Risk vs Reward for Global Bond and Emerging Market CEFs

Post on: 13 Июль, 2015 No Comment

A version of this post was submitted to Seeking Alpha.

As a retiree, I am always looking for opportunities to obtain more income. In May of this year, the Fed hinted that it was considering “tapering” the amount of quantitative easing. This caused interest rates to rise and derailed the price of many bond Closed End Funds (CEFs). Two of the sectors hit hard were global and emerging market bonds, with prices plummeting as much as 20% to 25%. As investors began selling these funds, the prices fell more than the Net Asset Values (NAV) and many of the funds that were selling at a premium reverted to selling at a discount. Now, that the shenanigans in Washington have been resolved, it appears that tapering is (hopefully) off the table for the foreseeable future. The selloff has created some potential opportunities in emerging market and global bond CEFs. This article assesses the risks and rewards associated with these types of bonds and identifies three CEFs that have performed significantly better than their peers.

International Bonds

Why invest in international bonds? Typically two reasons are given:

- Diversification. Foreign bonds rise and fall due to local conditions which may not be in synch with the U.S. market, thus offering diversification to a fixed income portfolio

- Higher returns. Since the risks are usually higher, the yields are also higher. This is true especially for emerging markets where political instability, lack of infrastructure, and the currency volatility exacerbate the risks.

International bonds may trade in either the currency associated with their country of origin or trade in U.S. dollars. The bonds that trade in local currency have an additional risk due to the fluctuations in foreign exchange rates. Note that global bond CEFs are usually go-anywhere funds that invests in both emerging and developed markets. The developed market portion of these portfolios can include a sizable percentage of bonds from the United States, which may decrease the amount of diversification you receive.

Selection Criteria

To select funds for my analysis, I used www.CEFConnect.com and limited my analysis to either the emerging market income or the global income categories. There were 6 emerging market income funds and 9 global income funds that passed my initial screen. To reduce the sample size, I also required the CEFs to meet the following criteria:

- Distributions greater than 6% with little to no return of capital over the past year

- Premiums less than 1%

- Market capitalization greater than $200 million

- At least 5 years of history

- Average daily volume of at least 50,000 shares.

Selected CEFs

The eight CEFs that achieved all these criteria are described below, with 3 focused on emerging market bonds and 5 in the broader category of global bonds.

- Templeton Emerging Markets Income (TEI). This CEF sells at a discount of 2.2%, which is well below the 52 week average premium of 2%. It has 105 holdings, distributed between government and corporate bonds. The highest concentrations are in Brazil (8.6%), Kazakhstan (8.2%), Mexico (7.5%), and Russia (7%). About 83% of the holdings are denominated in U.S. dollars. The fund does not use leverage and has an expense ratio of 1.1%. The distribution is 6.8%.

- Western Asset Emerging Markets Debt (ESD). This CEF sells at a 10% discount, which is below the average discount of 4.9%. This fund provides broad exposure to both emerging market corporate (26%) and sovereign debt (70%). The 169 holdings are focused primarily on Latin America and Eastern Europe, with the top countries being Mexico, Brazil, Russia, and Venezuela. The managers have significant latitude in determining how to adjust holdings depending on market conditions. The fund uses only 6% leverage and has an expense ratio of less than 1%. The distribution is 8.1%.

- Morgan Stanley (MS) Emerging Market Domestic (EDD). This CEF sells for a discount of 13.2%, which is below its average discount of 10%. This is the only CEF that invests exclusively in local currency emerging market debt. The investment team analyzes macroeconomic indicators in about 40 emerging markets to assess which debt securities to purchase. As of the end of 2012, the fund was diversified across 16 countries, with the major focus on Brazil, Mexico, Turkey, Poland, and South Africa. This fund ajusts its distribution to reflect the currency and interest rate environments. The fund employs 22% leverage and has a distribution of 7.1%.

- AllianceBerstein Global High Income (AWF). This CEF sells for a small discount of 0.5%, which is lower than the average premium of 0.7%. This fund has a go-anywhere strategy that allows the managers to select different fixed income sectors as well as the amount of leverage to use. The fund is diversified with 946 holdings, spread across 52 countries. The U.S. has the largest weighting in the portfolio at 66% and almost all the holdings are denominated in dollars. This fund was previously an emerging market debt fund but in 2006 the fund was allowed to branch out into other high income classes. The fund is now 50% invested in high yield bonds. The fund employs only 10% leverage and has an expense ratio of less than 1%. The distribution is 7.8%.

