Selecting The Best Emerging Market Bond Funds

Post on: 8 Июнь, 2015 No Comment

Summary

- Emerging market bond funds offer diversification coupled with the potential for higher yields.

- EMB offers the best risk-adjusted performance among the emerging market bond ETFs and CEFs.

- Closed end funds can provide high returns for the risk-tolerant investor.

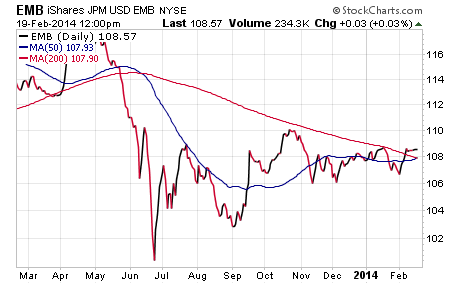

In a search for higher yield, many investors have turned to more exotic asset classes such as Emerging Market (EM) bonds. EM bonds were on a tear since the bear market ended in 2009 until they stumbled last year. Last May, EM bonds sold-off after the Fed began to discuss plans for tapering, which sparked fears that less capital would be flowing into emerging markets. The performance of EM bonds last year was definitely not the type of results you would want for your retirement account. However, I must confess that I like to maintain a small investment in this asset class because of attractive yields, potential capital gains, and diversification. If you decide to invest in this type of bond, the question is: what are the best funds to purchase?

There are many ways to define best. Some investors may use total return as a metric but as a retiree, risk is as important to me as return. Therefore, I define best as the asset that provides the most reward for a given level of risk and I measure risk by the volatility. Please note that I am not advocating that this is the way everyone should define best; I am just saying that this is the definition that works for me.

Emerging markets refer to securities domiciled in a country that is considered to be emerging from an under-developed economy to a more mainstream environment. The countries considered to be emerging are mostly in Africa, Eastern Europe, the Middle East, Latin America, and some Asian countries excluding Japan. Many of these economies depend on either exporting commodities or providing services to the more developed world. There are several subclasses of EM bonds. For example, EM bonds may trade in either the currency associated with their country or trade in U.S. dollars. In addition, EM bonds may be corporate bonds or Government treasuries (which are usually referred to as Sovereign debt).

Some of the reasons for investing in emerging market debt include:

- EM bonds offer higher yields than comparable bonds from developed countries.

- As the credit worthiness of an emerging economy improves, the rating of the bonds may improve leading to capital gains.

- EM bonds rise and fall due to local conditions, which may not be in sync with the U.S. market, thus offering diversification.

- If the EM bond is denominated in local currency, there is a potential for additional appreciation due to currency fluctuations. Of course, depreciation is also a possibility.

Since many EM bonds are thinly traded and are available only on local exchanges, it is difficult for individual investors to purchase these bonds. The easiest way to invest in this asset class is to buy funds. Exchange Traded Funds (ETFs) are the most popular vehicle with some ETFs trading over 700,000 shares per day. However, Closed End Funds (CEFs) are an alternative choice. The closed nature of these CEFs makes it easier for the manager to invest and hold limited liquidity assets without having to worry about cash inflows and outflows. However, the downside of CEFs is that the price is based on market action, which can wreak havoc when the asset falls from favor. This was demonstrated with a vengeance in the second quarter of 2013 when talk of tapering caused the average share price of these CEFs to drop 11%.

This article will compare the risks and rewards of EM bond funds, both CEFs and ETFs, versus more conventional US treasuries and high yield corporate bonds. I will use a 5-year time frame and require that the selected funds trade at least 50,000 shares per day. Based on these criteria, I selected the following CEFs for my analysis:

- MS Emerging Markets Domestic (NYSE:EDD ). This CEF invests in emerging market domestic debt and sells for a discount of 6.8%, which is higher than its 52-week average discount of 11.9%. This is the only leveraged fund that invests exclusively in local currency debt. The fund has 42 securities, almost all in sovereign debt. Even though the bonds are from emerging markets, about 85% are actually investment grade (BBB or higher). The fund invests in a wide range of countries including Brazil (17%), Turkey (13%). Russia (12%), South Africa (11%) and Mexico (11%). In terms of bear market performance, the price of this fund dropped 29% in 2008. It also lost 13% last year. The fund utilizes 25% leverage and has an expense ratio of 2.5%. The distribution rate is usually about 7.6% but last year the fund paid out an additional special dividend of an additional 4%.

