SelfDirected Brokerage Accounts and Your 401(k)

Post on: 24 Август, 2015 No Comment

Self-Directed Brokerage Accounts and Your 401(k)

In our first quarter client newsletter, we mentioned that we are happy to help our clients with a self-directed brokerage account if the option is offered through their 401(k) plan, at no additional cost.  We have received a good deal of feedback and questions, so I thought that this would be an appropriate blog article for the week.

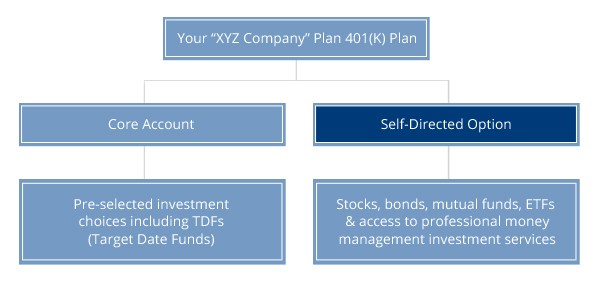

Generally, employer-sponsored retirement plans have offered participants a diverse, but usually limited number of mutual funds (On average 10-20 funds).  As a result of employees asking for more choices, some employers have begun to offer the option for a self-directed brokerage account (Approximately 21% of today’s plans offer the option*).  A self-directed brokerage account is an account that you open with a brokerage firm through your retirement plan.

The main advantage of a brokerage option, in our opinion, is that it enables you to invest in a much larger sub-set of funds potentially providing you with access to higher quality fund(s) or funds that are more appropriate for your situation.  You may also be able to invest in stocks, bonds, options, ETFs, etc. The expanded investment menu means that you will likely need to spend more time researching your investment options.  Or you can have an advisor like Smart401k advise you.  In most cases, all we will need to complete a recommendation is the name of the brokerage platform you are able to access. We will then prepare a new recommendation for your self-directed account and continue providing you with recommendations for your core 401(k) account.

The main disadvantage of a self-directed account is that it will likely come with restrictions such as how much and how often you can transfer money.  For example, you might be able to move only 50% of your total account balance to a brokerage account, there may be minimum dollar requirements for each transaction and in most cases contributions cannot go directly into the brokerage account.    In addition, there may be additional fees such as an administrative fee, for having the account open, and/or transaction fees (Note: we only use no-load mutual funds in our brokerage recommendation which may reduce or eliminate transaction fees).

We believe self-directed brokerage accounts are beneficial, if used correctly, and generally recommend that our clients take advantage of the option. If you do decide to open a self-directed account, please let us know and we will update your recommendation.  Feel free to contact us directly by phone at 877-627-8401 or by email at info@smart401k.com if you have any questions.

Jessica Slaters, Investment Advisor

*Source — 2008 Profit Sharing Council of America