Social Security 5 Littleknown Facts About Social Security

Post on: 30 Июль, 2015 No Comment

5 little-known facts about Social Security

Most Americans watch their money go into the Social Security trust fund in the form of payroll deductions as soon as they begin working, when retirement seems a long way off. As a result, many go through their working lives without giving it much thought.

Who is entitled to retirement benefits?

Just about anybody who has worked for 10 or more years is eligible for Social Security retirement benefits.

You need 40 credits or quarters of coverage, earning a minimum income of $1,200 per quarter, according to the Social Security Administration.

The income requirement is so low that it could be met with seasonal work, says Richard W. Stumpf, a Certified Financial Planner at Financial Benefits Inc. in Wichita, Kansas.

There are some exceptions. Most federal employees hired before 1984 aren’t eligible to participate, says Brett Horowitz, principal and wealth manager at Evensky & Katz/Foldes Financial Wealth Management in Coral Gables, Florida, Stumpf adds that pastors may choose not to pay in.

Also, railroad workers and their families generally get benefits through a separate retirement system.

How are payouts calculated?

The size of your monthly check is arrived at by a series of calculations.

Your primary insurance amount, or PIA — the benefit you would get at full retirement age — determines the size of your monthly retirement check. According to the Social Security Administration’s website, the PIA is based on the Average Indexed Monthly Earnings, or AIME, as applied to an inflation-adjusted formula. The PIA is then adjusted for whether you take retirement before or after your normal retirement age — 66 for those now reaching retirement age, but gradually adjusted to age 67 for those born after 1960.

You can begin drawing reduced Social Security as early as 62. For every month you delay after reaching full retirement age, up to age 70, the monthly benefit increases.

According to a 2010 report of the Senate Special Committee on Aging, for someone with an AIME of $5,000 in 2010, the PIA would total $1,971.

In keeping with the original intent behind Social Security — a way to lift seniors out of poverty — lower-wage earners get a higher proportion of their earnings than higher-wage earners. The maximum monthly benefit that can be received in 2014 is $2,642 for a worker retiring at full retirement age.

What are spousal benefits and widow benefits?

If one partner in a marriage earns significantly less than the other, the lower-earning spouse can collect spousal benefits rather than payouts based on his or her own earnings history.

The spouse can get the greater of their own or 50 percent of the other spouse’s PIA, Horowitz says. The lower-earning spouse is not eligible until the higher earner starts getting benefits, but both can start as early as 62.

Stumpf says this option can be a financial planning tool.

Imagine a high earner whose spouse is his employee, he says. If they cut her pay and transfer the rest to him, when she reaches retirement age, one-half of his income will be significantly higher than what she earned.

A divorced spouse who was married for more than 10 years and has not remarried can draw against the ex-spouse’s work history. Widows and widowers can receive the higher of their own or their spouse’s monthly payment, but not both.

That’s why it’s important for the higher earner to delay taking benefits for as long as possible, says Horowitz.

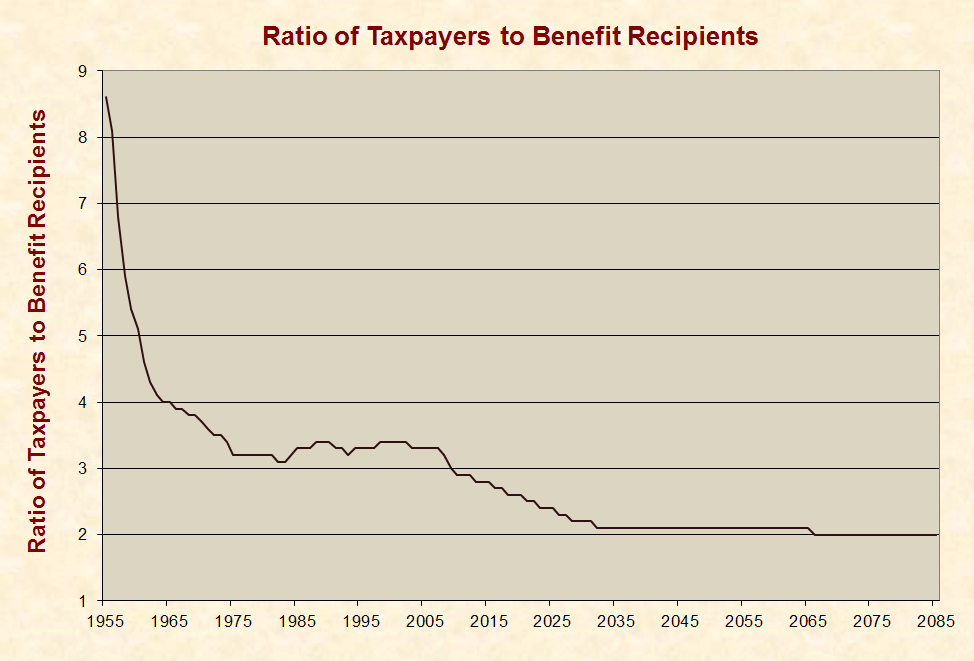

How broke is Social Security?

According to the 2014 annual report from the Social Security Board of Trustees on the financial status of the program, without policy changes, the combined Social Security trust funds will become depleted and unable to pay scheduled benefits in full on a timely basis in 2033. After that, Social Security could pay about three-fourths of scheduled benefits through 2089.

The year that funds fall short varies somewhat in each annual report depending on economic, demographic and other variables, according to the Center on Budget and Policy Priorities, but it has ranged between 2029 and 2042 for the past two decades.

Where do payroll deductions for Social Security go?

In theory, they’re held in trust by the government. But it’s not as if your money sits there in the Social Security trust fund waiting for you to retire. After current beneficiaries are paid, surplus dollars are used to buy bonds from the U.S. Treasury. So the trust has the bonds, but the money is now in the Treasury, where Congress can use it for any purpose.

The Social Security trust fund is. a piggybank holding paper IOUs from Congress, Stumpf says.

For the trust funds to remain solvent over the next 75 years, the 2014 Trustees Report says, one of these measures would have to be implemented immediately:

- Payroll taxes would have to increase by 2.83 percentage points, from its current level of 12.4 percent to 15.23 percent;

- Benefits would have to be cut by 17.4 percent to all current and future beneficiaries;

- If applied only to beneficiaries enrolling in 2014 or later, benefits would have to be cut by 20.8 percent;

- Or some combination of the above should be adopted.

According to the report: The Trustees recommend that lawmakers address the projected trust fund shortfalls in a timely way in order to phase in necessary changes gradually and give workers and beneficiaries time to adjust to them.

Lawmakers have been dragging their heels to make any fixes to Social Security, in part because it’s such a hot-button issue.

More On Social Security: