Retirement Q&A Best dividend ETFs

Post on: 24 Июль, 2015 No Comment

Story Highlights

- The dividend yield on the Standard and Poors 500-stock index in 2013 was 2.44% Dividend income also helps cushion downturns Companies with a history of raising dividends tend to be financially stable

Q. What are the best exchange-traded funds for dividend investors?

A. Naturally, it depends on what you mean by best.

Retirees love dividends because they offer regular income, something that your money fund or bank CD offers very little of. The average money market fund yields just 0.01%, according to iMoneyNet.com, and the top-yielding one-year bank CD listed by Bankrate.com yields just 1%.

The dividend yield on the Standard and Poor’s 500-stock index in 2013 was 2.44%. But that’s not all that makes dividends appealing. Companies can (and often do) increase their payouts annually, something that bonds and CDs don’t do.

Investing in a dividend ETF has several advantages over picking individual stocks. ETFs are mutual funds that trade on the stock exchanges, just as IBM or ExxonMobil does. When you buy an ETF, you’ll get a slice of a diversified portfolio of dividend-paying stocks, which can cushion your losses. You’re much better off if one stock in a portfolio of 50 gets clobbered than if you own three stocks and one gets smacked.

Because most ETFs are index funds, they charge very little in annual expenses. If you own a fund that’s receiving a 2.5% dividend yield and charges you 1% a year, you’re giving away 40% of your investment income to the fund manager.

Now comes the hard part: How to pick a dividend ETF. You have several choices:

•High yield. This is the riskiest approach. A company’s dividend yield is its previous 12 months’ payout divided by its current share price. If a company’s share price is $20 and its dividend is 50 cents, its yield is 2.5%. Most companies don’t have really high dividend yields because they’re swell people who want to give away money. Most cases, a high dividend yield means that the company’s share price has fallen. In the above example, suppose the company’s share price fell to $10. its yield would be 5%.

If you’re not worried about the risks of high-yielding dividend ETFs, consider iShares High Dividend ETF (ticker: HDV), which yields 3.17%, according to Morningstar, the mutual fund trackers. The fund charges 0.40% in annual expenses.

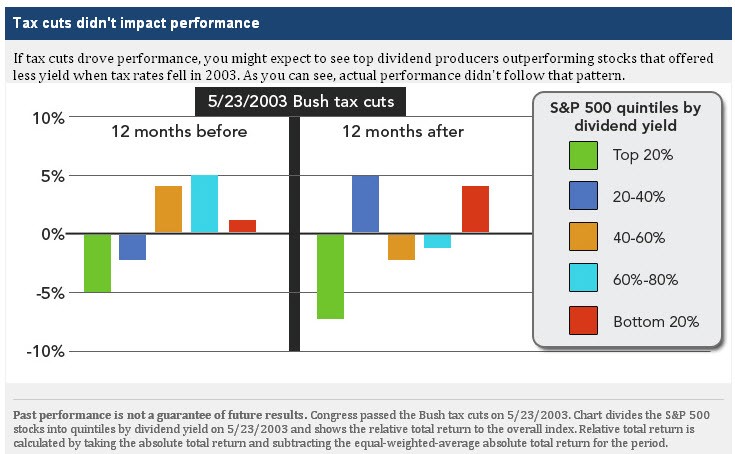

•Rising dividends. Companies that raise their dividends are usually pretty confident that they can keep the dividend at that level. Why? Because Wall Street clobbers companies that cut their dividends. One strategy that works well in times of low interest rates is to buy stocks of companies with a long, unbroken history of raising dividends. Coca-Cola, for example, has raised its dividend every year for 51 years.

Vanguard Dividend Appreciation ETF (VIG) invests in companies with a solid track record of raising their dividends. The yield: 1.84%. (One reason companies can continually raise dividends is by keeping dividends relatively low to begin with. The fund charges just 0.10% in annual fees, or $10 per $10,000 invested.

•Pure dividends. Rather than engage in a dividend strategy, consider investing in an ETF that simply invests in the companies in the S&P 500 that pay dividends. WisdomTree Large Cap Dividend (DLN) does just that. Yield: 2.40%. Expenses: 0.28%.