Stocks The Best Inflation HedgeKiplinger

Post on: 25 Июль, 2015 No Comment

Over the long-term, stocks have historically been unaffected by overall price increases.

One of the biggest threats facing investors is the possibility that massive U.S. budget deficits and the Federal Reserve’s easy monetary policy will lead to significant inflation. As an investor, how should you structure your portfolio to guard against such an event?

First and foremost, don’t abandon stocks. As long as inflation doesn’t ramp up to the double-digit levels of the 1970s and early 1980s — a scenario I consider extremely unlikely — stocks will act as an excellent hedge. The reason is simple: Stocks are claims on real assets, such as land and plant and equipment, which appreciate in value as overall prices increase.

History supports this outcome. Over 30-year periods, the return on stocks after inflation is virtually unaffected by the inflation rate.

Nearly all the inflation that the U.S. has experienced during its history has occurred since the end of World War II. The price level, as measured by the consumer price index, has risen tenfold since January 1947. Meanwhile, Standard & Poor’s 500-stock index, which was valued at 15.66 in January 1947, was 1328 in early April 2011 — about 90 times higher.

Advertisement

In fact, the real return on stocks in the inflationary postwar period is almost exactly the same as it was in the 19th and early 20th centuries, when inflation was virtually nonexistent.

Over shorter periods, however, it’s a different story. Although stocks do well when annual inflation is in the range of 2% to 5%, their performance begins to falter when inflation exceeds 5%. Some analysts theorize that stocks lose their hedging ability because inflation sparks higher interest rates, and interest rates are a key variable in calculating current stock prices.

But that couldn’t be the main explanation. Interest rates certainly rise when investors foresee inflation, but inflation also boosts future revenues and earnings. Theoretically, in a world where the prices of raw materials and finished goods rise at the same rate, the increase in future cash flows should exactly offset higher interest rates.

But this ideal situation rarely exists. In practice, companies can’t always pass along increased costs, especially in the case of an important raw material, such as oil. As a result, many companies will see their profits squeezed.

Stock prices also falter in the face of rising inflation because investors fear that the Fed will hike interest rates. If chairman Ben Bernanke were to act forcefully to slow inflation, the market would have short-term fits.

What’s the Alternative?

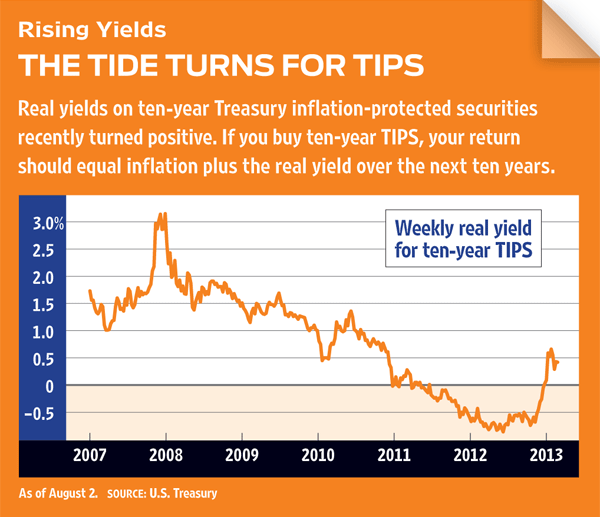

Stocks are not good short-term hedges against rapidly increasing inflation, but bonds are worse. Bonds are promises to pay in dollars, and those dollars are fixed unless you hold Treasury inflation-protected securities or other IOUs that adjust their payments with changes in the general level of prices. In early April, ten-year TIPS offered a real yield of less than 1%, and the yield on TIPS with maturities of less than five years was negative.

In an inflationary environment, investing in short-term bonds is better than investing in long maturities; as inflation rises, you can take advantage of rising interest rates. Gold and commodities also do well in periods of high and increasing inflation. But, like bonds, they have poor results over the long term. Gold, for example, has returned only 0.7 percentage point per year more than inflation over the past two centuries.

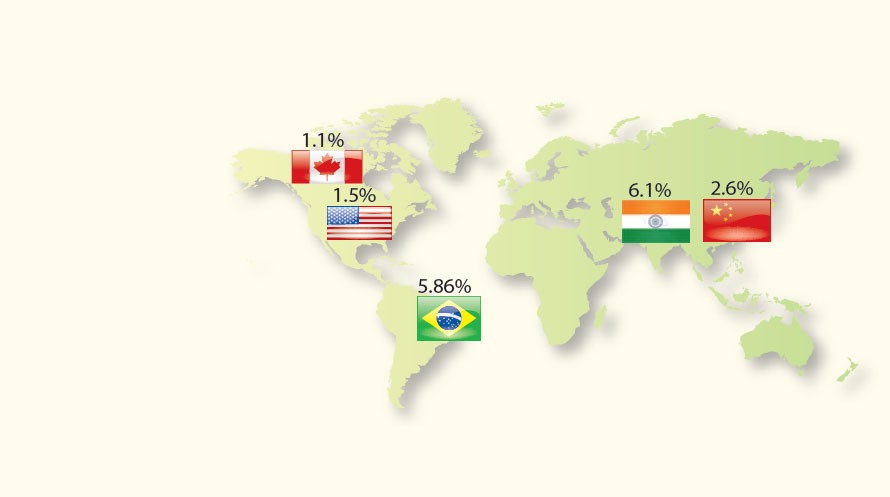

To best insulate your stock portfolio from inflation, you must diversify internationally. If inflation kicks into overdrive, the dollar will fall and foreign stocks will act as an automatic hedge as money invested in foreign currencies is translated into more dollars back home. But don’t run to speculative assets that will deflate in price when inflation slows. For long-term investors, stocks will be an excellent hedge against rising prices.

Columnist Jeremy J. Siegel is a professor at the University of Pennsylvania’s Wharton School and the author of Stocks for the Long Run and The Future for Investors.