SPDR Barclays Capital High Yield Bnd ETF Market Vectors ETF Trust Time For Junk Bond ETFs

Post on: 8 Май, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

An improving U.S. economy will continue to keep default rates at lower levels and tighten spreads, making these junk bonds attractive. Notably, the spread between Treasury and high yield bonds narrowed to 4.53% from 5.04% at the end of 2014, suggesting that investors are now demanding lower premium than comparable Treasury bonds in order to compensate for the risk.

Additionally, the Fed is on track to raise interest rates later this year that will hurt bond prices as yields and prices have an inverse relationship. The impact of this has already been felt with yield on 10-year Treasury bond currently hovering around 2%, a sharp increase from 1.65% seen early in the month. In such a backdrop, junk bonds provide cushion against rising interest rates as these are generally less sensitive to interest rate fluctuations while offering outsized yields.

Further, yields in this sector offer a significant premium over the more highly rated Treasury bonds. The high yield bonds tend to outperform the other corners of the fixed income market when the economy is in full swing. And given low default rates, the hefty yield premium could be worth chasing. Moreover, the declining fixed-income markets liquidity encourages investors to look into this lucrative corner.

Yield-hungry investors find it difficult to ignore this opportunity to tap meaty dividends. While there are a number of options in this segment, we have taken a closer look at the three high-yield corporate bond ETFs that are actually leading the fixed income world, outpacing the broad fund (BND).

These ETFs could maximize investor’s returns while maintaining low correlated assets, and thus could be high quality picks.

Market Vectors Fallen Angel ETF (ANGL)

This innovative fund uses sampling strategy to track the performance of the BofA Merrill Lynch US Fallen Angel High Yield Index and focuses on ‘fallen angel’ bonds. Fallen angel bonds are high yield securities that were once investment grade but have fallen from grace and are now trading as junk bonds. This unique approach results in a portfolio of 150 securities with financials as the top sector and none holding more than 2.01% share.

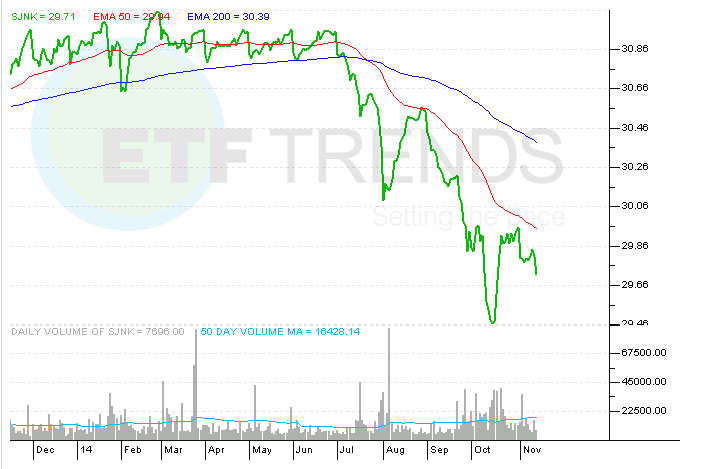

The fund has effective duration of 5.60 years and 11.13 years to maturity. The ETF trades in paltry volumes of around 7,000 shares and charges a relatively low fee of 40 bps per year from investors. It has amassed just $22 million in its asset base and has added 5.4% so far this year. It yields 5.31% in dividends per annum, which is higher than the 30-day SEC yield of 4.60%.

WisdomTree BofA Merrill Lynch High Yield Bond Zero Duration Fund (HYZD )

This ETF follows the BofA Merrill Lynch 0-5 Year US High Yield Constrained, Zero Duration Index with effective duration of -0.15 and years to maturity of 3.61. Holding 95 securities in its basket, the fund is widely spread across components with each security holding less than 2.9% of HYZD.

The product is often overlooked by investors as depicted by its AUM of $16.8 million and average daily volume of 23,000 shares. Expense ratio came in at 0.43%. The fund yields 4.32% in annual dividends, much higher than the 30-Day SEC yield of 3.72%.