Sovereign bonds Do markets need a riskfree rate

Post on: 4 Сентябрь, 2015 No Comment

With concern growing over the credit risk embodied in many sovereign bonds, fixed-income investors need to think harder about how they assess risk.

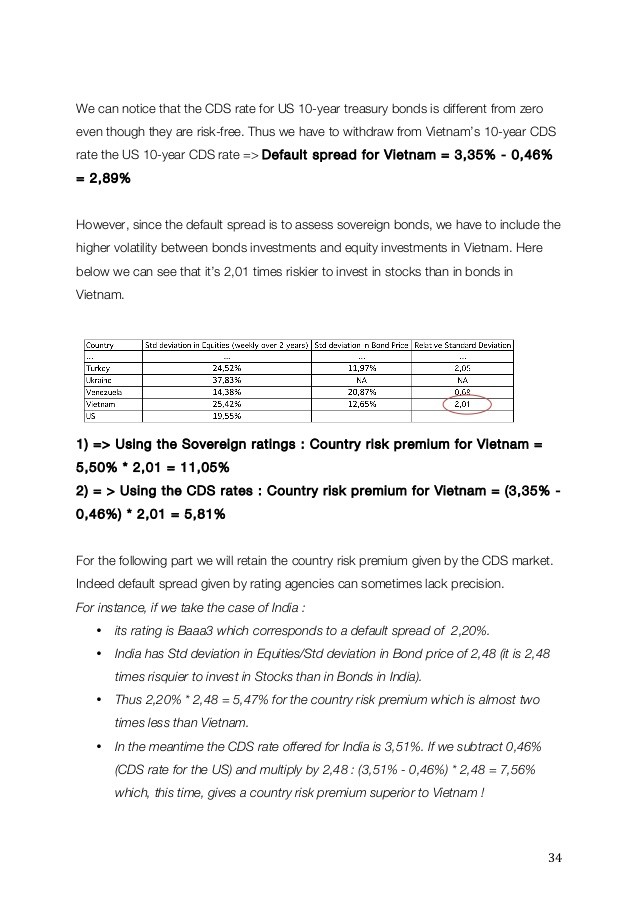

Given events in Europe over the past couple of months it is illuminating to reflect that the two banking systems that best survived the crisis of 2008 were those of Greece and Cyprus. This was because they had not bought any structured products; they had just invested in nice safe government bonds. Subsequent events have destroyed the concept that sovereign debt is risk free and created a challenge for investors that have always priced credit risk off this basic premise. Does it matter that in today’s markets there is no such thing as a genuine risk-free rate?

Anyone watching the US government bond market in the summer of 2011 would have had a sharp reminder that treasury spreads do incorporate an element of default risk, no matter how remote that might seem. The essential role of a risk-free asset is to provide liquidity, and as the level of credit risk associated with sovereign bonds increases, the negative impact on market liquidity grows.

The ranks of sovereigns that are still considered risk free are thinning fast, and this is something that investors need to think about. They need smarter indices to cope with what has happened since 2007: the government bond market in Europe has morphed from one of interest rate risk to a market with 16 different bonds incorporating 16 different credit risks.

The shrinking number of risk-free sovereign bonds distorts current indices. Speaking at a recent seminar at the London Business School, Andrew Balls, head of European portfolio management at Pimco, argued that there is a reward for failure: the more a sovereign issues, the larger a constituent of the index it becomes. He says that government bond indices should therefore be weighted for GDP.

There is certainly growing concern over the extent of credit risk that US treasuries incorporate. However, Balls questioned whether the market needs a risk-free rate. He says that if there are no triple-A assets it doesn’t matter, as you simply price off the highest-rated asset available. Treasuries are not risk free (incorporating both currency and inflation risk), but their credit risk is tiny. The US will never be forced to default but might flirt with it, as it did in 2011. However, a distressed peripheral European sovereign might well be forced to default.

Should US treasuries or German Bunds be the proxy for the absence of risk in a period of prolonged monetary easing on both sides of the Atlantic? Many would argue that fixed-income investors should use Libor or the swaps rate as the risk-free rate, rather than the government bond rate, to guard against financial repression. There is now simply too much political interference in the sovereign bond markets for them to be the benchmark against which all other risks are measured. “It is very important as an investor to be aware of how rigged the markets are,” Balls warns. “Central banks want to collapse the risk-free rate in order to force investors to take on more risk.”

To receive similar stories, sign up for Regions and emerging markets emails.