Risk vs Reward for Floating Rate (Senior) Loans

Post on: 12 Май, 2015 No Comment

A version of this post has been submitted to Seeking Alpha.

Floating Rate Loan Funds

As a retiree, I am always searching for sources of high income but lately I have worried about rising interest rates. Floating rate loans Closed End Funds (CEFs) seem to offer the best of both worlds, providing over 6% income plus a hedge against increased rates. To asses this asset class, I analyzed the risk and reward associated with floating rate loan over the past several years.

Tutorial

The characteristics of floating rate loans (also called senior loans) are not that well know so I will provide a quick tutorial. First off, these are loans made to below investment grade companies to support business purposes, such as expansion. The loans are typically large, with sizes in the $50 million to over a billion dollar range. They are called “floating rate” because the rate of interest is adjustable and moves higher or lower with the London Interbank Offer Rate (Libor). They are also called “senior” loans because they are backed by real assets and are the first to be paid when a company pays its debts.

Until the 1980s, most commercial loans were issued by the local bank. Then someone had the idea that banks could sell these loans to another company, who could bundle the loans into packages that could then be sold to institutional investors. This process was called securitization. Since then, the floating rate loan market has exploded and is now about the same size as the popular high yield bond market. Floating rate loans are not traded on a public exchange; instead they are traded among banks and institutional investor, which makes them fairly illiquid.

The interest rate paid by senior loans is calculated as a “spread” over a benchmark, typically the Libor. The Libor is the rate banks pay one another to borrow funds and the rate depends on when the loan is due, either 30, 60, or 90 days. The spread is specified in terms of basis points (bps), which are a hundredth of one percent. The spread on the loan does not change but the Libor can change daily in response to market conditions. Senior loans have a “reset period” that determines how frequently the interest rates are synched with the Libor. The reset varies from loan to loan but a diversified portfolio of loans will typically have a reset period that averages about 60 days. Thus, the interest earned on floating rate loans is very responsive to changes in short term interest rates.

Different than High Yield Bonds

Senior loans are different than high yield bonds. When interest rates go up, the price of bonds go down but the amount of interest paid is always the same. The opposite happens to senior loans. When interest rates change, the interest on senior rate loans is adjusted but it seldom impacts the price of the loan. Thus, senior loans are a good hedge in a rising interest rate environment. Also senior loans are secured by assets of the company and if the company files for bankruptcy, senior loans recover an average of about 70% of face value, which is much better than the 44% average recovered by high yield bonds.

Selection Criteria

The bottom line is that floating rate loans have a number of characteristics that make then well suited for the current environment of potentially higher rates. The easiest way to invest in senior loans is by either a closed end fund (CEF) or an exchange traded fund (ETF). Senior loan ETFs have a relatively short history (the first was launched in 2011) so I will focus primarily on CEFs. The website www.cefconnect.com lists 25 CEFs that invest primarily in senior loans. To reduce the number of funds I needed to analyze, I selected candidates based on the following criteria:

- At least 6 years of history. As an asset class, over the past 15 years, senior loans on average showed positive returns each year except for 2008 where they lost almost 30%. This was followed by a tremendous rebound in 2009 where the loans had a total average return of over 50%. Other years were not as dramatic with total returns ranging from 2% to 10%. I wanted to make sure that I included 2008, thus the requirement for a 6 year look back period.

- Market Cap greater than $200 million

- Premium less than 5%

- Average trading volume greater than 50,000 shares per day.

Selected CEFs

The following 10 funds satisfied all of these conditions:

- BlackRock Float Rate Strategies (FRA). This CEF sells at a discount of 3%, which is low compared to an average premium of 2% over the past year. The distribution has been managed at 6.1% and a small amount (less than 10%) has been return of capital (ROC). However, this has not negatively affected net asset value (NAV) so has not been destructive. The fund holds 447 securities, with 90% in floating rate loans. FRA utilizes 27% leverage and has an expense ratio of 1.7%, including interest payments.

- Eaton Vance Floating Rate (EFR). This CEF sells at a 1% premium, which is low compared to an average premium of 5% over the past year. The distribution is 6.2%, none of which was ROC. The fund holds 800 securities, with 90% in floating rate loans. About 85% of the securities are from U.S. companies. EFR utilizes 35% leverage and has an expense ratio of 1.8% including interest payments.

- ING Prime Rate Trust (PPR). This CEF sells for a premium of 2%, which is below the average premium of 5%. It has a distribution of 6.8%, none of which was ROC. The fund has 350 holdings, virtually all in senior loans and from US companies. PPR utilizes 29% leverage and has a high expense ratio of 2.1%, including interest payments.

- Invesco VK Dynamic Credit Opportunities (VTA). This CEF sells for a discount of 5%, which is below the average discount of 1%. It has a distribution of 7.1%, none of which was ROC. The fund has 495 holdings, with 76% in floating rate loans. About 25% of the loans are from non-US companies. VTA utilizes a relatively low 20% leverage but still has a high expense ratio of 2.1%, including interest payments.

