Sentiment Economic Cycles with Market Fluctuations

Post on: 27 Июнь, 2015 No Comment

I’ve already made entries on some cyclicals and will expand on it here. First, though, some clarification: there are three terms that have been used interchangeably: Economic Cycle . Market Cycle . and Business Cycle . I want to separate them with more distinct definitions.

To me, the Economic Cycle is about the swings from general periods of expansion to periods of economic contraction as you can see in the graph below (the outer band). The Market Cycle is about how the various markets move in relation to the Economic Cycle. And the Business Cycle is the politico/economic fluctuation of the markets within the Market Cycle, also called the Presidential Cycle (the words in blue: Stocks Up/Down, Commodies Up/Down, Bonds Up/Down).

The Economic Cycle is economy-wide fluctuations in production or economic activity over several years. These fluctuations are shifts over time between periods of relatively rapid economic growth (expansion), and periods of decline (contraction). When real GDP (Tek’s GDP I and GDP II ) is rising quickly the economy is said to be experiencing economic growth or recovery. When real output falls or when the growth of output is below its long run trend rate — then economic recession exists.

In general and apart from random shocks to the economy, such as wars and technological changes, the main influences on the level of economic activity are investment and consumption. An increase in investment, as when a factory is built, leads to consumption because the workers employed to build the factory have wages to spend. Conversely, increases in consumer demand cause new factories to be built to satisfy the demand. Eventually the economy reaches its full capacity, and, with little free capital and no new demand, the process reverses itself and contraction ensues. Natural fluctuations in agricultural markets, psychological factors such as a bandwagon mentality, and changes in the money supply have all been proposed as explanations for initial changes in investment and consumption. After World War II many governments used monetary policy to moderate the economic cycle, aiming to prevent the extremes of inflation and depression by stimulating the national economy in slack times and restraining it during expansions.

The Economic Cycle is the juggernaut of the economy — the mother of all trends. Governments may try to fine-tune this cycle through monetary and/or fiscal policy, but if they stray too far they will be crushed. Government policy follows the economic cycle — it reacts or over-reacts to it. In the chart below, the Fed’s reactions come at relatively specific times within the Economic Cycle. but are basically part of the Market Cycle .

In the most excellent chart above, you can see how some indicators line up to define which phase an economy is in. It is interesting to note that in the increasing and decreasing sections inflation is an economic concern and money flow is a major sentiment factor between bonds and stocks — risk aversion or risk appetite. It is these periods when sentiment turns from amassing capital to protecting it. This is the guiding sentiment factor. Industries turn on this as the public opens and closes it’s wallet or, more likely, takes its spending from one source to another.

There are four stages to the Economic Cycle and, thoiugh they are not regular, they are measurable and predictable. The following quote of Sam Stovall, chief investment strategist at Standard & Poor’s, is from his April 16, 2009 BusinessWeek column, “Sector Watch”:

“The National Bureau of Economic Research [NBER ] sets dates for peaks and troughs in economic activities, based on its assessment of such factors as gross domestic product and employment growth. Since 1945, the U.S. economy has experienced 11 recessions and 10 expansions (it’s now in our 11th expansion). Growth periods have lasted an average of nearly five years (59 months, to be exact), with the shortest being 12 months from July, 1980, to July, 1981, and the longest at 120 months from March, 1991, to March, 2001.”

Stovall goes on to suggest that by dividing the NBER cycles into sub-stages, historically successful periods for stocks in certain sectors become apparent:

Economic Cycle in Four Stages with Market Fluctuations

Here are the four basic stages of the economic cycle, and some market indicators — again, keep in mind that these market indicators usually trail the economic cycle by a few months.

Full Recession — Not a good time for businesses or the unemployed. GDP has been retracting, quarter-over-quarter, interest rates are falling, consumer expectations have bottomed and the yield curve is normal. Sectors that have historically profited most in this stage include:

Cyclicals and transports (near the beginning).

Technology.

Industrials (near the end).

Early Recovery -Finally, things are starting to pick up. Consumer expectations are rising, industrial production is growing, interest rates have bottomed and the yield curve is beginning to get steeper. Historically successful sectors at this stage include:

Industrials (near the beginning).

Basic materials industry.

Energy (near the end).

Late Recovery -In this stage, interest rates can be rising rapidly, with a flattening yield curve. Consumer expectations are beginning to decline, and industrial production is flat. Here are the historically profitable sectors in this stage:

Energy (near the beginning).

Staples.

Services (near the end).

Early Recession -This is where things start to go bad for the overall economy. Consumer expectations are at their worst; industrial production is falling; interest rates are at their highest; and the yield curve is flat or even inverted. Historically, the following sectors have found favor during these rough times:

Services (near the beginning).

Utilities.

Cyclicals and transports (near the end).

Keep in mind that as the Economic Cycle moves from one stage to the next money will flow from the previous sectors to the next.

Economic activity is indicated by GDP, which in turn, is largely affected by aggregate demand, unemployment and so forth. EconGuru.com lists some possible causes of economic cycles:

Political power

Rise and decline in supply of labor due to workers illusions

Innovation

Monetary supply

Supply shocks

The following charts shows this on a time line where the Market Cycle (Stock Market Cycle) leads the Economic Cycle. Stovall’s theoretical model states that different sectors are stronger at different points in the economic cycle. The graph below shows these relationships and the order in which the various sectors should get a boost from the economy. The Market Cycle preceeds the Economic Cycle because investors try to anticipate economic effects. So, if you know where the Economic Cycle is, then you know where you want to be looking for opportunities in the markets or what to expect in the market you’re trading.

So where are we in the Economic Cycle?

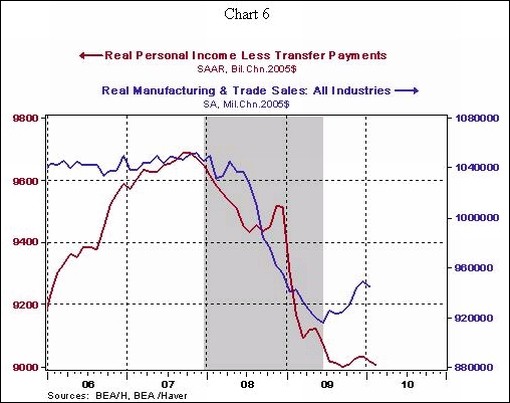

The determination that the last expansion ended in December 2007 is the most recent decision of the Business Cycle Dating Committee of the National Bureau of Economic Research . [The NBER does not define a recession in terms of two consecutive quarters of decline in real GDP. Rather, a recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.]

Although most indicators have turned up, the committee decided that the determination of the trough date on the basis of current data would be premature. Many indicators are quite preliminary at this time and will be revised in coming months. The committee acts only on the basis of actual indicators and does not rely on forecasts in making its determination of the dates of peaks and troughs in economic activity.

I came across this fascinating visualization the other day, the OECD Business Cycle Clock. It tracks four types of economic indicators and plots them as a time series. Play the animation and you can see how the economic indicators move through the four stages of the economic cycle: Expansion, Slowdown, Downturn, and Recovery.

And check out this animated graphic from the NYTimes which takes the reader step by step through how the OECD’s information graphic is assembled, and then “plays” past recessions, and the recession of 2007-2009.