Risk management in the asset management industry (risk measurement techniques) An evaluation of

Post on: 22 Июнь, 2015 No Comment

- Introduction

- Global mutual fund industry

- Mutual fund industry in India

- A study of risk and asset management industry

- Major global developments deregulation globalization

- Changing environment in the Indian context

- Impact of various changes

- Definition of risk

- Factors contributing risk to the environment in which mutual funds operate

This Report is divided into two parts. Part I is introductory in nature containing brief profiles of global and Indian mutual fund industries, risk and the mutual fund industry, theoretical aspects of risk management process and various concepts associated with measurement of risks in mutual funds. Part II specifically focuses on Value at Risk (VaR) concept and examines the VaR tool in a comprehensive manner from various dimensions. Observations and conclusions are given at the end of the Report. With the increasing introduction of new financial products, expanding global marketplaces and increasing use of information technology, the nature of the securities business is constantly changing and becoming more complex.As a result,a dynamic risk management function must play an essential role in assuring investor protection and the integrity of a firm’s financial condition. Risk management is the modern discipline that answered the call to handle various business risks . A mutual fund is a type of Investment Company that gathers assets from investors and collectively invests those assets in stocks, bonds, or money market instruments. Individuals and institutions invest in a mutual fund by purchasing units (shares) issued by the fund. It is through these sales of units that a mutual fund raises the cash used to invest in its portfolio of stocks, bonds, and other securities. Through the collective investments of the mutual fund, each investor shares in the returns from the funds portfolio while benefiting from professional investment management, diversification, liquidity, and other benefits and services. The mutual fund industry experienced tremendous growth both in number of funds and amount of assets under management all over the world. In the past 20 years, mutual fund assets have grown from under $400 billion to more than $ 14.0 trillion and become a vital component of the financial security of millions of investors worldwide. The asset management industry is large, complex and fragmented. With assets in the range of tens of trillions of dollars, the industry is noted for the wide scope and depth of its investments, ranging from equities, bonds, money market and currencies, to their equivalent derivatives thereof. This had led to a perception that the industry has immense potential to affect/disrupt almost any economy in the world with its activities alone. The first funds, in the 1980s, were closed-end funds. With increasing liquidity in emerging markets, open-end funds have become the most widely used instrument. It is not surprising that it attracts a lot of attention of the regulatory agencies that would like to ensure that fund managers select investment strategies that are optimal from the investors point of view. Keeping in view the large amount of assets managed by mutual funds, the health of asset management industry is very vital for maintaining the vibrancy of financial markets from the point of view of investors, fund managements and the regulators.