- Invesco VK Senior Income (VVR). This CEF sells for a discount of 1%, which is below the average premium of 3%. It has a distribution of 7.1%, none of which was ROC. The fund has over 500 holdings, with 89% in floating rate loans. Almost all (95%) securities are from US companies. VTA utilizes 26% leverage and has a relatively high expense ratio of 2.1%, including interest payments.

- Nuveen Credit Strategy Income (JQC). This CEF sells for a discount of 5%, which is below the average discount of 1%. It has a distribution of 7.7%, none of which was ROC. The fund has 446 holdings, with 71% in floating rate loans and 20% in high yield bonds. Virtually all securities are from US based companies. JQC utilizes 29% leverage and has an expense ratio of 1.9%, including interest payments.

- Nuveen Floating Rate Income Opportunities (JRO). This CEF sells for a discount of 3%, which is below the average premium of 4%. It has a distribution of 7.3%, none of which was ROC. The fund has 274 holdings, with 79% in floating rate loans and 11% in high yield bonds. About 93% of the securities are from US based companies. JRO utilizes 30% leverage and has an expense ratio of 1.8%, including interest payments.

- Nuveen Floating Rate Income (JFR). This CEF sells for a discount of 3%, which is below the average premium of 3%. It has a distribution of 7.0%, none of which was ROC. The fund has about 300 holdings, with 80% in floating rate loans and 10% in high yield bonds. About 90% of the securities are from US based companies. JFR utilizes 30% leverage and has an expense ratio of 1.8%, including interest payments.

- Nuveen Senior Income (NSL). This CEF sells for a discount of 3%, which is below the average premium of 3%. It has a distribution of 7.0%, none of which was ROC. The fund has about 250 holdings, with 85% in floating rate loans and 10% in high yield bonds. About 92% of the securities are from US based companies. JFR utilizes 30% leverage and has an expense ratio of 1.8%, including interest payments.

- Pioneer Floating Rate Trust (PHD). This CEF sells for a discount of 3%, which is below the average premium of 3%. It has a distribution of 7.1%, none of which was ROC. The fund has 379 holdings, with 90% in floating rate loans. About 96% of the securities are from US based companies. PHD utilizes a high 36% leverage but has a low expense ratio of 1.6%, including interest payments.

For comparison with bonds and equities, I also included the following ETFs in the analysis:

- iShares Barclays 7 to 10 Year Treasury Bond (IEF ). This ETF tracks the performance of intermediate term treasury bonds and yields 1.7%.

- iShares Barclays 20+ Year Treasury Bond (TLT ). This ETF tracks the performance of long term treasury bonds and yields 2.9%.

- iShares iBoxx $ High Yield Corporate Bonds (HYG). This ETF tracks the performance of high yield corporate bonds. It yields 6.4%.

- SPDR S&P 500 (SPY). This ETF tracks the performance of the S&P 500 equity index and yields 2%.

Risk versus Reward past 6 Years

To analyze the risks and return of floating rate CEFs, I used the Smartfolio 3 program (www.smartfolio.com ), using data over the past 6 years. The results are shown in Figure 1, which plots the rate of return in excess of the risk free rate of return (called Excess Mu on the charts) against the historical volatility.

Figure 1. Risk versus Reward over past 6 years (click to expand)

As is evident from the figure, floating rate funds had a wide range of returns and a relatively narrow range of volatilities between 22% and 27%. JQC is the exception with both a very high return coupled with a very high volatility. Are the returns associated with floating rate funds commensurate with the risk? To answer this question, I calculated the Sharpe Ratio.

Sharpe Ratio

The Sharpe Ratio is a metric, developed by Nobel laureate William Sharpe that measures risk-adjusted performance. It is calculated as the ratio of the excess return over the volatility. This reward-to-risk ratio (assuming that risk is measured by volatility) is a good way to compare peers to assess if higher returns are due to superior investment performance or from taking additional risk. In Figure 1, I plotted a red line that represents the Sharpe Ratio associated with HYG to facilitate comparing floating rate funds with high yield bonds. If an asset is above the line, it has a higher Sharpe Ratio than HYG. Conversely, if an asset is below the line, the reward-to-risk is worse than HYG.

Some interesting observations are apparent from Figure 1. Over the turbulent times between 2007 and today, the floating rate loans had poorer risk-adjusted returns than high yield bonds. However, most of the floating rate funds have done reasonably well with returns better than SPY (representing equities) and risks about the same as SPY. The floating rate funds were significantly more volatiles than either treasuries or high yield bonds. This is likely due to the large downswing in 2008 followed by equally awesome upswing. JRO had the best risk-adjusted return among the senior loans followed closely by JFR, EFR, and JQC. VVR had the poorest absolute and risk-adjusted performance over this period.

