Rounding Out Your Retirement Portfolio

Post on: 15 Апрель, 2015 No Comment

Last week we added Real Estate Investment Trusts (REITs) to a retirement portfolio, and this week we add international investments. The completed portfolio will now have domestic stocks, domestic bonds, REITs, and international stocks. Just these four investments can carry a retiree a long way into efficient, reasonably stable returns.

Why international investments? Diversification and growth are the best answers. Fifty years ago the United States dominated the world of investment opportunities, but today many countries have growing economies, well-run innovative companies, and good opportunities for investing.

Model Portfolio

As before, I have selected a Vanguard mutual fund to round out the portfolio: Vanguard Total International Stock Index Fund Investor Shares. This fund contains stocks from all major regions of the world except the United States, and it includes companies from developed and emerging markets. It is a good all purpose international fund to join a portfolio with Vanguard Total Stock Market Index Fund, which has domestic United States stocks.

I receive no benefits from selecting Vanguard funds, and I choose them because they are high quality index funds bearing low costs. They are not the only portfolio choice, but they serve as excellent examples of investments that retirees can self-manage.

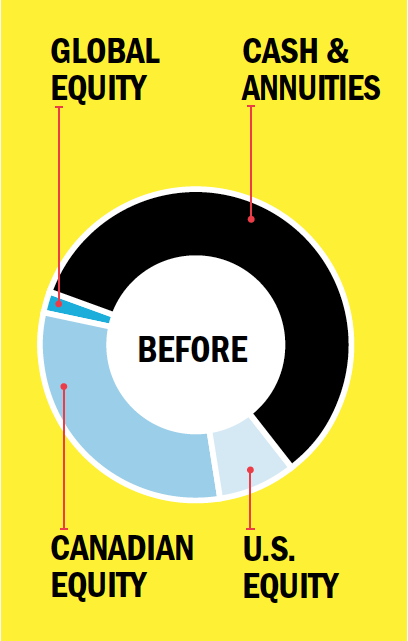

The asset class balance I selected for this writing is:

The above allocation preserves a basic split of about 50% stocks and 50% bond or bond-like investments—which fits a retiree who wants to preserve capital and capture growth. Those two goals are appropriate for new retirees facing 30 or so years of retirement. The allocation also fits with recommendations of several prominent authors who write well within the mainstream of modern investment research.

Real estate offers characteristics of both stocks and bonds, so the REIT allocation (14%) came half from stocks and half from bonds. Like interest payments on bonds, rents for real estate are fixed by leases and offer stable income. Like stocks, the values of REITs are influenced by estimates of contingent economic events. Real estate values are appraised values, and appraisals blend replacement costs, current market valuations of similar properties, and prospective incomes including rents beyond current leases, all of which require estimates of uncertain elements.

Investors in stocks and REITs usually face large upside and downside potentials, depending on how the contingencies turn out. Bonds tend to fluctuate less but produce higher levels of current income. Therefore, REITs are both similar to and dissimilar from stocks and bonds, therefore they usually offer significant diversification to a portfolio.

Several writers recommend that stock portfolios be about evenly split between domestic and international investments, as is done here with 22% in domestic stocks and 21% in international stocks

The table below shows the results of maintaining a well-rounded four-fund portfolio from the end of 2000 through 2011. In my earlier post, Two Important Benefits to Rebalancing Risk in Retirement Investments. an appendix describes in detail the calculations for a two-fund portfolio, and although there are more investments now, the procedures are the same.

The 11-year period ends with a portfolio value of $128.46, fully 28% larger than the initial $100 value, even while supporting a $4 annual withdrawal—4% of the initial portfolio. Given the economic turbulence of the model period, the end result is comforting and encouraging. Respected professional advice, backed by significant unbiased research, produced good results.

The 4% rule—that in retirement a portfolio can sustain an annual withdrawal equal to 4% of the initial portfolio value and likely last 25 or 30 years—usually involves increasing annual withdrawals to compensate for inflation. The above model, incorporating a 2.5% annual increase of the withdrawal, gives a final portfolio value of $119.76, still almost 20% above the initial value of $100. The withdrawal at the end of 2011 was $5.25 (these results are not shown in the table).

As in previous posts, the results in the table are scalable so long as the withdrawal is kept at 4% of the initial value. If a person retired at the end of 2000 with $300,000 in her portfolio, and set up the investments used in the model, then withdrew $12,000 each year, she would have had $385,380 at the end of 2011.

No one can guarantee future investment performance, and the portfolio developed here is no exception to that truism. At the same time, the first decade or so of retirement is critical to financial health. If retirees spend too much or invest poorly they may long outlive their retirement funds. It turns out that a simple set of four investments, coupled with conservative withdrawals, has a very good chance of producing good results for the first 11 years and throughout retirement.

Have a happy and prosperous July 4th!