- MS Emerging Market Debt (NYSE:MSD ). This CEF sells for a discount of 13.3%, which is lower than its average discount of 11.5%. The fund has 104 holdings, with about 80% in sovereign debt and 15% in corporate bonds. Virtually all the bonds are denominated in U.S. dollars. Geographically, the holdings are distributed among a large number of countries including Mexico (14%), Russia (13%), Indonesia (9%), Venezuela (7%), and Turkey (7%). About 73% of the bonds are investment grade. In 2008, the price of this fund fell 18% and in 2013, the price dropped 13%. The fund is only 65% correlated with its sister fund, EDD. MDD uses 16% leverage and has an expense ratio of 1.2%. The distribution is about 5.7% but a special distribution of 2.8% was paid last year.

- Western Asset Emerging Market Debt (NYSE:ESD ). This CEF sells at a discount of 11.1%, which is lower than its average discount of 8.2%. It has 180 holdings with about 50% in sovereign debt and 42% in corporate bonds. The assets are distributed among several countries including Mexico (10%), Turkey (9%), Venezuela (9%), Brazil (7%), and Cayman Islands (6%). In 2008, the price of this fund fell 27% and in 2013, the price dropped almost 17%. The fund uses only 8% leverage and has an expense ratio of 1.2%. The distribution is 8.4%, consisting primarily of income and long-term gains.

- Western Asset Emerging Market Income (NYSE:EMD ). This CEF sells for a discount of 12.2%, which is significantly below its average discount of 8.8%. The fund has 181 holdings with 55% in sovereign debt and 43% in corporate bonds. About 75% of the holdings are investment quality. Note that this fund has 43% of the holdings in the U.S.A. and only about 57% in emerging markets. The top five emerging markets represented in the fund are Russia (8% of total assets), Venezuela (8%), Turkey (7%), and Mexico (6%). In 2008, the price of this fund dropped 28% and in 2013, the price went down 17%. This fund is about 76% correlated with its sister fund, ESD. EMD utilizes 8% leverage and has an expense ratio of 1.2%. The distribution is 8.4%, consisting primarily of income plus realized long term and short-term gains.

- Global High Income Fund (NYSE:GHI ). This CEF sells for a discount of 13.4%, which is lower than its average discount of 10.7%. The fund has 254 holdings, with 67% in sovereign debt and 19% in corporate bonds. All the holdings are denominated in U.S. dollars. The holdings are distributed among a large number of countries including Brazil (12%), Turkey (8%), Indonesia (7%), Russia (7%), and Venezuela (6%). About 40% of the holdings are investment grade, 20% below investment grade, and the rest unrated. In 2008, the price of this fund fell 32% and in 2013, the fund lost 17% in price. This fund does not use leverage and has an expense ratio of 1.5%. The distribution is a high 8%, consisting primarily of income and gains but some of the distribution recently appears to be destructive return of capital.

- Templeton Emerging Markets Income (NYSE:TEI ). This CEF sells at a discount of 2.7%, which is slightly below its average discount of 1.8%. This fund has 115 holdings with 56% invested in sovereign debt and 34% in corporate bonds. The securities are distributed across many countries including Brazil (9%), Kazakhstan (8%), Mexico (8%), Ghana (6%), and Ukraine (6%). About 83% of the holdings are denominated in U.S. dollars. In 2008, the price of this fund dropped 20% and in 2013, the price fell by 13%. The fund does not utilize leverage and the expense ratio is 1.1%. The distribution is 7.2%, consisting of income. In 2013, the fund also has a special distribution of 3%, comprised of income and long-term gains.

