REITs or Bonds Deciding Between REITs and Bonds for Investment

Post on: 9 Июнь, 2015 No Comment

The Totally Risk-Averse Investor Usually Chooses Bonds & Lower Total Yield

You can opt-out at any time.

When comparing bonds to REITs on the one aspect of yield, bonds will frequently look better than REITs. Bond dividend yields are higher in many cases. That would exclude government bonds with generally lower yields but lower risk, as the government isn’t going to go bankrupt. we hope.

Bonds also guarantee the return of the original investment if held to maturity. If you purchase a $5000 bond with a 7% yield, you’ll get your $5000 back when it matures plus you will have earned the 7% interest through the period. REITs can not guarantee the value of the shares at any given point in time. Taking all of the above into consideration, the investor that absolutely doesn’t want to risk their original investment in any way would opt to invest in bonds.

Let’s look at the other ways in which REITs can return profits on your investment and why they are right for many investors who are willing to take on a little more risk in return.

Bonds are very sensitive to interest rate fluctuations. — If interest rates rise, the market value of a bond decreases. If the investor must sell at this time, they will receive less than face value. If interest rates fall significantly, the bond is in risk of being called. The investor gets their full value but must then find another investment at a lower yield. Since many REITs are invested in commercial or residential rental properties with fixed mortgages, a rise in interest rates will not significantly impact their profitability. On the contrary, they can push potential home buyers into rentals, thus increasing demand and raising rents.

Inflation reduces the bond owner’s buying power. Inflation reduces the buying power of the dollar. Your bond investment is fixed at the value and yield at which purchased. Inflation eats away at your return. With REITs, inflation driving up the price of housing can also move more people into the rental market. With increasing demand, the REIT can raise rents and profits.

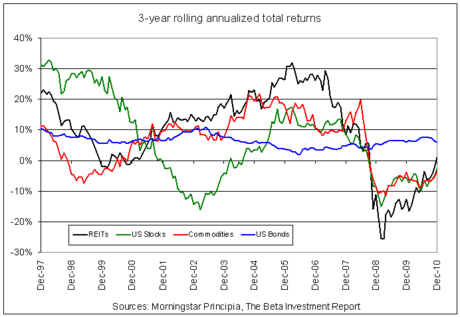

Bond values are fixed, while REIT shares can climb. As we’ve stated, the bond you purchase at $5000 will return that amount to you at maturity, with interest. The REIT will also be paying a dividend throughout your period of ownership, as by law they must return 90+% of their operating profits to the share holders. REITs that are operating efficiently can increase their profits through good management or increased rents with higher demand. They can also purchase and sell properties to create profits. Doing these things well results in financial performance that creates more demand for the REIT shares, thus their prices can rise like any normal stock.

No investor should make their decisions based on this information alone. A careful study should be done of the types of REITs available and their performance over time. Then compare these results with that of bonds of different types, assess your risk tolerance and decide what to do. It is probable that some balance of both will create a properly diversified portfolio.