Sharpe Ratio

Post on: 27 Май, 2015 No Comment

Definition :

The Sharpe Ratio, named after Nobel laureate William F. Sharpe, measures the rate of return in association with the level of risk used to obtain that rate. Its a particularly useful tool for novice investors to use as a method tracking luck versus smarts.

Heres an easy example to help conceptualize how the Sharpe Ratio works in real life. You and your two friends are out for a drink when the topic turns to investing. Friend number one is the play it safe guy who puts his money in Treasury Bonds and hopes for the best. Essentially his investment is as close to risk free as possible (excluding the threat of inflation of course). Its safe and requires nothing more than automatic payroll deductions to generate a steady albeit decidedly insignificant rate of return. This is considered a risk free rate. Since anyone can obtain that rate of return by doing almost nothing, it is removed from the equation. Stocks, by their very nature, have some element of risk and as a rule of thumb, any investment with an element of risk should generate a premium above the risk free levelotherwise, why put your money at stake?

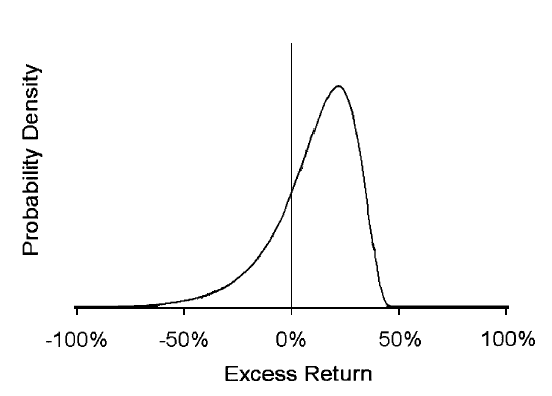

Friend number two is telling you about his hot new investment tip that just generated an amazing 25 percent rate or return. Is this guy a genius or what? Maybe not. By using the Sharpe Ratio, you can measure whether your friend is taking on too much risk. Briefly, it works like this Subtract the risk free rate (like that available from your friends Treasury bills) from the rate of return generated then divide by the standard deviation of the portfolio returns. The result provides a way to measure the excess return derived from the level of risk assumednot necessarily insight and intuition. Chances are your friend isnt a genius but rather a lucky hot-shot who needs to take the money and run before his luck runs out. To give you some insight, a ratio of 1 or better is considered good, 2 and better is very good, and 3 and better is considered excellent. One final note: if your investment portfolio isnt performing above the risk free rate then its time to put up or shut up. Either figure out what you are doing wrong and begin educating yourself on the basics of investing or sign up for those bonds via payroll deduction and hope inflation leaves you a little to live on by retirement.

Risk –Free Rate (Savings Account at ING Direct) = 3% Stock A = Apple (AAPL)

Practice this on HTMW

You can calculate your own Sharpe Ratio on stocks after trading it on: