traders can purchase today. So we can now start to put this together and see that a convertible bond can be deconstructed into some basic pieces:

1. A Long Call Option

2. A Long Treasury

3. A Short Put Option

This is the very basic structure and needs much more definition in order to become an effective trading strategy. Next we will start to put this into action and show all the moving parts.

Synthetic Convertible Guy

Disclosure: No Positions discussed in article