Secular stagnation Why is stagnation bubbly

Post on: 16 Март, 2015 No Comment

Why is stagnation bubbly?

This post has been updated.

LAST weekend crowds of economists gathered in frigid Philadelphia for the annual meetings of the American Economic Association. Among the highlights of the conference was a panel discussion on the consequences of austerity featuring a few policy heavyweights, including Larry Summers. Mr Summers reprised and extended the comments he made at an IMF gathering last year on the subject of “secular stagnation ”. The room was packed, no doubt to hear more about Mr Summers’ diagnosis. (You can get a flavour of the remarks from a new op-ed in the Financial Times .)

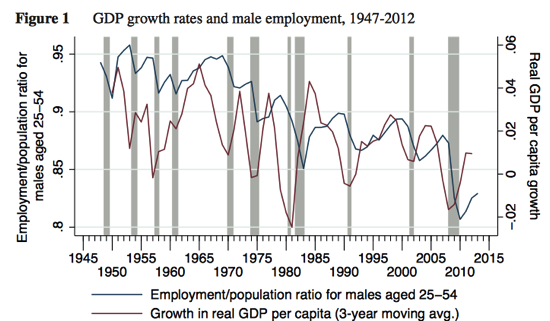

The basic set-up of his narrative remained unchanged from last year. Imagine a world, he said, in which resources are increasingly concentrated in the hands of those with high propensities to save and low propensities to invest: reserve accumulating foreign governments, for example, and the very rich. In that world, the real rate of interest that clears the market—that balances savings and investment and therefore ensures that no willing workers are left unemployed—could fall to and remain at very low levels.

It could fall to such a low level that the central bank would need to keep its policy rate near zero to clear the market; with interest rates near zero, asset prices would soar, such that a full-employment equilibrium inevitably meant a dangerous rise in financial instability. Alternatively, the market-clearing interest rate could fall below zero, leaving the central bank unable to move its policy rate low enough to generate adequate demand and trapping the economy in a prolonged slump. The evidence of our senses, and the judgment of bond markets, appears to strongly support this story, said Mr Summers.

In this world there are two potential courses of policy action. Mr Summers’ preference would be to close the gap between investment and saving through direct fiscal stimulus. He argued that it is madness not to be engaged in a hefty programme of public investment at the moment (to paraphrase him: if now—with the economy slumping and the government able to borrow at negative real rates—is not the time to fix JFK airport in New York City, when is?). But, he said, if one runs a large, 5-year fiscal stimulus plan through the Federal Reserve’s basic economic forecasting model, one gets a debt-to-GDP ratio several decades down the road that is lower than in the absence of stimulus, because of the costly nature of a prolonged slump, even if one assumes that production resulting from stimulus is tossed in the ocean and generates zero productivity gains for the economy.

There is another possibility, he acknowledged—what I called “the solution that cannot be named” in commenting on his talk last year: temporarily raise inflation so that the real policy rate of interest (the Fed’s policy rate less the rate of inflation) becomes more negative, dropping to the market-clearing level and propelling the economy out of the slump.

Mr Summers dismissed this possibility. He argued that clearing the market by raising inflation would simply encourage more private investment and reduce saving (it would, that’s why the central bank reduces interest rates to stimulate the economy). Full employment generated that way would simply lead to increased financial instability: more bubbles. This left me a bit puzzled as to what his story about stagnation actually is.

I had thought that the key to the full-employment-leading-to-bubbles relationship was that: 1) full employment required a prolonged period of low interest rates, 2) and low interest rates lead to soaring asset prices, such that 3) full employment could not be achieved without accompanying bubbles. But Mr Summers seemed to be arguing something else: that at present a full-employment economy inherently leads to financial instability and bubbles—regardless of the rate of interest.

Here’s what the literature suggests would happen given a Fed commitment to raise inflation to a new, higher target. First, according to research generated last year by economists at the Federal Reserve Board, unemployment would fall rapidly, inflation would rise, and the path for nominal interest rates would leap. A higher inflation target ejects you out of the world of low interest rates pretty doggone quickly. And secondly, faster growth should generate a rise in the market-clearing real interest rate. That’s exactly what we would expect to happen. However low the average market-clearing real interest rate, we would expect it to take another big step down when it falls low enough to trap the central bank at the zero lower bound. Higher inflation gets you higher interest rates, but why would higher interest rates lead to bubbles?

