Russian Ruble Crisis Spreads Across US Emerging Markets And BRIC Nations

Post on: 20 Август, 2015 No Comment

The Russian ruble soared 10 percent Wednesday, after tumbling to a 16-year low Tuesday, as the Russian Central Bank announced a series of new measures to pump money into banks in 2015. Reuters/Maxim Zmeyev

The ruble soared 10 percent Wednesday, boosted by the Russian central bank’s announcement that it is prepared to pump money into banks in 2015 and adopt a series of measures to “maintain the stability of the Russian financial sector.” But even as the currency appeared to rebound after a sharp decline earlier in the week, the ripple effects of crisis in the world’s sixth-largest economy will be felt far and wide.

“The currency has collapsed, and it’s possible that the economy could also collapse. They’ve become a wild card at this point, it’s a very dangerous situation,” said Stephen Guilfoyle, chief economist at Sarge986.com.

Russia’s $3.5 trillion economy depends heavily on exports, and oil accounts for roughly half of government revenue. As a result, the country is reeling from the combination of trade sanctions resulting from its invasion of Ukraine and Crimea, and the precipitous recent drop in global oil prices. And the meltdown will be a “headache” for the U.S. according to Ariel Cohen, director of the Center for Energy, National Resources and Geopolitics at the Institute for the Analysis of Global Security in Washington, D.C.

“We do not know and cannot predict the political ramifications of this economic crisis,” said Cohen. “Russian leaders didn’t realize how fragile the economy was and what the macroeconomic implications from the conflict in Ukraine would be.”

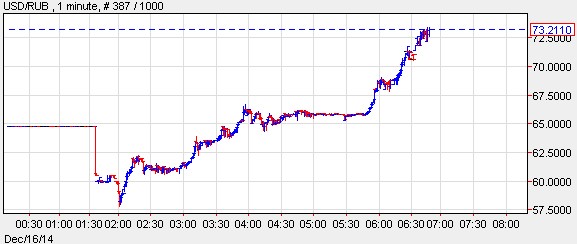

The ruble had previously tumbled over 20 percent against the dollar to 58 rubles per dollar on Tuesday, a record low. That came after Russia made a surprise move and hiked interest rates to 17 percent from 10 percent. In afternoon trading Wednesday, the ruble jumped over 10 percent to 62.04 rubles per dollar.

Meanwhile, the U.S. is benefiting from the 40 percent drop in global oil prices in the last six months. The country is also enjoying a stronger dollar compared to other major currencies. At the same time, global investors—especially Russians seeking a safe haven to park assets—are channeling funds into U.S. treasuries.

Continued strength in the dollar could hurt U.S. multinational companies. “Between 40 percent to 50 percent of S&P 500 revenues are now overseas. So you’ll probably start to see companies pre-announce a negative impact in earnings from a stronger dollar in early January,” said Charlie Bilello, director of research at Pension Partners, LLC.

As global crude oil prices have fallen, it’s turned into a stimulus for the U.S. consumer, but it will begin to affect U.S. credit markets “because roughly 13 to 15 percent of the high-yield market is energy related and the credit spreads there have really widened,” Bilello said. Meaning, as global crude oil prices continue to plummet, contagion fears have risen as oil prices are hurting high-yield corporate bonds, which are now posing broader risks.

For a while, investors thought the spread would be contained in the energy sector, but in the last week it has spilled over to other sectors. “You’re seeing high-yield spreads in the U.S. really start to widen out at their highest level since 2012,” Bilello said.

That will also affect companies’ ability to raise more debt to buy back stocks. “To the extent that companies have higher borrowing costs, obviously with very slow top-line growth, any marginal increase in that borrowing cost is difficult to stomach,” Bilello said.

Global Fallout

Economists expect the Russian economy to contract 5 percent next year, according to Neil Shearing, chief emerging markets economist at Capital Economics.

“Russia is most likely headed for a prolonged recession. In conjunction, all of the BRICS [Brazil, Russia, India, China and South Africa] are looking quite poor, and the potential for boost from the emerging markets is looking quite poor,” Gregory Daco, chief U.S. economist at Oxford Economics, said.

How wide might the contagion spread? “You’re really seeing the emerging markets getting hit,” said Bilello. The global economy is already seeing spillover effects in commodity-centric countries such as Venezuela and Brazil.

In addition, economists are watching Iran, West African nations such as Angola and Nigeria and the so-called BRICS nations.

Many countries can ill afford the contagion. Brazil went through a recessionary environment with almost no growth this year along with little growth expected next year. China is slowing, and its growth outlook is expected to fall below its 7 percent target next year, Daco said.

“It’s still highly inflationary for Russia and these other emerging countries. It’s much harder situation for them to pay back their denominated debts. That’s the real big issue,” Bilello said. Meaning, it’s going to put pressure on these countries, as well as the companies within those countries, to pay back debt and issue new debt.

In the midst of the Russian Central Bank trying to calm contagion fears, other economies around the world are also showing signs of weakness, as Japan unexpectedly fell into recession last quarter while China is experiencing its slowest growth since 2009. Meanwhile, Europe is teetering on a triple dip recession.

“We haven’t seen this in a long time where oil prices have fallen without a global recession,” Bilello said. “The U.S. is really the strong hand here, but global growth issues are also part of the decline, and people can’t totally dismiss that.”