- First Trust/Aberdeen Global (FAM). This CEF sells at a discount of 6.9%, which is lower than the average discount of 3.7%. The fund has 120 holdings spread primarily between government bonds (73%) and corporate bonds (20%). About half the holdings are investment grade. The holdings are diversified across many countries with Brazil, Russia, Canada, and Australia having the largest representation at about 8% to 9% each. Approximately 58% of the holdings are denominated in U.S. dollars. The fund utilizes 26% leverage and has an expense ratio of 2.1%, including interest payments. The distribution is a high 10.1%.

- Western Asset Global Partner (GDF). This CEF sells for a discount of 4.4%, which is very low when compared to the average premium of 1.4%. The funds holds 499 securities partitioned between high yield bonds (67%) and Government bonds (26%). The fund has about 73% of its assets in the U.S. and the rest in emerging markets. Almost all of the holdings are denominated in U.S. dollars. The fund utilizes 23% leverage and has an expense ratio of 1.5%. The distribution is 9.2%.

- Western Asset Global High Income (EHI). This CEF sells at a 7% discount, which is substantially lower than the average discount of 3.6%. The fund has 549 holdings invested primarily in high yield (51%) and emerging market (31%) bonds that are denominated in U.S. dollars. About 54% of the fund holding are domiciled in the United States. The fund utilizes 21% leverage and has an expense ratio of 1.4%, including interest payments. The distribution is 9.2%.

- DWS Multi-Market Income (KMM). This CEF sells at a small discount of 1.9%, which is low when compared to its average premium of 4.7%. The fund has 498 holdings invested in corporate bonds (70%), loans (17%) and government bonds (11%). About 69% of the holdings are domiciled in the Unites States. The fund utilizes a relatively high 31% leverage and has an expense ratio of 1.7%, including interest payments. The distribution is 8.5%.

Reference ETFs

For comparison, I also included the following Exchange Traded Funds (ETFs) in the analysis:

- Ishares 20+ Year Treasury Bond (TLT). This ETF tracks long term treasury bonds. It has an expense ratio of only 0.15% and a yield of 2.9%.

- iShares JPMorgan USD Emerging Market Bond (EMB). This ETF tracks the total return associated with bonds in emerging markets that are denominated in U.S. dollars. This is a cap weighted fund with holdings from 39 different countries, with the largest weighting from Russia, Brazil, Mexico, Turkey, and the Philippines. The fund has an expense ratio of 0.6% and yields 4.6%.

