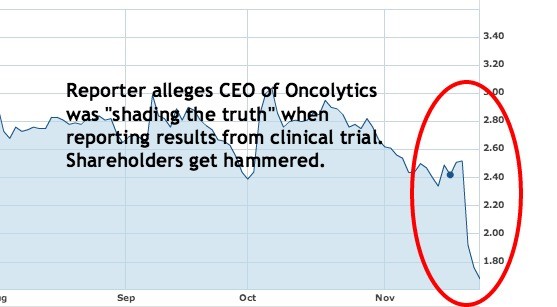

Securities Fraud

Post on: 18 Июнь, 2015 No Comment

Were Your Investment Losses Due to Fraud?

There is always a level of risk when you invest in securities. An investment without risk is an investment with little opportunity for profit. Thats likely why you hired an experienced professional to manage your investments to increase your odds of making money.

While the law does not guarantee that a broker will turn a single dollar of profit from your investments, it does protect you from a broker who abuses your trust and wastes away your money through misconduct. These sorts of losses are not due to fluctuating market forces. They are the result of securities fraud.

Scammed investors have lost millions of dollars in stocks, bonds, mutual funds, annuities and other investments. Money they were counting on some day simply gone.

If you have suffered substantial losses and believe you were the victim of fraud, contact Sokolove Law today at 800-836-3907 or fill out the form on this page for a free consultation to learn how an attorney may be able to help you recover your money.

How It Happens

Once you learn that you have suffered serious financial losses, you will want to get to the bottom of what happened.

Would you answer yes to any of the following questions?

- Were you promised a specific return on your investment, or told it was risk-free? There is no investment without risk, and basic financial theory holds that the greater the return, the greater the risk.

- Did your broker knowingly offer inaccurate, incomplete or biased information about a specific investment or its risks? Did he or she omit a material fact you should have been told?

- Was your investment portfolio over-focused on a small number of stocks or one asset class?

- Did your broker trade in just one of your accounts excessively and unnecessarily to generate excessive commissions?

- Did your broker suggest an outside investment that was not reviewed, approved or recommended by the brokerage firm?

If any of this sounds familiar, you may be the victim of investment fraud.

Complicated Schemes

It is not always easy to know if you have been the victim of fraud. Brokers often use very complex schemes to hid their misconduct that go unnoticed, even by experienced investors.

According to the Securities and Exchange Commission, securities fraud victims are most commonly:

- Male

- College-educated

- Aged 55 to 65

- Relatively high income

- More financially experienced than the average person

Get Help

If you have been the victim of broker misconduct, contact Sokolove Law today to speak with a case manager who understands the legal obligations of your broker. You may be able to file a claim and seek compensation for your losses.

Contact us today at 800-836-3907 or fill out the form on this page for a free, no-obligation consultation. Time to seek compensation for your damages may be limited, so dont delay.