Schwab on Bonds Try a Ladder Look Beyond Indexes Income Investing

Post on: 17 Апрель, 2015 No Comment

By Michael Aneiro

Charles Schwab fixed-income strategist Kathy Jones is out with a new white paper on bond investing in todays rate-challenged environment. While not offering any radical strategies Schwab basically recommends a core portfolio of high-quality bonds plus a dash of riskier, higher-income assets its a handy overview of current conditions and a quick primer on various fixed-income asset classes. A sampling of thoughts from Schwab:

- Even though the municipal bond market will be challenged by a weak economic recovery and rising public service costs for at least a decade to come, munis remain relatively attractive overall, offering more yield than Treasuries, tax advantages and a relatively stable income stream.

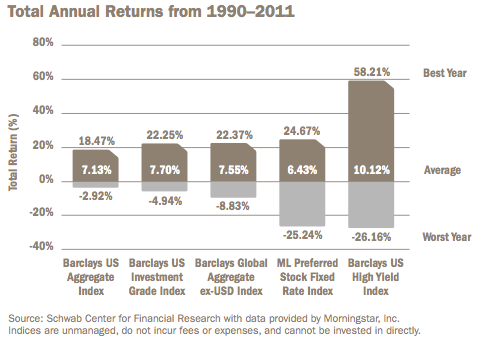

- Most investors should limit the amount of aggressive income investments, such as high-yield bonds, to no more than 20% of an overall fixed income portfolio.

- Investors may also want to reconsider strictly passive strategies as major bond indexes have become less diversified in the past few years, with a higher concentration of longer-maturity government debt. Schwab suggests supplementing core government bond holdings with high-quality investment-grade corporate bonds of intermediate duration to help diversify portfolios.

- Schwab likes bond ladders, which are designed to create a predictable income stream by spreading out bond maturities over time. If interest rates move higher, you can reinvest short-term bonds at higher rates. If rates stay low, you still have some bonds locked in for the longer term at higher yields. Ladders may not outperform portfolios with more narrowly targeted maturities, and bond prices will still decline if interest rates rise, Jones writes. But we see the benefits as outweighing the risks for many investors in a low-interest-rate environment.

- Schwab also explores preferred securities, lately an appealing alternative to investors looking for higher yields, cautioning that preferreds may not be appropriate for all investors. Preferreds rank lower than bonds in a company’s capital structure and are considered “loss absorbing” securities. In the event of a default or distress, the dividends or interest payments from preferreds would be cut before interest on bonds. Many preferreds are callable, lack a maturity date and are sensitive to interest-rate risk. Most issuers of preferred securities are banks and financial companies, which can inadvertently lead to a concentrated position in the financial sector, and preferreds may be less liquid than other securities issued by the same firm.

More from this section