Risk vs Reward 5 Years

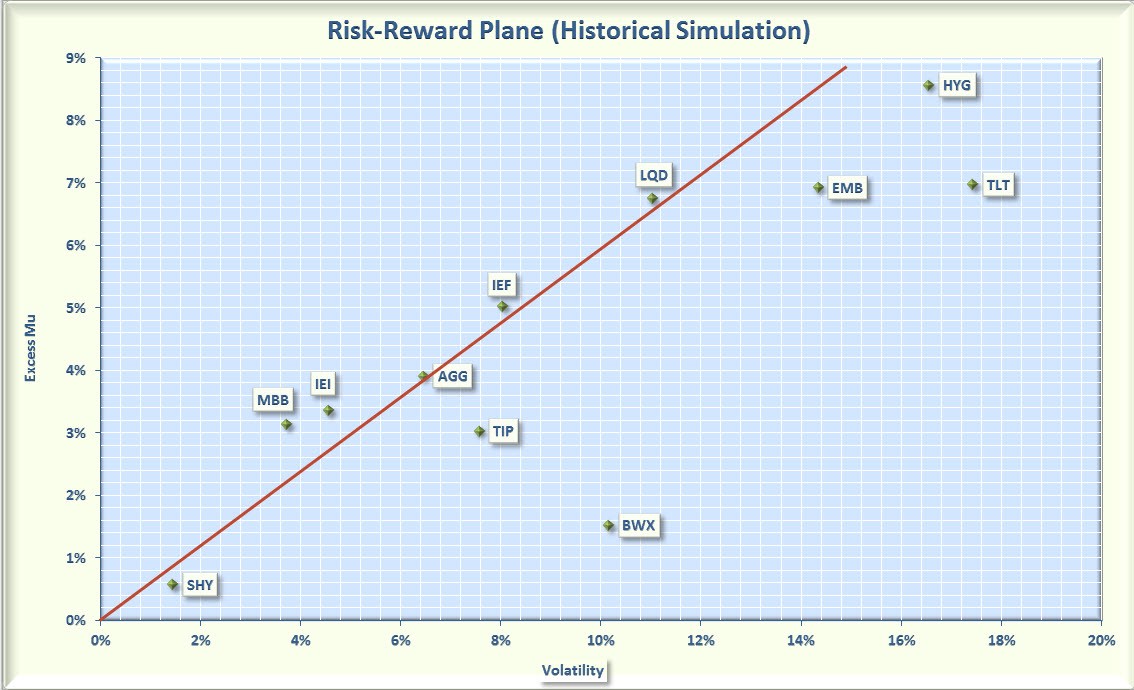

To analyze risks and returns, I used the Smartfolio 3 program (www.smartfolio.com ) over the past 5 years. The results are shown in Figure 1, which plots the rate of return in excess of the risk free rate of return (called Excess Mu on the charts) against the historical volatility.

Figure 1. Risk versus Reward over past 5 years (click to expand)

As is evident from the figure, these CEFs generated excellent returns but also had relatively high volatilities. Were the returns commensurate with the increased risk? To answer this question, I calculated the Sharpe Ratio.

Sharpe Ratio

The Sharpe Ratio is a metric, developed by Nobel laureate William Sharpe that measures risk-adjusted performance. It is calculated as the ratio of the excess return over the volatility. This reward-to-risk ratio (assuming that risk is measured by volatility) is a good way to compare peers to assess if higher returns are due to superior investment performance or from taking additional risk. In Figure 1, I plotted a red line that represents the Sharpe Ratio associated with TLT. If an asset is above the line, it has a higher Sharpe Ratio than SPY. Conversely, if an asset is below the line, the reward-to-risk is worse than SPY. Similarly, the blue line represents the Sharpe Ratio associated with EMB. The “red dot” indicates an emerging market bond CEF while the “green square” is associated with global bond CEFs.

Some interesting observations are apparent from Figure 1. First off, all the CEFs had higher returns and higher volatilities than either EMB or TLT. The CEFs also handily beat TLT on a risk-adjusted basis (they were all above the red line). However, when compared to EMB, the story is not as clear. On a risk-adjusted basis, most of the CEFs (FAM, ESD, KMM, EHI, and AWF) were similar to EMB. This implies that the increased returns by using leverage were commensurate with the increased volatility risks. Generally the emerging markets bond CEFs (red dots) did not fare as well as the global bond CEFs. The highest absolute return was booked by AWF, likely due to its high concentration of high yield bonds, but the risk-adjusted return of AWF was on a par with most of the other CEFs. The worst performer on a risk-adjusted basis was GDF, due primarily to its substantial volatility.

Diversification

Next I wanted to see if the diversification promised by these emerging market and global bonds lived up to expectation. To be diversified, you want to choose assets such that when some assets are down, others are up. In mathematical terms, you want to select assets that are uncorrelated (or at least not highly correlated) with each other. I calculated the pairwise correlations associated with the selected funds. The results are provided in the 5 year correlation matrix shown in Figure 2. As is evident from the matrix, these CEFs were relatively good diversifiers. The CEFs were negatively correlated with long term treasuries and (somewhat surprisingly) the CEFs were only 30% to 40% correlated with EMB. The CEFs were only moderately correlated among themselves, with correlations in the 50% to 60% range. So my conclusion was that these CEFs lived up to expectation and provided a reasonable amount of portfolio diversification.

Figure 2. Correlation matrix over past 5 years (click to expand)

Risk vs Reward 3 Years

I then looked at the past 3 year period to see if the outperformance of the CEFs had continued. The results are shown in Figure 3. What a difference a couple of years made! As I noted at the beginning of this article, these bonds were hit hard this year and this was reflected in the 3 year returns. With only a few exceptions, the risk-adjusted returns of the CEFs were worse than either EMB or TLT. It is also interesting to note that EMB exhibited a very low volatility, even lower than TLT, although the risk-adjusted return of EMB was similar to TLT. The three exceptions to the under-performance were EHI, KMM, and AWF, all of which had excellent risk-adjusted returns. The “go-anywhere fund AWF had both the best absolute return and the best risk-adjusted return. An unexpected result was that over the past three years, the CEFs have had volatility similar to that of long term treasury bonds.