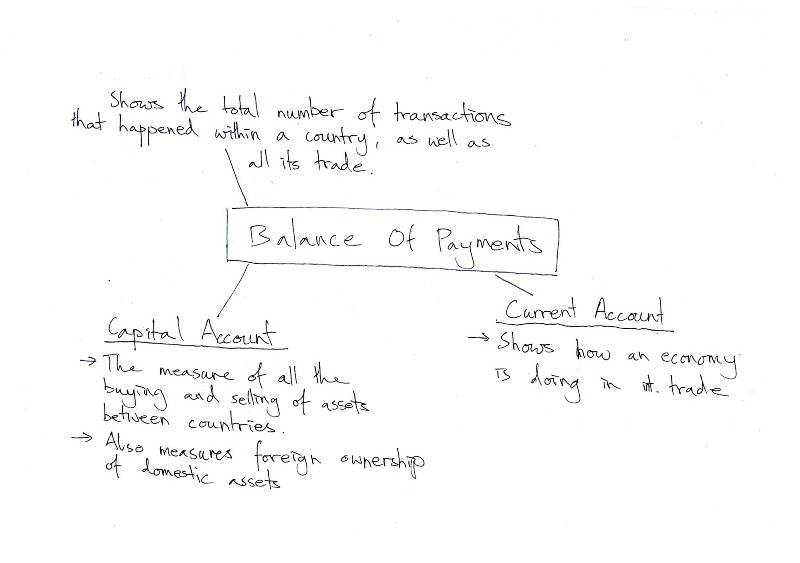

Structure of Balance of Payments

Post on: 16 Март, 2015 No Comment

The Balance of Payment is an organized account of all economic transactions between a country (say India) and the rest of the world, carried out in a particular time period. In other words, a country archives all the inflows and outflows of funds in a statement referred to as BOP.

The Structure of Balance of Payments (BOP) is as follows

The BOP structure depends on the concepts of the double-entry book-keeping. This implies that all the inflows of funds are placed on the credit side and all sorts of outflows of funds are debited. The balance of payments accounting differs from the business accounting in one aspect. In the BOP accounting the credits are on the left side and debits on the right side.

It is the difference between exports and imports of items, typically referenced as visible or tangible items. In case the exports are higher compared to imports, you will see trade surplus and if imports are more than exports, you will have trade deficit. Trade balance shows whether a nation enjoys a surplus or deficit. Developing countries usually have trade deficit. The trade balance is a part of current account.

In the current account, merchandise trade is entered first. There are actually a large number of distinct items which belong to the goods category. Export receipts are shown on the credit side and the imports are shown on the debit side. The second item that is recorded in the current account is invisibles. The current account consists of trade in services, dividends, unilateral receipts, investment income, etc. After entering the details, balancing is performed for the current account. This balance is referred to as the balance of current account. When debits are more than credits deficit occurs. Current account surplus will take place when credits are higher than debits. Current account balance is extremely important. It exhibits a countrys earning and payments in foreign currency. A surplus balance improves the countrys financial position. It may be utilized for growth and development of the country.

The Capital account includes all the short-term and long-term transactions between a country and the world. Usually, these types of flows of money are related to saving and investment, but speculation has turned into a major component of the account in recent times. In the capital account, both direct and portfolio foreign investment is recorded. External assistance and commercial borrowing are presented net repayment. Direct investment identifies the money which moves across national boundaries with the intention of investing in a business. Portfolio investment moves across national boundaries with the intention of purchasing shares and bonds. The Official reserves means the reserves of gold and foreign exchange kept by the Reserve Bank of India to be used by the government.

Errors and Omission

According to double entry book keeping concept for every credit, there exists a matching debit and thus, there must be a balance in BOP as well. In reality BOP may not balance. Once various types of international financial flows are recorded, the statistical discrepancy, referred to as errors and omissions, is also recorded. The statistical discrepancy occurs due to complications associated with collecting balance of payments data. You can find different sources of data which occasionally differ in their approach. For instance, merchandise is shipped in March, however the payments are received in April. If statistics are compiled on the 31st March, the numbers will differ. The errors and omissions amount is equal to the amount required to balance both the sides. It is useful to keep in mind that whenever past figures for the BOP are adjusted as time passes by, the figures for net errors and omissions get smaller and smaller as the errors are located and fixed.

Foreign exchange reserves exhibits the reserves that are kept in the form of foreign currencies. If the overall balance is surplus, it is moved to the official reserves account which raises the foreign exchange reserves. It may be in form of dollar, pound, gold and Special Drawing Rights (SDRs). If there exists a deficit, a sum equal to the deficit is taken from the official reserves account bringing the BOP into equilibrium. When surplus is moved to the foreign exchange reserve, it is displayed as minus in that specific years balance of payment account. The minus sign (-) signifies a rise in forex and plus sign (+) exhibits the borrowing of foreign exchange from the forex account in order to meet the deficit.

Watch a Video on Structure of Balance of Payments