Stable Value Funds Exploring Risks and Rewards

Post on: 13 Июль, 2015 No Comment

The last time I wrote about stable value funds was in late 2008, both before the 2009 crash and a time when most of my 401k was in stocks. This time around, as I was trying to figure out how to rebalance my larger portfolio in a tax-efficient manner. I took another look at this asset class found almost exclusively in defined-contribution plans like 401ks. According to the Stable Value Investment Association (SVIA ), approximately 15 to 20 percent of 401(k) assets are in stable value funds.

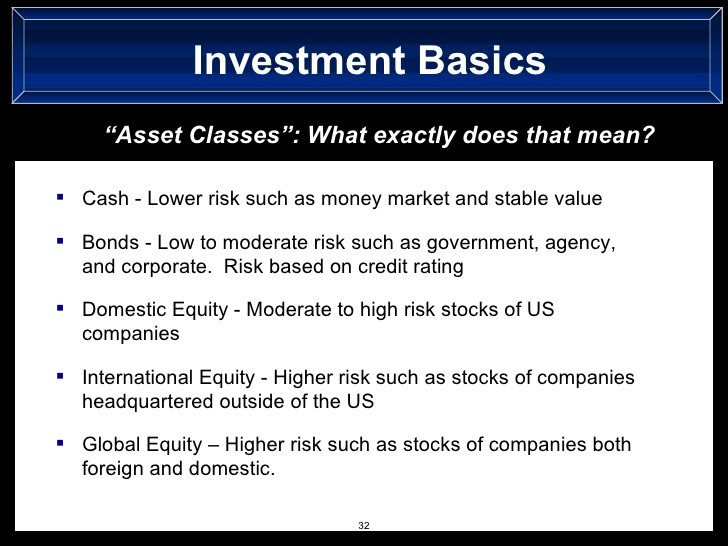

What are Stable Value Funds?

Generally, stable value funds are a bunch of bonds which have a insurance wrapper around them which protects it from interest rate volatility. The intended result is a product that pays the higher interest rates of intermediate-term bonds, with the liquidity and stable day-to-day price of a money market fund. Think cash but pays higher interest. A chart from the SVIA [pdf] illustrates:

The Attraction

Heres my current situation. The stable value fund in my 401k has a guaranteed net interest rate in 2010 of 3.50%. The low-cost Vanguard Intermediate-Term Bond Index Fund Investor Shares (VBIIX) currently yields 3.17%. but will have a moderate amount of price volatility, especially if interest rates rise. The Vanguard Prime Money Market Fund (VMMXX) currently yields 0.11% with its high-quality, ultra-short-term holdings and Vanguard backing.

I could get the stability of money market fund, with an interest rate more than 3% higher! (All yields are net of fees.)

The Risks

Higher interest rates with no price volatility? Free lunch? Not quite. First of all, any guarantee is only as good as the entity doing the guarantee. Check the safety ratings of the insurer of your fund. Mine is Transamerica Financial Life Insurance Co. (TFLIC):

Not the greatest, but not bad. In addition, there are actually several ways an insurer can get out of the contract. From the SVIA FAQ:

Are there instances when book value or contract value does not apply?

There are a few, limited instances when participants do not get book value from a stable value fund. These limited instances are typically contractually defined. One such instance typically not covered is security defaults or downgrades. In order to protect the integrity of the stable value fund, most contracts incorporate investment guidelines establishing minimum credit quality requirements for the underlying securities. These contracts have established mechanisms to address downgraded or defaulted securities that fall outside the contractual guidelines.

Corporate-initiated events, which are employer-driven events such as an early retirement program, layoff, or bankruptcy, are also typically not covered. Corporate-initiated events generally cause withdrawals in masse from a stable value fund. These withdrawals can negatively impact investors and plans that choose to remain in the fund.

First up, if the underlying securities turn out to be utter crap via a default or credit downgrade, then the insurance doesnt apply? Wait, the insurer gets to choose the securities in the first place? Sometimes smells here. In fact, this happened in 2009 to the insurer State Street, although they decided to step in to make investors whole in order to preserve their reputation. Via this CBS Moneywatch article :

In December 2008 and January 2009, State Street elected to provide support a total of $610 million to the bond portfolio in stable value funds the company managed. State Street was not contractually obligated to do this. As the company’s 8-K filing (a report filed with the SEC to notify investors of any events that could be of importance to shareholders) stated, “liquidity and pricing issues in the fixed income markets” so affected the accounts that the wrappers “considered terminating their financial guarantees.” State Street’s action to bolster its portfolios kept the wrappers in place.

Finally, there is the corporate-initiated event of a huge layoff or bankruptcy. At the end of 2008, Lehman Brothers infamously went bankrupt, which left their stable value fund managed by Invesco with a negative return of 1.7 percent in December and an annual return for 2008 of 2 percent. In April 2009, a stable value fund for Chrysler employees only paid out 89 cents on the dollar. a drop of 11% due to the companys troubles.

As you can see, there is a lot of things that can invalidate the guarantee. So, the next step is to understand the holdings, which in the event of a liquidation can help you imagine your worst-case scenario. You should be be able to see at least an overall breakdown of the assets, and a market-to-book-value ratio must be disclosed at least once a year. This will show any discrepancies between what the insurer says is worth $1 and what the market says. My TFLIC stable value funds market-to-book ratio was 101.30% as of March 31s, 2010 and here is their holdings summary:

Bottom Line

In good times, the stable value fund has a pretty easy job of maintaining an image of price stability and paying out the stated interest rate. However, when the poo hits the fan there are a lot of ways the insurance wrapper can be worth less than a bubble gum wrapper. The only real good news is that you are still left with some intermediate-term, investment-grade bonds. Even with the upheaval of 2009, the worst example I could find was a drop of 11%. Even Lehman Brothers investors ended up with a overall positive return for the year. These losses are not insignificant, but something the order of the drop in other similar bond funds during that time. The key is to understand the risks that you are taking, which oftentimes people dont (including me).

As for my personal investments, after doing my bit of due diligence, I am going to put a small percentage (less than 5%) of my total assets in my stable value fund, given the limited alternatives in my 401k. I am willing to take the risk of a small loss in order to earn 3.50% for all of 2010 in this current interest rate environment.