Risks you should know before investing in international bond funds Market Realist

Post on: 8 Июль, 2015 No Comment

An investor’s key guide to international bond funds (Part 7 of 7)

Risks you should know before investing in international bond funds

In the last part of this series, we discussed how differences in macroeconomic variables in the U.S. and other countries can affect the returns from fixed income investments. In this article, we’ll discuss some of the risks an investor must consider before investing in international bonds. Some of these risks are unique to this asset class.

Sovereign or credit risk

Sovereign risk is the risk that a national government will fail to make timely payments on the debt it issued or actually default on its debt obligations. For non-governmental borrowers, sovereign risk is known as “credit risk.” For example, the iShares International Treasury Bond ETF (IGOV ), which invests in sovereign debt issued by developed market governments, will have sovereign risk, while the bonds included in the iShares iBoxx $ Investment Grade Corporate Bond Fund (LQD ), which invests primarily in U.S. domestic corporate bonds, would have credit risk.

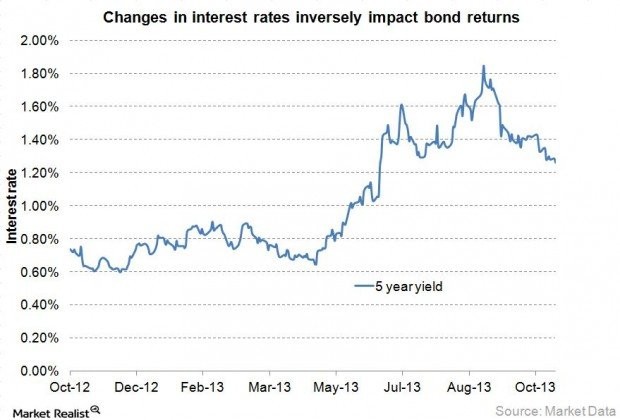

Interest rate risk and duration

Like domestic bonds, interest rate risk also affects international bonds. Bond prices fall when interest rates increase and vice versa. Durations measure price sensitivity in bonds due to parallel shifts in the yield curve. The higher the bond or the bond fund’s duration, the greater the price change for a given change in the interest rate, all else being constant. For example, the duration for the Emerging Markets Sovereign Debt Portfolio ETF (PCY ) is estimated at

8.6, while the duration for IGOV is estimated at

6.95 years. This implies PCY has lower interest rate risk than IGOV in terms of duration.

For more on duration and how it affects your fixed income portfolio, please read the Market Realist series Interest rate risk: Measure and avoid the pitfalls of duration.

Currency risk

Currency risk arises for U.S. investors when the investment is denominated in currencies other than the U.S. dollar. Fluctuations in the exchange rate can affect returns on investments. If the USD appreciates versus the local currency, the returns in terms of the USD will be lower, all else equal. The reverse is also true. So funds like IGOV, which invest in local currency–denominated debt, have currency risk.

Investors can overcome this risk by investing in ETFs like the Vanguard Emerging Markets Government Bond ETF (VWOV), which invests in dollar-denominated bonds issued by governments and government-related issuers in emerging market countries. In comparison, currency risk is zero for domestic bond funds like LQD and USD-denominated international bond funds like PCY. Some international bond funds use hedging techniques to overcome currency risk, like the Vanguard Total International Bond ETF (BNDX ). Currency risk in these funds will be eliminated to the extent that these strategies are successfully executed.

“Country risk” refers to the risk arising from the economic and political environment of a country. The U.S. is widely perceived to have the lowest country risk in the world, with U.S. Treasuries often the asset of choice in times of market turmoil. Some countries have higher country risks compared to others. For example, frontier market countries like Argentina would have higher country risk than developed market countries like Japan.

Since international bond funds invest in securities issued outside the U.S. they’ll be subject to the risks arising from the economic and political environment of the countries whose governments are issuing the bonds. For example, consider elections in Brazil or geopolitical tensions in Russia and Ukraine. So international investments often require an additional “country-risk premium” to compensate for the higher risk involved in overseas investments.

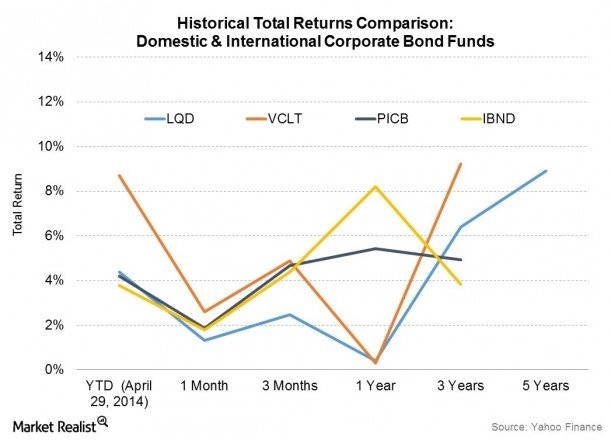

We’ll follow up this series with another tomorrow, which will include comparisons between domestic and international bond funds in terms of returns, costs, and risks.