Should You Start Buying Build America Bonds

Post on: 18 Апрель, 2015 No Comment

By Guest Contributor. on April 24th, 2009, 8:56 am in Fixed Income

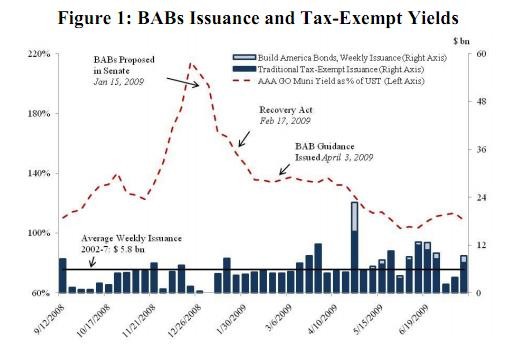

Income investors are hungrily snapping up a new form of pseudo municipal bonds known as Build America Bonds (BAB). As part of President Obamas stimulus package, they afford access to capital at a reduced rate, while providing investors with attractive yields.

There are two ways these BABs work

A state or agency can elect to pay a higher rate to bondholders, while 35% of the interest it pays will be rebated back to the issuer by the Federal government. Or the issuer can pay a lower rate in which 35% of the interest received by investors will be tax-free. While issuers have so far mostly gone with choice number one, either way, the bonds are taxable, an important difference from traditional municipal bonds.

Since BABs are taxable, try comparing them to corporates instead of munis altogether.

This Broke State Could Reward You Handsomely

California recently issued $5.23 billion of 25 and 30-year BABs that pay an annualized rate of 7.4%. But with the Fed reimbursing it for 35% of the interest, the state will only be responsible for 4.8% in the end.

To get a similar yield in the in the corporate bond market, an investor could buy bonds of Amgen (Nasdaq: AMGN ), Norfolk Southern (NYSE: NSC ), or Verizon (NYSE: VZ ), three solid companies that shouldnt be going under any time soon.

Then again, these days, you can never be too careful, which is yet another reason why a BAB is interesting. Because for the same yield, investors who take the patriotic route through a Build America Bond, can have their cake and eat it too backed by the full faith and credit of the state of California.

While I can understand if that particular states finances dont dazzle you these days, even now with all of its economic woes, the chances of default are significantly low. And quite frankly, if California starts defaulting on bonds, well have much bigger problems to deal with than whether or not we receive our interest payments.

If even after all of that, trusting the first state to officially go running for help from the Fed still sounds like the financial equivalent of sticking your head into a fire ant hill, than dont worry. Other BABs do exist.

The New Jersey Turnpike Authority also issued 30-year BABs at approximately the same rate as California. While that deal was supposed to raise $250 million, due to overwhelming demand, it has since grown to $1.32 billion.

BABs vs. Treasuries and Munis

One note of caution though: Dont make the mistake of assuming that just because the Federal government is subsidizing the interest payments, its guaranteeing the bonds in the same way it would a Treasury.

But while the Fed wont, the state or agency issuing the bond will With a yield thats around 3.6 percentage points higher than a U.S. Treasury.

Comparatively, a 30-year, tax-free muni from the state of California yields about 5.0%. Even in the highest 35% tax bracket, youd need to earn 6.75% to make up the difference between paying taxes on the bond and earning tax-free income.

Or you could take the much more simplistic road by choosing a BAB, which in this example yields 7.4%.

Investors interested in taxable income at attractive yields with high credit quality may want to take a closer look at BABs. Keep in mind these may not be suitable for trading at this point as they are not be as liquid as other bonds. As of right now, theyre likely better used as a long term investment.

For more information about this new type of bond, be sure to talk to your broker. Or if you prefer, call GunnAllen Financials Bill Nonte at 1-800-329-1924. Hell be able to answer your questions and help you determine if this is a suitable investment for you.

Marc Lichtenfeld,

Smart Profits Report

BAB Correlations (Random Roger's Big Picture, 12/22/09)