Swing Trading Blog

Post on: 16 Март, 2015 No Comment

Below, you will see links to new pages that have been added to my website and updated information on existing pages. I also post interesting news items that I find around the web and trading ideas.

Get email updates to this blog by subscribing to my newsletter .

Sep 25, 2013

Trader Education Week begins October 2nd

Elliott Wave International is having a free event that runs from October 2nd through the 9th. To attend this event you will need to register (free).

When you register for this event you will have immediate access to 4 free trading resources from EWI analyst Jeffrey Kennedy. Then you will receive new lessons each day during Trader Education Week — each designed to help you learn to spot high-confidence trade setups in the charts you follow each day.

On the website it says that you will learn:

- How to discover trading opportunities using the Elliott Wave Principle

- Unique ways to time the market using Trendlines

- How to employ Fibonacci ratios to calculate price targets

- Candlestick and bar patterns that have proven reliability

- How to apply Jeffrey’s proprietary channeling technique

- How to use Price Gaps to identify high-probability turning points

I’m not sure if this event is primarily for new or for more advanced traders but it might be worth checking out.

And you can’t beat the price!

Jun 28, 2013

CCI (5)

May 05, 2013

How Discretionary Traders Lose All Their Money

Imagine that you are about to go down a river.

In a raft.

With violent whitewater rapids.

You cannot predict what adjustments you will make to stay afloat. You only know that you have the skills to adapt to whatever actually happens .

The same is true with discretionary trading.

There are two parts:

- Your initial bias — which direction you think the stock will move.

- Adapting to the reality of which direction the stock actually moves.

The first is easy. The second is where traders lose money.

1. Your initial bias

Let’s say you find a stock that has a bullish engulfing candle. at a support level, that is oversold. You think this stock will reverse so you buy the stock. You have just developed a bias as to which direction this stock will move next. In this case — up.

So good so far.

But now you have to forget this bias entirely and move on to the next step. This transition (or lack therof) is where traders lose money.

2. Adapting to the trade

Unfortunately, the next day this stock falls and closes under the low of the engulfing candle. It did not reverse so your bias is completely irrelevant .

You must adapt.

You must take the loss.

The biggest mistake

This is the biggest mistake that discretionary traders make. They don’t transition from bias to adaptation. They hold on to their bias and try to force their hopes and wishes on a stock:

This stock will go in my favor eventually.

I’ll just adjust my stop loss order a little.

Etc. etc.

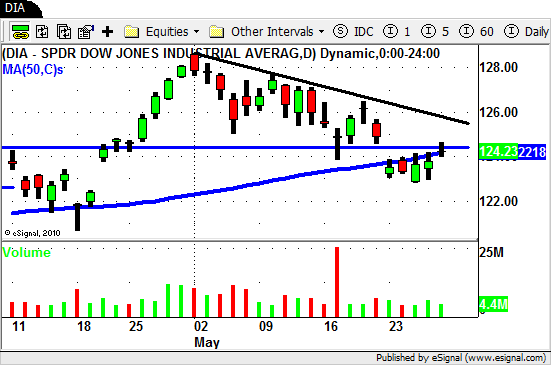

Is it Time for the Stock Market to Correct? Probably.

The areas that I have circled all happened during the months of April to May. Now might be a good time to brush up on your short selling skills.

Be careful out there!

Mar 30, 2013

Want to See an Example of Volume Preceding Price?

You’ve probably heard the saying that volume precedes price. But what does that mean? It means that (sometimes) volume will increase significantly before a big move. Here is an example:

See how volume increased dramatically (bottom arrow) compared to previous days? Now look at the candle for that day (top arrow). Price didn’t move much on that day. So you have a high volume day with very little price movement.

Look at the 15 minute time frame for that day. You will see huge volume spikes near the end of the trading day.

The breakout followed a couple days later.

Volume preceded price.

Feb 07, 2013

Which is More Important: Entry or Exit?

Of course both are important. But, as a swing trader, which should you put the majority of your efforts into? Which should you try to perfect first?

Definitely your entry.

Your money is most at risk when you first enter a stock. This is where you can get stopped out for a loss. Get the entry right and you will either have a win or a small loss.

Get it wrong and you can lose a lot of money.

What about the exit strategy?

You can do a lot of things wrong with your exit strategy — and still make money. You can sell too soon or too late. The good news is that once a stock goes in your favor you can move your stop to break even and the worst thing that will happen is that you will lose nothing (assuming there are no overnight gaps against you!).

What is the secret to getting a good entry?

Candlestick patterns? Fibonacci? Technical indicators?

None of the above.

I’ve spent a lot of years perfecting my entry and I can tell you that the secret to getting good entries can be found in the lower time frames. Find a good setup on the daily chart and then move down to the hourly and 15-minute time frames to find your entry.

You’ll see reversals taking place before they show up on the daily chart. And sometimes you can get a closer stop allowing you to buy more shares.

New to swing trading? Spend a lot of time perfecting your entry strategy.

I promise it will be time well spent!