Stocks v The LongTerm Performance Data

Post on: 18 Июнь, 2015 No Comment

The Best Performing Bond Market Segments as of September 30, 2014

Getty Images / iStock Vectors

How do the bond market’s total returns compare to stocks over time? Below, we examine the historical returns of stocks and bonds, along with the best performing segments of the bond market in the three-, five-, and ten-year periods. This article will be updated at the end of each quarter.

Stocks vs. Bonds

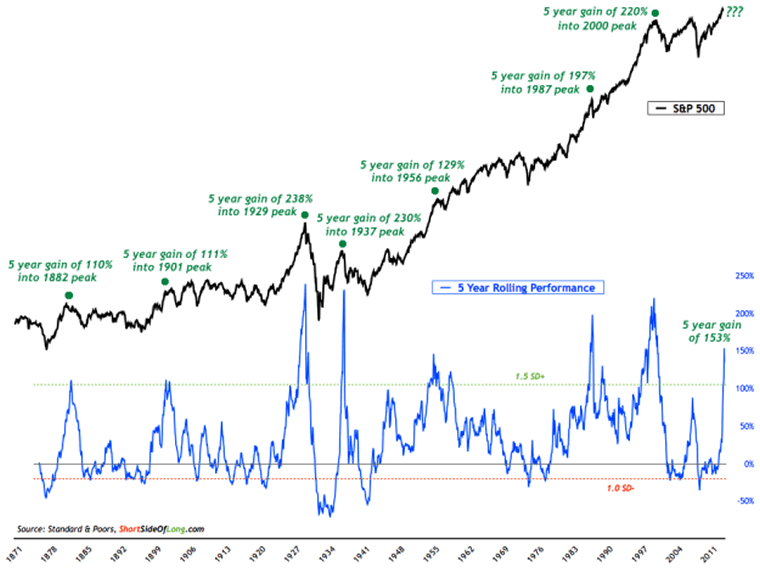

During the ten years ended on September 30, 2014, the S&P 500 – a measure of performance for large U.S. companies – registered an average annual total return of 8.11%. In comparison, the domestic bond market, as gauged by the Barclays Aggregate U.S. Bond Index. had an average annual return of 4.62%. Bonds also underperformed developed-market international stocks, which rose 6.32% each year on average, and emerging market stocks, which returned 10.68% annually. *

While stocks have had better 10-year performance than bonds, it’s important to keep in mind that bonds offer diversification. and that the presence of bonds can help smooth out the volatility of the stock market. In addition, there may also be extended periods in which bonds outperform stocks — as was the case from 2000-2002.

Best Performing Bond Market Segments, 10 Years

One of the most common maxims in investing is that more risk equates to higher long-term returns. The 10-year results bear this out, as the best performing market segments were emerging markets. which had an average annual return of 9.28%, and high-yield bonds. which returned 8.67%. Both finished ahead of the S&P 500 — even after stocks 32%+ gain in 2013 — as well as the bond market as a whole.

Below are the best performing market segments for the 10-year period, with the major bond and stock indices for comparison.

- High Yield 7.98%

- Emerging Markets 7.78%

- Long-term U.S. Corporate Bonds 6.97%

- Long-term U.S. Government Bonds 6.78%

- Investment-Grade Corporates (all maturities) 5.49%

Best Performing Bond Market Segments, 5 Years

The past five years has been a time of improving economic conditions. a gradual increase in investors’ appetite for risk, improving corporate earnings, and a broad rally in U.S. equities. This has led to outperformance for the bond-market segments that are most sensitive to economic conditions: high yield bonds, senior loans. and emerging market debt. When looking at these numbers, it’s important to keep in mind that these numbers will almost certainly not be repeated in the next five years:

- Emerging Markets 10.70%

- High Yield 10.36%

- Investment-Grade Corporates (all maturities) 10.57%

- Long-Term Corporate Bonds 8.69%

- Long-Term Goverment Bonds 6.99%

- Barclays U.S. Aggregate Bond Index 4.12%

- S&P 500 Index 15.70%

Note: Stocks’ five-year numbers are up significantly in the past twelve months, as the worst phase of the 2007-2008 financial crisis is no longer included in the current five-year period. Consider this evidence that even long-term performance numbers can be misleading .

Best Performing Bond Market Segments, 3 Years

The three-year period is similar to the five- and ten-year intervals in that it paid to take risk, as bonds with the highest sensitivity to credit conditions — high yield and the emerging markets — performed very well. Note, too, that longer-term bonds also performed very well. This is due to the sharp drop in bond yields that occurred in 2011-2012, so these returns are also unlikely to be repeated. Further, the impact of the 2011-2012 move will soon be rolling off the back end of the three-year performance period, so these categories may no longer be on the list of top-five categories by the end of 2014.

- High Yield 10.62%

- Long-term Corporate Bonds 6.85%

- Senior Loans 6.66%

- Investment-Grade Corporates (all maturities) 5.47%

- Emerging Markets 5.03%

- Barclays U.S. Aggregate Bond Index 2.43%

- S&P 500 Index 22.99%

It’s true what the legal disclaimers on investment brochures always say: past performance is indeed no guarantee of future results. However, these return figures tell us three things. 1) longer-term investors shouldn’t be afraid to take risks, 2) holding investments for the long term can smooth out the impact of even the worst market meltdowns (such as that which occurred in stocks and high yield bonds in 2008), and 3), bonds can play a meaningful role in long-term portfolio diversification. Keep in mind as you construct your investment portfolio .

* Indices used are: U.S. large company stocks: S&P 500, U.S. small companies: Russell 2000 Index, developed market international stocks. MSCI EAFE, emerging market stocks: MSCI Emerging Markets, emerging market bonds: JP Morgan EMI Global Diversified Index, high yield bonds: Credit Suisse High Yield Index, long-term U.S. government bonds: Barclays U.S. Government Long Index, long-term U.S. corporate bonds. Barclays Corporate Long Investment Grade Index, TIPS: Barclays US TIPS Index, corporate bonds — all maturities: Barclays Corporate Investment Grade Index, Senior Loans: S&P / LSTA Leveraged Loan Index, Municipal Bonds. Barclays Municipal Bond Index.

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Always consult an investment advisor and tax professional before you invest.