Roth vs Traditional IRA Comparing the Most Popular IRA Plans

Post on: 16 Март, 2015 No Comment

Investing for your retirement is one of the most important things you can do for your future. And one of the best ways to do that is by investing in an Individual Retirement Account (IRA). There are two main types of IRAs which most people are eligible to contribute to the Traditional IRA and the Roth IRA. They have the same contribution limits. but other than that, they are two very different retirement plans. Which is better?

What You Need to Know About Traditional IRAs

Traditional vs. Roth IRA Which is best?

Simplified Definition: A Traditional IRA is a tax deferred retirement vehicle. Contributions to a Traditional IRA plan may be tax deductible depending on the taxpayers income, tax filing status and other factors. Contributions to Traditional IRAs are made on a pre-tax basis, meaning the money is invested before it is taxed.

The benefit to investing pre-tax money is that it has the potential to lower your current tax bracket, and your money can grow tax free until you withdraw it. Qualified withdrawals are treated as ordinary income and may be subjected to income tax.

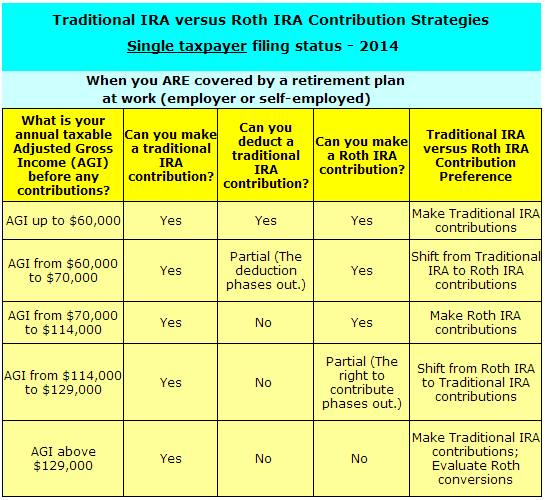

Income limits: Everyone is eligible to contribute to a Traditional IRA, but not everyone will get the benefit of a tax deduction. Here is a list of the Traditional IRA deductibility limits .

Withdrawals: Traditional IRA holders are eligible to withdraw from their IRA at age 59 ½, at which point their withdrawals are taxed as ordinary income. There are stiff penalties for early withdrawal (with certain exceptions).

Required Minimum Distributions: Owners of Traditional IRAs are subjected to Required Minimum Distributions. which begin at age 70 ½. This means Traditional IRA holders are required to make a minimum withdrawal every year regardless of whether or not they need the money.

Advantages of a Traditional IRA: There are several advantages for investing in a Traditional IRA, and they primarily deal with taxes. The tax savings at the time of investment may be enough to decrease your taxable income to a lower tax bracket. Many retirees income is lower in retirement years, thus they may have a lower tax rate when they withdraw their funds. Depending on your income, you may be able to use a Traditional IRA to lower your tax bracket during your working years, and then withdraw your money in retirement in a low tax bracket.

Disadvantages of a Traditional IRA: The minimum required distribution is a disadvantage because it requires IRA holders to withdraw a certain portion of their funds whether they want to or not. It is also difficult to determine what your tax rate will be in retirement.

What You Need to Know About Roth IRAs

Simplified Definition: A Roth IRA is a tax exempt retirement vehicle. Contributions to Roth IRAs are not tax deductible when they are made; however, qualified distributions made during retirement years are tax free.

Income limits: A person filing their taxes as single cannot earn over $95,000. Married couples are limited to an annual maximum income level of $150,000.

Withdrawals: The minimum withdrawal age is 59 ½. When the money is withdrawn, none of it is taxed. The principal can also be withdrawn at any time without penalty, however, the earnings must remain in the IRA or they will be subject to taxes and penalties if withdrawn early.

Required Minimum Distributions: There is no minimum distribution for Roth IRA accounts.

Advantages of a Roth IRA: The biggest advantage of a Roth IRA is tax free withdrawals on the principal and all earnings. The other advantage is the absence of minimum withdrawal requirements.

Disadvantages of a Roth IRA: Not everyone qualifies for a Roth IRA because of the income limits.

Which IRA is Better Traditional or Roth?

Investing with IRAs is a great way to diversify your taxes in retirement years, and as you can see, there are distinct advantages to each type of IRA. If you are like me and have the option of funding a company 401(k) plan or other tax deferred retirement plan, then a Roth IRA may be the way to go. This gives me investments that benefit me now by decreasing my taxable income with my 401(k) contributions, but also investing in a Roth IRA, which will give me tax free withdrawals in retirement. It is very difficult (or impossible) to predict our future tax brackets, so tax diversification is a strong benefit to retirement planning.

Where to Open One

You can open an IRA in a variety of places, including banks, credit unions, brokerage firms. independent financial advisors, and more. We have a list of preferred locations to open an IRA .

I recommend investigating your personal situation and investing in whichever plan you decide is best for you. If you are eligible for both, you also have the option of splitting your investment to take advantage of tax benefits now, and in retirement.