Diversification

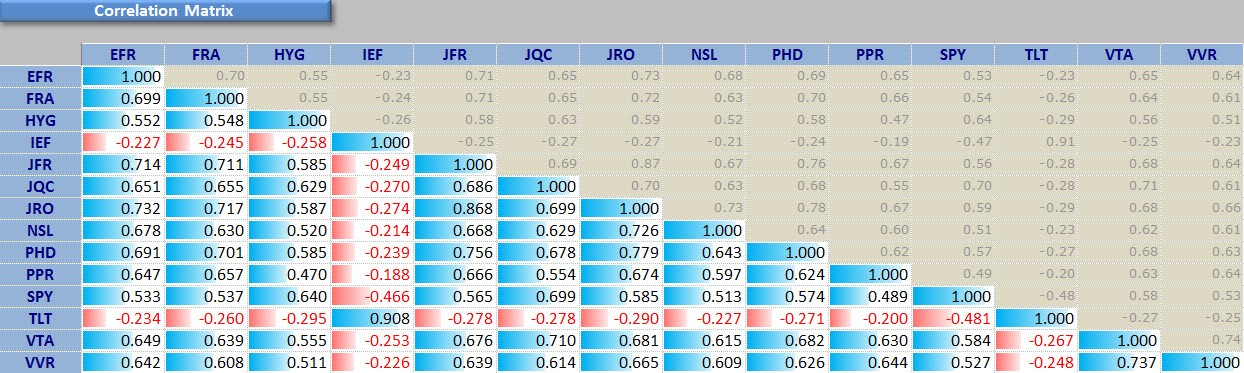

Floating rate loans are also touted as providing portfolio diversification. To be diversified, you would choose assets such that when some assets are down, others are up. In mathematical terms, you want to select assets that are uncorrelated (or at least not highly correlated) with each other. To assess the diversification potential of floating rate loans, I calculated the pairwise correlations associated with these funds. The results are shown in Figure 2.

Figure 2. Correlation matrix over past 6 years (click to expand)

As shown in the figure, none of the assets were highly correlated with each other or with treasuries. Most of the senior loan funds had correlations with each other in the 50% to 70% range. They were also negatively correlated with treasures. So overall, floating rate loans did provide good diversification.

Risk versus Reward past 3 years

I next looked at the past 3 year period to see if the performance had changed during the more placid years after 2008 and 2009. The results are shown in Figure 3. In this figure, the blue line represents the Sharpe Ratio associated with long term treasuries (TLT).

Figure 3. Risk versus Reward over past 3 years (click to expand)

As you might expect, the volatilities during the past 3 years are much smaller than those over the 6 year period. Most of the floating rate loan funds still have similar volatilities but they are now in the 13% to 18% range. Equities were in a rip-roaring bull market during this time so they blew away the other asset classes in terms of risk-adjusted return. Floating rate loans had much better performance than treasuries. On an absolute return basis, senior loans beat high yield bonds but high yield bonds had a better risk-adjusted return than all the loan funds except for JQC. Similar to the 6 year results, JRO, JFR, and JQC had excellent results but EFR settled back into the pack. VVR redeemed itself and became one of the best performers.

Risk versus Reward since January 2012

The investment landscape became even murkier in the more recent past. Since early this year, the fear of rising rates has taken its toll on many CEFs, including floating rate funds, causing them to give back most of the year-to-date gains. Due to the nature of senior loan funds, I believe this selloff created a buying opportunity. To get a more near term view, I ran the analysis from the beginning of 2012 to the present, a little over 1.5 years. This data is presented in Figure 4. For completeness, I also added the following floating rate ETF that was launched in March, 2011:

- PowerShares Senior Loan Portfolio (BKLN). This ETF tracks S&P/LSTA U.S. Leveraged Loan 100 Index, which is an index designed to mirror the market-weighted performance of the largest institutional leveraged loans. The portfolio consists of the 100 largest loans in the senior loan space. This fund has a yield of 4.6% and a very low expense ratio of 0.7%.

Figure 4. Risk versus Reward since Jan 2012(click to expand)

Over the near term, floating rate funds have had excellent performance, with most of the funds beating the high yield ETF on both an absolute and a risk adjusted basis. JQC, JRO, and JFR have continued their good performance and over the past 19 months, VTA, VVR, and PPR also moved to the head of the line.

It is interesting to compare the PowerShares ETF with the CEFs. Since January, 2012 BKLN generated a relatively low return but did so with an extremely low volatility. BKLN had an excellent risk-adjusted return, with an absolute return comparable to high yield bonds but with half the volatility.

Bottom Line

In summary, floating rate CEFs are a unique asset class that provides investors with current income and diversification. The recent turmoil in the fixed income space has resulted in these assets selling off in sympathy with bonds. However, over the longer run, if rates do rise as expected, these assets should have good performance. In my opinion, the recent sell off is a buying opportunity and retirees looking for income should give this asset class serious consideration. But make no mistake, these are highly volatile assets and if you decide to add them to your portfolio, they will need to be managed carefully.