Stock Earnings Per Share Calculator to Calculate EPS Ratio

Post on: 2 Июнь, 2015 No Comment

Explains what Earnings Per Share (EPS) means, and helps you to determine the EPS ratio of a company’s stock.

This free online Earnings Per Share Calculator will calculate the EPS ratio for a stock given the net income, preferred dividends paid, and the number of common shares outstanding.

If you don’t know the answer to the question, What is EPS?, it may help to read the following explanations related to what EPS is, how it’s calculated, and what may or not be included in it — before using the earnings per share calculator.

What is EPS?

EPS is an acronym for Earnings Per Share. Earning per share is one of the figures used in calculating a company’s P/E Ratio (price to earnings ratio) and is also often used by investors to compare the growth (shrinkage) of a company’s earnings from year to year, as well as to forecast future growth of earnings.

EPS comparisons and forecasts can then be used for deciding which stock to purchase shares in and/or when to sell a shrinking EPS stock in exchange for buying a growing EPS stock.

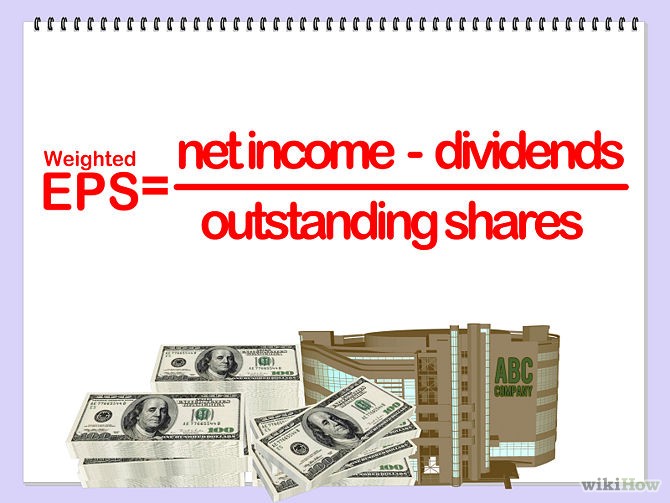

EPS Formula

EPS is calculated by subtracting the preferred dividends paid from the net income, and then dividing that result by the average number of common shares outstanding.

For example, if a company reported a net income of $25,000,000, preferred dividends totaling $1,000,000, and an average of 12,500,000 common shares outstanding, the earnings per share ratio would be 1.92 ((25,000,000 — 1,000,000) 12,500,000 = 1.92).

Be Sure to Check Under the EPS Hood

One thing to be aware of when seeing an increase in a company’s EPS ratio, is that the increase may not mean the company had a growth in sales. This is because it’s possible for a company to increase its EPS simply through buying back its own stock.

This stock buy back reduces the number of outstanding common shares without effecting net-income — thereby inflating the EPS figure. That’s why it’s important that you study the company’s financial statements in order to determine the real reason the EPS increased.

What is Meant by Diluted EPS?

If a company has convertible bonds, convertible preferred stock, in the money options, or any other types of securities that can be converted to common stock, the company’s EPS figure might be diluted from the increase in common shares outstanding that would occur if and when the securities are converted.

If a company has any of these convertible securities they are then required to disclose what is referred to as, their fully diluted earnings per share.

With that, let’s use the Earnings Per Share Calculator to calculate the EPS ratio of a company you wish to compare or forecast growth for.

Earnings Per Share Calculator