In addition to CEFs, there are a number of ETFs that specialize in emerging market debt but only two have a 5-year history and trade at least 50,000 shares per day. The ETFs that I used for my analysis are:

- iShares J.P. Morgan USD Emerging Market Bond (NYSEARCA:EMB ). This ETF is a passive fund that tracks an index made up of U.S. dollar denominated emerging market bonds. The country allocations are rebalanced monthly based on the amount of outstanding debt. The fund has 247 holdings, all in sovereign debt and spread across a large range of countries including Russia (6%), Brazil (6%), Philippines (6%), Turkey (6%), and Mexico (6%). About 50% of the bonds are investment grade. The price of this fund lost a relatively low 12% in 2008. It should be noted that in 2008, the price deviated significantly from the Net Asset Value (NAV), which fell less than 2%. This is very unusual for ETFs and illustrates how badly the financial markets were dislocated in 2008. The fund lost about 7% in 2013 (in both price and NAV). The fund has an expense ratio of 0.60% and yields 4.7%.

- PowerShares Emerging Markets Sovereign Debt (NYSEARCA:PCY ). This ETF tracks an equal weight index of emerging market sovereign debt from 22 countries. The fund has 66 holdings with about 62% being investment grade. In 2008, the price dropped 19% (NAV dropped 15%) and in 2013, both the NAV and price fell about 10%. The fund has an expense ratio of 0.50% and yields 4.5%. Over a 5-year period, PCY was 69% correlated with EMB.

For reference, I compared the performance of the EM bonds to the following U.S. bond ETFs:

- iShares Barclay 7-10 Year Treasury Bond (NYSEARCA:IEF ). This ETF consists of intermediate term treasuries. It racked up impressive gains of over 17% in 2008 (followed by a loss of over 6% in 2009 and again in 2013). This fund has a very low expense ratio of 0.15% and yields 1.8%.

- iShares iBoxx $ High Yield Corporate Bonds (NYSEARCA:HYG ). This ETF invests in below investment grade (junk) bonds and was devastated in 2008 with the price falling over 17%. The NAV fell even more (23%) but quickly recovered in 2009. HYG generated a positive return of about 6% in 2013. The fund has an expense ratio of 0.5% and yields 6%.

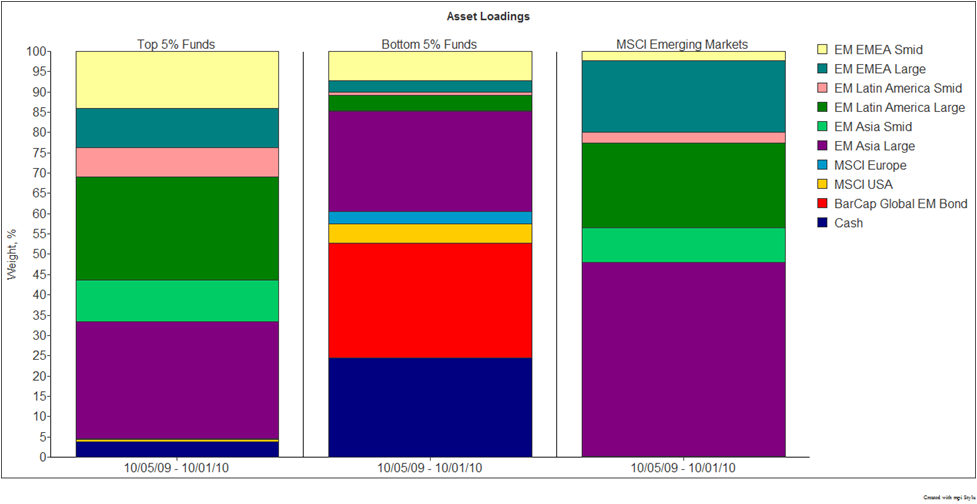

To determine which of the emerging market investments were best, I plotted the annualized rate of return in excess of the risk free rate (called Excess Mu in the charts) versus the volatility for the past 5 years. The Smartfolio 3 program was used to generate the plot shown in Figure 1.

