Synthetic CDO Wikipedia the free encyclopedia

Post on: 15 Май, 2015 No Comment

From Wikipedia, the free encyclopedia

A Synthetic CDO (collateralized debt obligation ) is a variation of a CDO that generally uses credit default swaps and other derivatives to obtain its investment goals. [ 1 ] As such, it is a complex derivative financial security sometimes described as a bet on the performance of other mortgage (or other) products, rather than a real mortgage security. [ 2 ] The value and payment stream of a synthetic CDO is derived not from cash assets, like mortgages or credit card payments — as in the case of a regular or cash CDO — but from premiums paying for credit default swap insurance on the possibility that some defined set of reference securities — based on cash assets — will default. The insurance-buying counterparties may own the reference securities and be managing the risk of their default, or may be speculators who’ve calculated that the securities will default.

Synthetics thrived for a brief time because they were cheaper and easier to create than traditional CDOs, whose raw material, mortgages, was beginning to dry up. [ 3 ] In 2005 the synthetic CDO market in corporate bonds spread to the mortgage-backed securities market, [ 4 ] where the counterparties providing the payment stream were primarily hedge funds or investment banks hedging, or often betting that certain debt the synthetic CDO referenced — usually tranches of subprime home mortgages — would default. Synthetic issuance jumped from $15 billion in 2005 to $61 billion in 2006, [ 5 ] when synthetics became the dominant form of CDO’s in the US, [ 6 ] valued notionally [ 7 ] at $5 trillion by the end of the year according to one estimate. [ 6 ]

Synthetic CDOs are controversial because of their role in the subprime mortgage crisis. They enabled large wagers to be made on the value of mortgage-related securities, which critics argued may have contributed to lower lending standards and fraud. [ 8 ]

Synthetic CDOs have been criticized as serving as a way of hiding short position of bets against the subprime mortgages from unsuspecting triple-A seeking investors, [ 9 ] and contributing to the 2007-2009 financial crisis by amplifying the subprime mortgage housing bubble. [ 10 ] [ 11 ] By 2012 the total notional value of synthetics had been reduced to a couple of billion. [ 12 ]

Contents

History [ edit ]

In 1997, the Broad Index Secured Trust Offering (BISTRO) was introduced. It has been called the predecessor to the synthetic CDO structure. [ 13 ] From 2005 through 2007, at least $108 billion Synthetic CDOs were issued, according to the financial data firm Dealogic. The actual volume was much higher because synthetic CDO trades are unregulated and often not reported to any financial exchange or market. [ 8 ] Journalist Gregory Zuckerman, states that according to some estimates, while there were $1.2 trillion of subprime loans in 2006, more than $5 trillion of investments, i.e. synthetic CDOs, were created based on these loans. [ 6 ] Some of the major creators of Synthetic CDOs who also took short positions in the securities were Goldman Sachs, Deutsche Bank, Morgan Stanley, and Tricadia Inc. [ 8 ] In 2012 the total notional value of Synthetic CDOs arranged was only about $2 billion. [ 12 ]

Definition [ edit ]

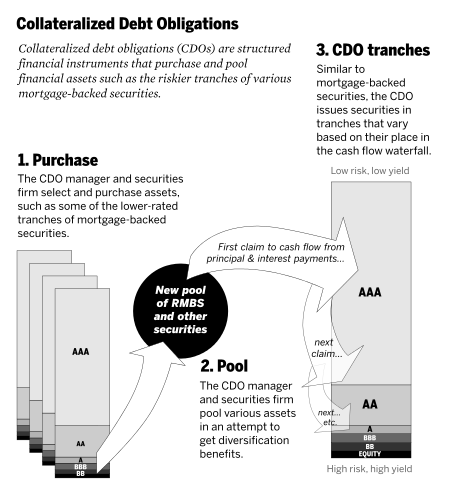

In technical terms, the synthetic CDO is a form of collateralized debt obligation (CDO) in which the underlying credit exposures are taken using a credit default swap rather than by having a vehicle buy assets such as bonds. Synthetic CDOs can either be single tranche CDOs or fully distributed CDOs. Synthetic CDOs are also commonly divided into balance sheet and arbitrage CDOs, although it is often impossible to distinguish in practice between the two types. They generate income selling insurance against bond defaults in the form of credit default swaps, typically on a pool of 100 or more companies. Sellers of credit default swaps receive regular payments from the buyers, which are usually banks or hedge funds. [ 14 ]