Should You Invest In Foreign Bonds of EmergingMarket Nations For Dummies

Post on: 11 Июль, 2015 No Comment

In the foreign bond market, you can invest in developed-world markets or emerging markets. Emerging markets is something of a euphemism for “poorer countries of the world.” Those who invest in them hope that these nations are emerging, but no one can say with any certainty.

In any case, if you want to buy bonds issued in Brazil, Turkey, Russia, Venezuela, Mexico, or Argentina, the opportunities are out there. The interest rates can be considerably higher than the interest rates you find in the developed world; the volatility can be enough to make your stomach contents start emerging.

What are emerging-market bonds?

The majority of emerging-market bonds are so-called sovereign bonds. That title sounds like it may have something to do with kings and queens, but all sovereign means is that these bonds are issued by national governments. U.S. Treasury bonds are sovereign bonds.

Unlike the bonds issued by developed nations, such as Germany and Japan, most emerging-market bonds are denominated in U.S. dollars (although thats slowly changing over time). Still, given the poverty, tsetse flies, and other problems of these nations, the governments can be shaky.

To get enough people to lend them money, they must pay high rates of interest. The Fidelity New Markets Income Fund has enjoyed an average annualized return since inception in May 1993 of slightly over 12 percent a year. Woooahhh. Find that anywhere else in a fixed-income investment.

Of course, with the high return, as always, comes high volatility. In 1998, when Russian government bonds went into defaultski, investors in the Fidelity New Markets Income Fund, like investors in most emerging-market funds, quickly saw about a quarter of their investments disappear overnightski. The following year, 1999, most emerging-market bond funds sprang back rather nicely, even though Ecuador defaulted on its bonds that year.

By the way, certain dollar-denominated bonds issued by Latin American countries are often referred to as Brady bonds, named after former U.S. Treasury Secretary Nicholas Brady. The bonds were part of a scheme developed in the late 1980s to figure out a way for Latin American countries to deal with their giant-sombrero-sized debt burdens.

In more recent years, emerging-market bonds took a serious hit in 2008 when investors in the Fidelity New Markets Income Fund, as well as most similar funds, lost nearly one-fifth of their investment value. (Treasuries were just about the only investment that actually made money that year.) But once again, the next year, 2009, was a gangbuster year, and investors who stayed put in their emerging-market bonds recouped nicely.

And then. a very strange thing happened. A debt crisis emerged in Europe. Bonds across the continent took a swan dive, with yields in certain nations like Spain and Italy reaching yields similar to most emerging-market bonds.

In January 2012, for example, just as S&P lowered its ratings on the government bonds of eight European nations, bonds issued by Italy were yielding more than bonds issued by Mexico, and bonds issued by Spain were yielding more than bonds issued by the Philippines. Bonds in Greece that month were yielding more than 30 percent way more than most emerging-market bonds.

As a whole, however, developed-world bonds, even immediately following the S&P (and later, Moodys) downgrades in Europe, never approached yields offered by the emerging-market nations. (Many, many more bonds are issued by Germany and France than by Italy, Spain, and Greece.)

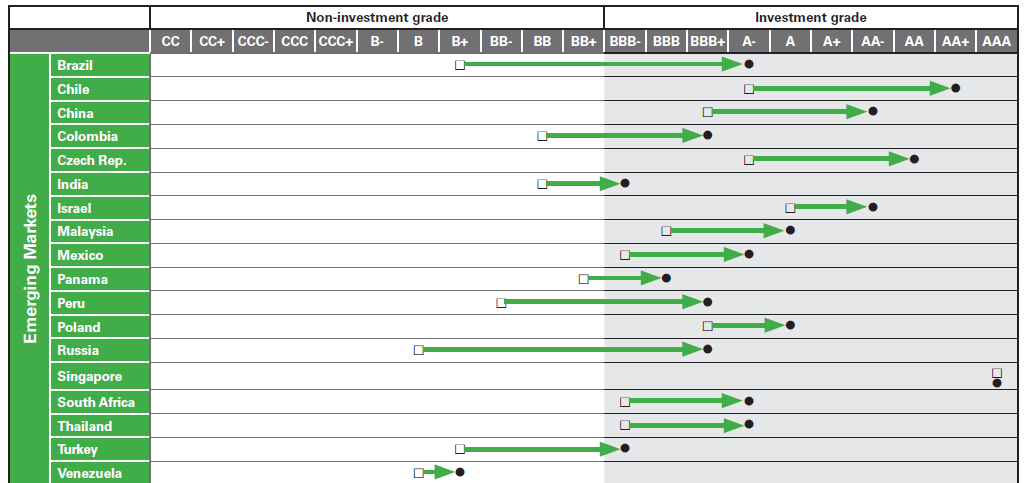

Most developed nations still maintain high S&P ratings: Germany and the Netherlands are still AAA; France and Austria are AA (same as the United States); Spain is A; Italy is BBB+. Most emerging markets have lower ratings: Russia and Brazil are BBB; Turkey and the Philippines are BB; Columbia is BBB-.

While there has been lots of talk lately about how the ratio of debt to gross domestic product has reached higher levels in many developed-world nations (including the United States) than in many emerging-market nations, that ratio is not the only determinant of a nations default risk.

And the ratings firms know this. Emerging-market nations because of unstable governments, economies that are often reliant on commodity prices, and lack of infrastructure are riskier places in which to invest and likely will remain such. Emerging-market bonds, therefore, must offer higher interest rates in order to remain attractive to investors.

Should you invest in emerging-market bonds?

Emerging-market bonds belong, in modest amounts, in most portfolios larger than $100,000 or so. If youre going to have high-yield bonds in your portfolio, emerging-market bonds make sense. When recession hits the United States and the Dow and S&P have a rough year, U.S. high-yield (junk) bonds usually tank.

That makes sense. As companies hit hard times, marginal companies are most likely to default. Emerging-market bonds, however, have little correlation to the U.S. stock market (despite their synched tumble in 2008). Thats why a small allocation perhaps 3 to 5 percent of a well-diversified portfolio belongs in emerging-market bonds.

But, given the volatility of these bonds and the potentially high returns, look at them more like stock investments than bond investments; in fashioning portfolios, emerging-market bonds go on the equity side of the pie. Theres only one practical way to invest in emerging-market bonds, and thats through a fund.

- Add a Comment Print Share