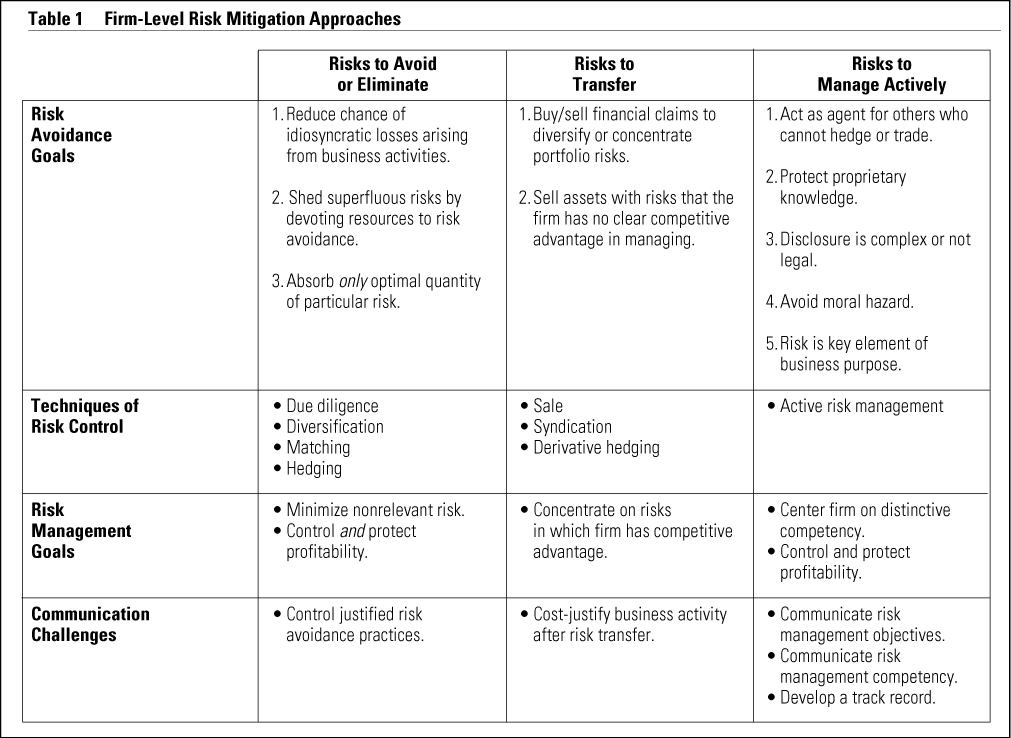

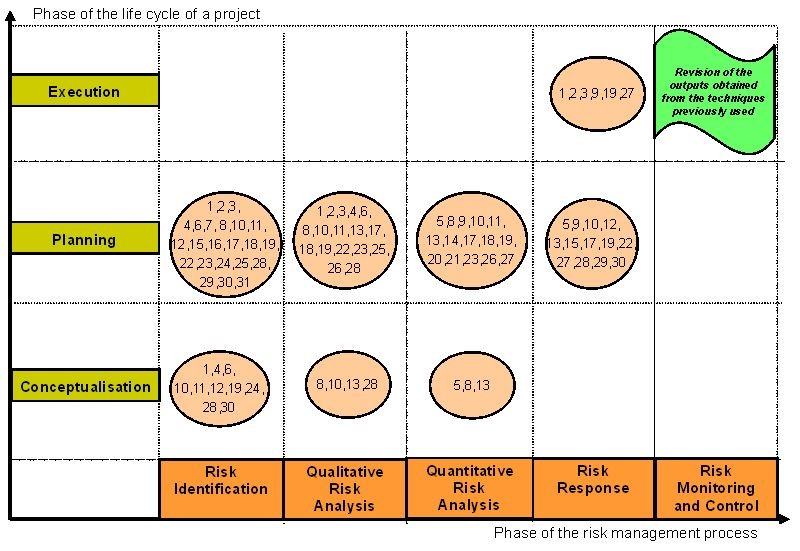

[. ] Risk Mitigation Monitor the Risk 3.4 Requirements for instituting active risk management techniques 3.5 Implementation Principles for Firm-Wide Risk Management Set of procedures 3.6 Critical challenges to risk management in mutual funds Quantification of risk Implementation problems Availability of relevant data Conceptual issues Systems failure Data related issues Need for more vigorous research Section — 4 MEASUREMENT OF RISKS BY MUTUAL FUNDS Measurement of risk — Various tools and concepts 4.2 Returns Distribution Histograms Skewness Kurtosis Omega and probability of loss 4.3 Absolute Risk Volatility Maximum Draw down Autocorrelation 4.4 Relative Risk Semi-Volatility Downside Volatility Value-At-Risk Correlation Beta Risk Decomposition 4.5 Performance Analysis Benchmarking Active Management Public and private information Passive Management 4.6 External Analysis Risk-Adjusted Performance Measures Sharpe Ratio Treynor Ratio Jensen Alpha M2 Approach Sortino Ratio Modigliani measure Morningstar Ratings 4.7 Investment style and risksInvestment performance analysis — Techniques PART — II Section 1 VALUE AT RISK 1.1 Introduction to Value at Risk 1.2 Definition of Value at Risk 1.3 Three Elements of VaR concept 1.4 Methods of calculating VaR The Historical approach The Variance-Covariance approach Monte Carlo Simulation 1.5 Conversion from one time period to another 1.6 Which method is the best? [. ]

[. ] Using VaR to check Compliance: The impetus for centralized risk management in the investment management industry came from the realization that the industry is not immune to the rogue trader syndrome that has plagued the banking industry. More generally however the fear is that an investment manager may deviate from guidelines, which may cause huge losses. VaR systems provide a central repository for all positions. Independent reconciliation against manager positions makes fraud a lot more difficult. VaR systems also allow users to quickly catch deviations from stated policies. [. ]

[. ] Their methodology has been accepted by regulators, fund managers, investors and academics as an initial step towards instituting a more efficient risk control and management system Definition of Value at Risk: summarizes the worst expected loss over a given target horizon under normal market conditions at a given level of confidence. Positive features of VaR. Among various reasons due to which, VaR has gained popularity is its ability in measure risk across different financial instruments. In general, it can be used to calculate risks implicit in price movements for equities, commodities, bonds and currency exposures provided there is sufficient data on assets and risk factors from which to calculate the probabilities and correlations of future price changes. [. ]