ShortTerm Health Plans Obamacare Alternatives They Are Not

Post on: 16 Март, 2015 No Comment

If you’re shopping for health insurance, you may get a pitch for something called a short-term medical plan. These policies have been around forever and are aimed at recent college grads, people between jobs, and new employees waiting for group benefits to kick in. They’re marketed by major insurers including UnitedHealthcare Services, Humana (HUM ). some Blue Cross and Blue Shield carriers, and many smaller companies.

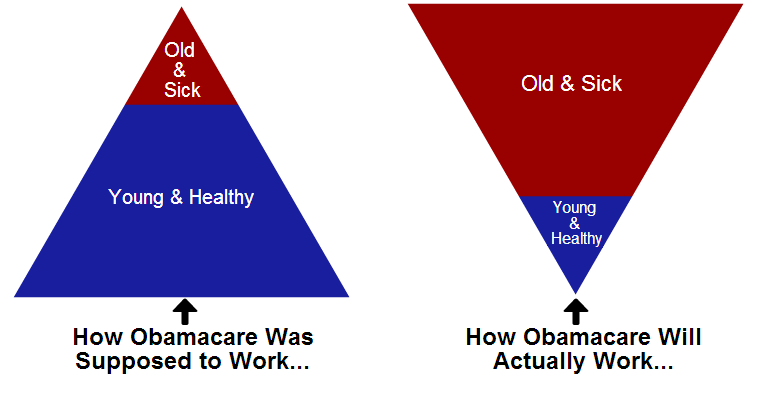

Short-term plans have become more visible as some insurers and brokers take advantage of the hoopla surrounding the Affordable Care Act to market them as alternatives to the policies available on the state and federal exchanges. Although the plans look a little like those approved under Obamacare, they provide less coverage and don’t have to adhere to the same rules. The companies are allowed to turn away patients who are sick and refuse to cover preexisting conditions. They don’t have to pay for preventative care and aren’t required to renew a policy if a patient needs a lot of medical care. “If you get sick, it’s not going to take care of you,” says Karen Pollitz, a senior fellow at the Kaiser Family Foundation, a health researcher.

The short-term plans also don’t satisfy the Obamacare requirement that people have adequate coverage, so people who buy them face the same tax penalties as the uninsured. Twenty percent of short-term policyholders believed, wrongly, that their coverage would be adequate under the ACA, according to a survey published in September by EHealth (EHTH ). an online brokerage that sells conventional and short-term policies. An additional 64 percent said they weren’t sure.

There’s plenty of cause for the confusion. Assurant, one of the larger sellers of the temporary medical plans, says on its website that “these plans do not meet minimum essential coverage requirements” and customers may face tax penalties. But insurance agency Liberty Medicare in Wynnewood, Pa. called short-term plans “a viable alternative to Obamacare plans” in a recent blog post, although the company also noted that “their benefits are not as broad as Obamacare benefits.” Even if the policies exclude preexisting conditions, says president Gregory Lazarev, for “healthy people who are not entitled to subsidies, it makes perfect sense to go and buy a short-term plan.”

20%

Percentage of short-term policy holders who wrongly believe their plan meets Obamacare standards

“There definitely are some companies out there that are aggressively marketing these and [similar] policies,” Pollitz says. One making expansive claims is Health Insurance Innovations (HIIQ ). which connects consumers with short-term policies from third-party insurers. The Tampa company, which raised $65 million in an initial offering about a year ago, is expecting a boost from the ACA, even though its plans don’t meet the law’s requirements for adequate coverage. “We want to be ready to take full advantage of this unprecedented degree of market expansion,” Chief Executive Officer Michael Kosloske said in a November earnings call. In an interview, Kosloske says: “Our benefits are the same or better than what you’re going to find, for example, on the exchanges.”

A sample policy sold by Kosloske’s company suggests otherwise. Unlike ACA plans, it doesn’t cover immunizations and routine physicals, outpatient prescription drugs, preexisting conditions, pregnancy or childbirth, sports injuries, substance abuse treatment, allergies, or kidney disease. It also comes with a $2 million lifetime limit on benefits, a provision banned under Obamacare rules.

Buying the stripped-down, short-term policy could save a 30-year-old Florida man $1,123 in premiums over a year, compared with a typical bronze-level HMO plan from Humana. If he earns $46,000 a year, he’d have to pay about 41 percent of the savings in tax penalties for not having coverage authorized by the ACA. The penalty rate will double in 2015. If the hypothetical consumer earns $23,000 or less, federal subsidies would make up the difference between the price of the bronze plan and the short-term policy.

Kosloske points out that the bronze plan has exclusions, too, and a limited network—it doesn’t pay anything if you see a doctor outside the plan. In the plan his company sells, “covered benefits are paid the same way whether in or outside the broad and highly accessible provider network,” he says.

Pollitz advises consumers to stay away from short-term plans. “It may cover your claims until your term of coverage runs out,” she says. But for anyone who gets sick and hopes to renew, “it’s junk.”