Now, this discussion has been a little unclear up to now on an important point: which real interest rate we’re talking about. The Fed is interested in pushing down long-term rates at the moment, but that’s because its short-term policy rate is wedged up against zero. What it would really like to do is just get the real short-term policy rate down to the market clearing level. A higher inflation target would do that.

When we worry about low interest rates leading to soaring asset prices, however, what we’re mainly concerned about are longer-term rates. So in the years prior to the crisis, short-term real and nominal interest rates increased. Long-term real rates remained low, however. This dynamic became known as Greenspan’s conundrum, and Ben Bernanke identified a global savings glut as the source of the trouble.

That, of course, is the sort of dynamic we worry about in a secular stagnation world. But note that we’re talking about two very different phenomena! We have the conditions of the early 2000s and the present, at which the zero lower bound prevents the central bank from generating adequate demand. And then we have the underlying structural problem in which savings pile up, generating a dangerous hunt for yield.

So one question is: why would we think that solving the first problem would exacerbate the second? Mr Summers seems to be arguing that more demand would simply mean more investment, and because we lack sufficient good (private) investment opportunities already (which is why long-term real rates are low) adequate demand just means more foolish investment. Or, to sum up what appears to be his view: a world of adequate demand supported by public investment is preferable to a world of inadequate demand, which is preferable to a world of adequate demand supported by private investment. Update: Mr Summers’s views are clarified here .

But once one looks at the matter like that, the secular stagnation hypothesis starts to look a little strange. Are we really arguing that there aren’t enough good private investment opportunities in America? A booming American economy would indeed lead to soaring home prices in the San Francisco Bay Area. But that’s because there is an obvious need for vastly more residential and commercial construction in the region: which is an extraordinarily rich, productive, export-intensive place!

The most straightforward answer to the puzzle, in my view, is simply to acknowledge that there isn’t one clear source of excess savings with one clear macroeconomic policy response. Olivier Blanchard responded to Mr Summers’ take on secular stagnation by arguing that policymakers should target higher inflation to generate adequate demand and then use macroprudential policies to rein in financial instability. Mr Summers tossed that idea aside, saying that the two policies—higher inflation and macroprudential regulation—push in exactly opposite directions and would cancel each other out. But that’s seems to wildly oversimplify matters. As Mr Summers himself notes, there are many sources of excess saving. Macroprudential policies might very effectively filter out some of them (like inward capital flows from reserve-accumulating foreign governments) while leaving other savings perfectly free to scale up investment and boost the economy.

It simply doesn’t make sense in this context to imagine that all investment is alike. It certainly wasn’t inevitable that excess saving in the 2000s poured into lousy subprime mortgages. Had regulation not accommodated those flows the savings would have gone elsewhere: maybe to Treasuries, which would have been safer for the economy as a whole but also less supportive of demand, but maybe other places as well. Maybe China would have just bought equities or land, supporting American demand without necessarily supercharging credit growth.

To be more clear, macroprudential policy might reduce some investment. But whether that would be the dominant effect is far from clear. It would also shift the composition of investment away from more troublesome areas. And it might also reduce saving, particularly if done in coordination with other governments in an effort to dampen costly financial flows.

I whole-heartedly agree with Mr Summers that seizing the opportunity now offered by bond markets to make lots of useful public investments is a win-win-win idea. Probably win-win-win-win. But the evidence strongly suggests that a higher inflation target would in fact make life much easier for stagnating economies by generating adequate demand. To argue that adequate demand would necessarily lead to unmanageable financial risks seems a bit of a stretch to me. In the 1970s America’s growth outlook was as lousy as it had been in decades and real interest rates fell into negative territory. Yet somehow America dodged dangerous financial instability and crisis.

The most important point to make here is that this discussion needs a little more clarity. Mr Summers is worried about low long-term rates. If he also thinks that appropriately stimulative monetary policy would be bad for society, he should say that explicitly.

Previous

Academic research: American exceptionalism

Next

Euro-zone inflation: Falling again