Should I Invest in Stocks Bonds or Mutual Funds

Post on: 22 Апрель, 2015 No Comment

For many regular folks, investing is a scary process that seems risky and opaque. Many people prefer to leave their hard-earned funds in the hands of reputable retirement professionals who can point to favorable past outcomes. These well-compensated investment gurus generally invest in moderately risky mutual funds that produce decent returns in exchange for a cut of the profits.

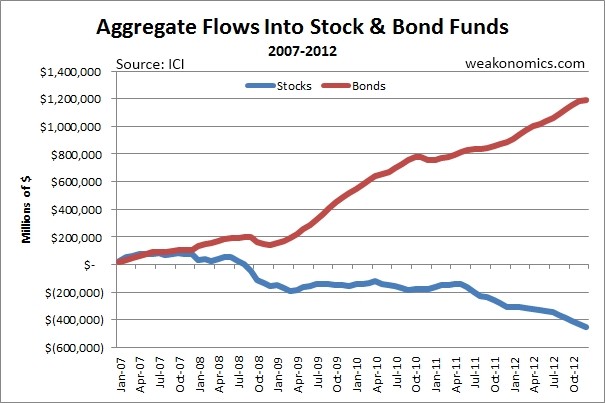

Others refuse to trust the volatile equity markets. Many of these individuals park the bulk of their assets in low-interest savings accounts or CDs. This is completely understandable: With the memory of the financial crisis of the late 2000s still fresh in the minds of many Americans, the stock market simply seems too risky for casual investors. In the aftermath of the financial crisis, so-called retail investors remain dormant. Most of the money that flows into and out of the stock and bond markets is controlled by investment bankers and money managers.

Fewer and fewer individuals have the time or inclination to manage their own investments. Those who do may be more inclined to take a riskier short-term approach to the equity markets. These risk-seekers often invest in flashy companies that offer the potential to produce outsize returns. Of course, plenty of these companies' stocks end up tanking permanently after regulators or competitors expose fatal flaws in their business models.

If you're looking to earn a substantial return on your investments, you should avoid low-interest savings accounts and CDs. These days, the interest rates on such savings vehicles are barely keeping pace with the underlying rate of inflation.

If you're looking for a stable return that carries a minimal amount of risk, you should invest in dollar-denominated government bonds. Federally-issued Treasury bonds come in short-term, medium-term and long-term varieties. These include the ever-popular 10-year Treasury and the long-term 30-year Treasury. Most of these federal bonds carry low rates of interest that may only slightly outpace the rate of inflation.

If you wish to avoid paying taxes on your bond holdings, consider investing in municipal bonds. These come with higher rates of interest and may not incur state and federal taxes. However, some municipal bonds may be quite risky. Before investing in one of these vehicles, investigate the financial health of the issuing municipality .

Stocks and mutual funds offer the promise of inflation-beating returns. Mutual funds are basically managed baskets of stocks that are suitable for retirement portfolios and conservative, long-term investors. Individual stocks carry more risk but offer better value in the short term.