Should You Invest in Bitcoin Here s 3 Reasons Why You Shouldn t

Post on: 26 Август, 2015 No Comment

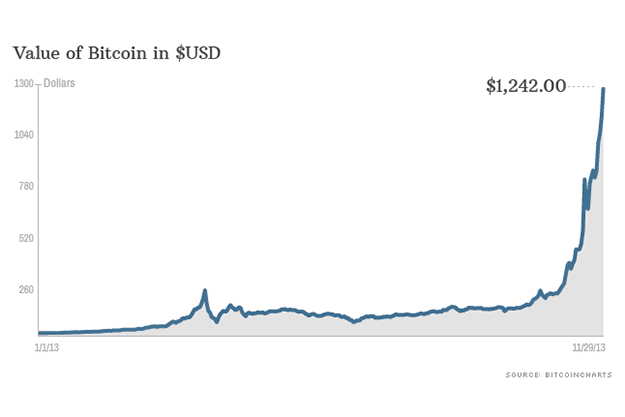

When an investment grows by 7,900% in less than one year, what do you do?

That’s exactly what happened with Bitcoin in 2013, as the value of the virtual currency soared from $15 in January to more than $1,200 in November. In fact, the best performing hedge fund last year invested exclusively in Bitcoins. So, should you invest in Bitcoin ?

After such an astronomical surge in prices, investors should NOT buy Bitcoin. In fact, there are three simple reasons for concern.

Bitcoin is not a proven alternative asset.

As part of my diversified portfolio, I like to own gold and silver. One easy way to do this is through the popular ETFs that track their value, including the SPDR Gold Trust (NYSE: GLD) and iShares Silver Trust (NYSE: SLV) .

Most long-term investors who hold gold ETFs or silver ETFs are seeking the diversification offered by alternative assets. After all, these assets are thought to be a good hedge against the U.S Treasury printing money.

But over the last year, the SPDR Gold Trust is down 23%. And the iShares Silver Trust has plunged 36%. After such a poor showing, investors are looking for an alternative. And increasingly they’re buying Bitcoins.

While Bitcoin is certainly an “alternative” to owning stocks and bonds or holding U.S. dollars, it is not necessarily a reliable one.

Gold and silver have been around for a very long time. You can pick them up in your hands and both have industrial uses. The same cannot be said for Bitcoin.

Bitcoin is merely a promising digital currency experiment. It was dreamed up out of thin air and the first Bitcoins entered circulation in January 2009, just five years ago. As a matter of fact, the person or group that created Bitcoin did so under a pseudonym so we don’t even know who created it.

I don’t know about you, but when I go looking for alternative assets to put in my portfolio I prefer something with more than 5 years of history and at least some physical existence or value.

Bitcoin isn’t a share of a company or a bond to be repaid by a borrower. Bitcoin is new, completely different and its future isn’t certain. While it could have a place in a speculative portion of your portfolio, Bitcoin is not a proven and reliable alternative asset.

Second, Bitcoin’s legal status is uncertain.

Bitcoin is a five-year-old digital money experiment. As skillfully as the technology and software behind Bitcoin have been designed and implemented, the concept of a virtual currency is unlike any other technology we use.

While no laws have been passed in direct response to Bitcoin, its prominent use in criminal enterprise makes it a high profile target for law enforcement and legislative efforts. Even for those using and investing in Bitcoin legitimately, tax implications and the legal status of Bitcoin exchanges remain uncertain.

Just last week Florida prosecutors charged three high-profile Bitcoin traders on various charges stemming from the use of an unlicensed money transfer service.

Is this just the tip of the iceberg when it comes to various local and national governments taking action against Bitcoin users and traders?

And my third concern is this: how do you value a virtual currency?

The argument that Bitcoins have no real value is a tough pill for Bitcoin advocates to swallow. They will argue that, relatively speaking, the U.S. dollar and the Euro have to real value as they are not backed by any hard assets either. And, while true, this argument misses the point.

Sure, the U.S. dollar is no longer backed by gold, silver or Treasury Notes. However, U.S. debt and currency is backed by the full faith and credit of the U.S. government. The government can tax to pay off its debts while Bitcoin is pure speculation.

Speculation isn’t necessarily bad, but it’s very important to recognize it as such.

Bitcoin has no assets or central bank behind it whatsoever. For some people, this is exactly the appeal of Bitcoin. Its only value comes from the value given to it by users and the speculators who have purchased Bitcoins on the assumption that the value will go up over time.

The reality is that we don’t have good answers to any of the risks I just outlined. I have heard intelligent responses to each of these issues but they miss the bigger picture.

This is a “virtual currency.” It is five years old. It was created by an anonymous person or group. It has questionable legal status. It is not tied to any asset of any kind.

Bitcoin is pure speculation. But, because there is no theoretical value, there are no fundamentals to slow its rise.

Despite the fact that Bitcoin could rise indefinitely there are so many other great alternative assets, investments with sound legal standing and with proven fundamental value.

I can’t stop you from investing in Bitcoin if that’s what you want to do. But you should know that it could be today’s riskiest investment.

Can you think of more reasons not to buy Bitcoin?

Buy Gold for $400 an Ounce

Most gold miners are lucky to get their gold out of the ground for less than $1000 an ounce – which is great if gold is $1400 or more…But we found a specialized gold company that can buy gold for $400 an ounce. It’s a unique story – a safe way to benefit from high gold prices, with lots of downside protection. Click here for the full write-up.