Figure 1. Risk vs. reward over past 5 years.

As is evident from the figure, there was a relatively large range of returns and volatilities. For example, TEI had a high rate of return but also had a high volatility. Was the increased return worth the increased volatility? To answer this question, I calculated the Sharpe Ratio.

The Sharpe Ratio is a metric, developed by Nobel laureate William Sharpe that measures risk-adjusted performance. It is calculated as the ratio of the excess return over the volatility. This reward-to-risk ratio (assuming that risk is measured by volatility) is a good way to compare peers to assess if higher returns are due to superior investment performance or from taking additional risk. In Figure 1, I plotted a red line that represents the Sharpe Ratio associated with EMB. If an asset is above the line, it has a higher Sharpe Ratio than EMB. Conversely, if an asset is below the line, the reward-to-risk is worse than EMB.

Some interesting observations are apparent from Figure 1. First, the CEFs were substantially more volatile than the ETFs. Emerging market CEFs were even more volatile than HGY, which represents United States high yield bonds.

On the other hand, the emerging markets ETFs (EMB and PCY) were not very volatile, with volatilities just a little more than intermediate term treasury bonds. This leads to the recommendation that if an emerging market bond investor is not risk tolerant; he should stick with the ETFs and not venture into CEFs.

In absolute terms, all the CEFs except GHI had higher returns than their ETF counterparts. This is not that surprising since the CEFs are actively managed and many use leverage. However, as shown in the figure, the increased returns were not sufficient to offset the increased volatility and all the CEFs had risk-adjusted performance worse than EMB or PCY. If you focus only on the CEFs, then EMD had the best risk-adjusted performance, followed by ESD. The risk-adjusted performance of MSD was about the same as TEI. GHI lagged badly in terms of both absolute return and risk-adjusted return.

Next I wanted to see if the diversification promised by these emerging market bonds lived up to expectation. To be diversified, you want to choose assets such that when some assets are down, others are up. In mathematical terms, you want to select assets that are uncorrelated (or at least not highly correlated) with each other. I calculated the pair-wise correlations associated with the selected funds. The results are provided in the 5-year correlation matrix shown in Figure 2. As is evident from the matrix, these CEFs provided relatively good diversification. The CEFs were negatively correlated with intermediate treasuries and (somewhat surprisingly) the CEFs were only 30% to 45% correlated with EMB and PCY. The CEFs were only moderately correlated among themselves, with correlations in the 50% to 70% range. The largest correlation was between EMB and PCY at 70%. So my conclusion was that these CEFs lived up to expectation and provided a reasonable amount of portfolio diversification.

Figure 2. Correlation over past 5 years.

As we have previously discussed, emerging market bonds were in a strong bull market until last year. So I decide to see which of these funds performed best during the 4-year bull market period from March 2009 to March 2013. The results are shown in Figure 3.

Figure 3. Risk versus reward: bull market (2009 to 2013)

As expected, all the funds had excellent performance over this bull market period. Interestingly, the relative performance of the funds was almost exactly the same as the 5-year results. During the bull market, the CEFs continued to generate high returns but this was again coupled with high volatility. However, during the bull market some of the CEFs had risk-adjusted performance almost as good as EMB. This was especially true for EMD and ESD, with MSD not far behind. GHI continued to lag the other funds.

Bottom Line

If you are a conservative investor who wants to diversify into emerging market bonds, the ETFs, either EMB or PCY, are your best bets. These ETFs offer better returns than IEF, with about the same volatility. The risk-adjusted performance of the emerging market ETFs is about the same as that received from high yield corporate bonds.

The emerging market CEFs are not for the faint hearted but if you can stand the volatility, they offer the potential for high returns. If you want to invest in CEFs, I would go with EMD, ESD, or MSD. However, please be aware that these CEFs can drop substantially if the emerging market bonds enter another bear market.

Disclosure: I am long EMB. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.