Sovereign international bonds versus the US Treasuries The returns Market Realist

Post on: 5 Сентябрь, 2015 No Comment

The risks and returns on domestic and overseas bond funds (Part 2 of 7)

Sovereign international bonds versus the US Treasuries: The returns

Comparing the returns of domestic and international funds investing in government securities

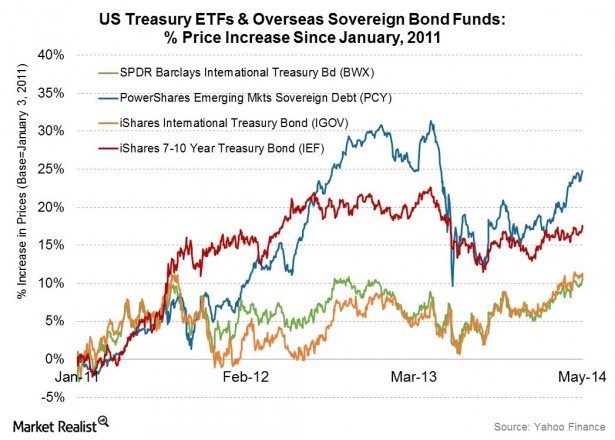

In this section, we will compare the performance of domestic bond funds investing in the U.S. Treasury securities with international bond funds, which invest in sovereign bonds issued by foreign governments.

For the purpose of comparison, we will be using the total returns on:

- The iShares 7-10 Year Treasury Bond ETF (IEF ), which invests in U.S. Treasury securities and which has Net Assets of

$4.51 billion (as of April 30) and an expense ratio of 0.15%.

$620.95 million (as of April 30) and an expense ratio of 0.35%.

$1.99 billion (as of April 30) and an expense ratio of 0.50%.

$2.36 billion (as of April 30) and an expense ratio of 0.50%.

Returns comparison

As can be seen from the graph above, PCY has posted the highest returns over the last three-year and five-year period, amongst all the ETFs considered. However, PCY also has significant holdings of lower rated debt in its portfolio (34.88% rated below BBB by S&P, as of March 31, 2014), which makes the higher return understandable, since investors would need a higher return to compensate for the higher risk.

PCY also has the highest 30-day SEC yield at 4.88% (as of May 7, 2014), while IGOV has the lowest at 1.09% (as of May 7, 2014). The distribution yield for PCY and IGOV was 4.59% and 1.37%, respectively. This implies an increasing interest rate environment in Emerging Market bonds and a declining interest rate environment in developed market bonds that make up PCY and IGOV respectively.

Impact of the Fed’s monetary policy and taper

Interest rates in EM countries are expected to go up following the Fed’s taper of monthly asset purchases in April and over the course of 2014. Investors had earlier sought investments in EM countries due to the higher yields offered compared to the US. Now with lower market liquidity following the taper, governments in EM countries are trying to stop the capital flight from occurring and make their exports more competitive, by raising rates.

Other EM countries, like Russia and Ukraine have been mired in political turmoil this year. The rising rate environment probably also reflects that. For example, the Market Vectors Russia ETF (RSX ), which invests primarily in Russian equities is down over 21% this year, due to the political upheaval.

European Union’s economic woes

Developed market countries, particularly those in the European Union block, are experiencing economic contraction and the European Central Bank has been under pressure in recent times to lower rates further, in order to stimulate growth.

In the next part of this series, we will discuss the risk aspects of the funds considered above.