Sections of the statement of cash flows

Post on: 22 Апрель, 2015 No Comment

The companies categorize their cash flows into operating. investing and financing cash flows. When a statement of cash flows is prepared, these three types of cash flows are reported under separate sections operating activities section, investing activities section and financing activities section. This categorization helps users of financial statements understand how the cash was received and used as the company performed various operating, investing and financing activities to conduct business during a particular reporting period.

Sections of the statement of cash flows:

As described above, the statement of cash flows consists of three section. These are briefly explained below:

Operating activities section:

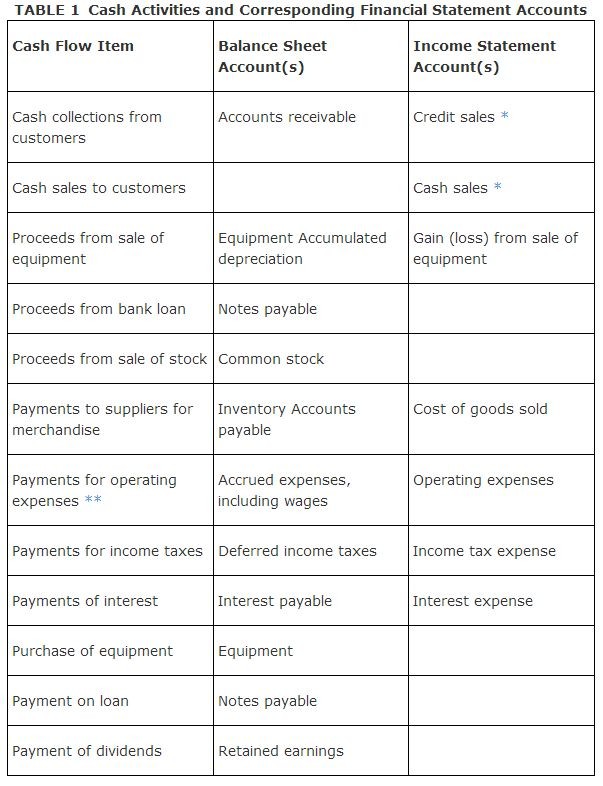

Operating activities section shows cash flows that arise from operating activities of the company. Operating activities include principle revenue generating activities plus other activities that are not investing and financing activities. In other words, the receipts and payments of cash that occur as a result of revenue and expense transactions are shown under this section. Following are the examples of operating activities that effect cash of the company:

Examples of cash inflow from operating activities:

- Cash receipts from customers.

- Interest income received in cash.

- Dividend income received in cash.

- Cash received as a result of the settlement of litigation.

Examples of cash outflow from operating activities:

- Cash payment to suppliers for purchase of merchandise or raw materials.

- Cash payment for expenses such interest, electricity bills, salaries, wages etc.

- Cash payment for income tax.

- Cash paid as a result of the settlement of litigation.

Investing activities section:

Investing activities include acquisition and disposal of long term assets and investments in the form of shares and bonds etc. The cash flows arising from such activities are shown under investing activities section. Some examples of the cash flows from investing activities are given below:

Examples of cash inflow from investing activities:

- Proceeds from sale of fixed assets (sale of equipment, machinery and plant etc.)

- Proceeds from sale of land

- Proceeds from sale of investment (shares and bonds of other companies etc.)

- Proceeds from sale of intangible assets

- Repayment of the principle amount of loans and advances made to others.

- Cash receipts from future contracts

Examples of cash outflow from investing activities:

- Cash paid to purchase fixed assets (purchase of equipment, machinery and plant etc.)

- Cash paid to purchase land

- Loans and advances made to others

- Cash paid to purchase investments (shares and bonds of other companies etc.)

- Cash spent on research and development activities of the company

Financing activities section:

Cash flow resulting from financing activities of the company are shown under financing activities section of the statement of cash flows. Financing activities include those activities that change the size and composition of the equity ( i.e. common or preference stock) and the long term liabilities (i.e. borrowings) of the company. Some examples of the financing activities that effect the cash are given below:

Examples of cash inflow from financing activities:

- Cash received from borrowings (both short and long term).

- Cash received from issuing of common or preferred stock.

Examples of cash outflow from financing activities:

- Payment of borrowings to others (principle amount only).

- Payment of cash dividends to the stockholders.