Redefining RiskFree

Post on: 6 Июль, 2015 No Comment

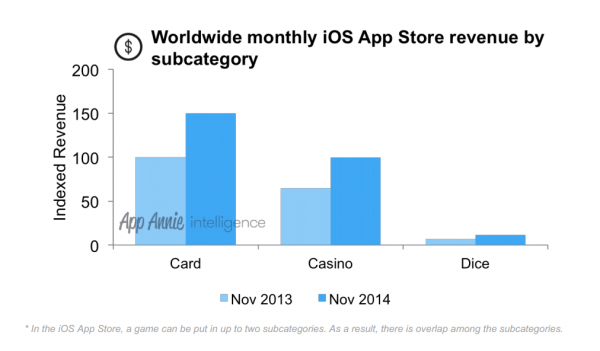

In my opinion, the term risk-free and the rate it usually pertains to in the world of debt markets is misleading at best. Holders of U.S. debt embrace the fact that the full faith and credit of the United States (i.e. the authority of its government to tax) is a guarantee for their principal. They see no substantial downside risk to their investment, let alone a default risk. Here in the U.S. we view the risk-free rate as the yield on the 1-month T-Bill. As you can see from the chart below, this rate is spiking.

At the beginning of the week, the risk-free rate was 0.08% and by the end of the week it had spiked to 0.25%. That is a substantial basis point rise in something that is considered to have no risk.

Why the Spike in Rates?

This spike is due to the fact that we are quickly approaching a deadline in which Treasury Secretary Jack Lew says the United States will breach the $16.7 trillion debt limit. In combination with a partial government shutdown, the U.S. is approaching a dangerous moment given the opposition for any kind of compromise on either side of the aisle.

Why Does it Matter?

The issuance of T-Bills is vital because they are the most liquid collateral for the $70 trillion shadow banking system. Without the constant liquidity and demand for these short-term T-Bills to provide for derivative markets, our banking system fails.

While I don’t think a full-blown default is likely to happen, a technical default is possible in the next month, only affecting the timing of the payments that are due. Yet, the future chances of a complete U.S. default is far from risk-free if not inevitable if fiscal policies aren’t drastically changed.

If or when a full-blown default happens, it will occur when major U.S. debt holders (China, Japan, etc.) realize the mighty U.S. dollar is not what is used to be and start selling their massive debt holdings.

Just last week Zhu Guangyao, the vice-finance minister of China, told reporters in Beijing: We ask that the United States earnestly takes steps to resolve in a timely way before 17 October the political [issues] around the debt ceiling and prevent a U.S. debt default to ensure safety of Chinese investments in the United States and the global economic recovery. This is the United States’ responsibility. China is the largest foreign holder of U.S. debt, owning about $1.28tn of U.S. Treasury bonds at the end of July, according to the Treasury. Along with that statement, Zhu added, we hope the United States fully understands the lessons of history , referring to the 2011 downgrade of the U.S. credit rating, which led to a sharp 15%+ decline in the S&P500 (NYSEARCA:SPY )(NYSEARCA:DIA )(NASDAQ:QQQ ).

Additionally, commentary on the Chinese state news agency Xinhua said Sunday (October 13th), The cyclical stagnation in Washington for a viable bipartisan solution over a federal budget and an approval for raising debt ceiling has again left many nations’ tremendous dollar assets in jeopardy and the international community highly agonized. They also expressed that, Instead of honoring its duties as a responsible leading power, a self-serving Washington has abused its superpower status and introduced even more chaos into the world by shifting financial risks overseas. In that same commentary, they stated that they believe U.S. fiscal failure warrants a de-americanized world. Lastly, and most importantly, they proposed a new international reserve currency that is to be created to replace the dominant US dollar (NYSEARCA:USD ). If the past is any prediction on what the future will bring, we could come to the conclusion that a reserve currency status does not last forever, and the USD is no exception.

Quantitative Easing?

Since 2008, Ben Bernanke and Federal Reserve has been implementing an economic experiment to epic proportions. Currently, the Federal Reserve is spending $85 billion a month in an attempt to prop up the economy (NYSEARCA:TLT )(NYSEARCA:TBT ). Subsequently, the Federal Reserves balance sheet has been growing at an exponential rate since the start of Quantitative Easing in 2009. You can see this below:

The Federal Reserve has been creating value out of thin air to provide the monthly stimulus that has more or less created a treasury and asset bubble of unprecedented size. At some point, the Federal Reserve will have to manage their massive treasury position, which has been pumping up the bond market bubble since 2008.

What can I do?

A collapse of the USD would send a shockwave through the world economies. According to Jamie Dimon, the CEO of J.P. Morgan (NYSE:JPM ), a US default would ripple through the global economy in a way you couldn’t possibly understand. Additionally, Deutsche Bank (NYSE:DB ) co-CEO Anshu Jain called the possibility of even a small default utterly catastrophic. He noted that the potential consequences are so immeasurable he couldn’t offer any legitimate recommendations on how to react. Even ignoring a complete default, Jim Cramer suggested that given the fragility of the globe’s economies it is difficult to see how this stalemate doesn’t throw the world into a recession .

Personally, I have been accumulating physical gold/silver (NYSEARCA:GLD ) (NYSEARCA:SLV ); the only true protection against the debasement of the currency. In the end, Article I, Section 10, Clause 1 of the Constitution states no state shall coin Money; emit Bills of Credit; make any thing but gold and silver coin a tender in payments of debts. Gold and silver is the only real currency and all fiat currencies are purely paper backed by debt filled central banks and governments.

However, back in 1933, during the Great Depression, FDR banned the private possession of precious metals (GLD ) and ordered all US citizens to turn there gold in to the government under Executive Order 6102. The people who did were paid around $20 per ounce even though the actual price of their gold was worth $33 per ounce. Effectively the government stole 70% of their wealth overnight. Thus, if you’re smart enough to hold precious metals as a hedge against the inevitable collapse of the dollar/paper currency, be aware of the historical executive orders against the individual possession of these metals. In that case, you will be prepared once the crisis occurs and the government implements their drastic capital controls.

Conclusion

For the first time on record. U.S. government debt (short-term T-Bill) is riskier than U.S. bank debt (short-term LIBOR) (NYSE:BAC )(NYSE:WFC ). The yield on the short-term T-Bill is greater than the LIBOR, presenting a larger risk. Thus, given the implications of the absence of a purely risk-free rate, typical asset pricing models used today seem flawed if not irrelevant.

Nevertheless, the political gridlock in Congress and their reluctance to raise the debt ceiling alone is a substantial risk to the solvency of U.S. debt. Given that they would hold up the whole government and risk default just because they don’t get their way on one specific issue is enough of a reason to take the label of risk-free off U.S. Treasuries. In other words, merely the presence of Ted Cruz and his allies in Congress present a threat to the soundness of U.S. debt, even ignoring our massive debt and deficits.

The next few months will be vital to the direction of the stock market and the USD. In the future I see an eventual steepening of the yield curve before the bond market completely implodes. To put it in perspective, the outstanding government debt is 23 times the $517 billion Lehman Brothers owed when it filed for bankruptcy on September 15th, 2008. Given the importance of the U.S. Treasury market to worldwide banking, the inevitable bond market collapse will make the crash of Lehman Brothers in 2008 and the recession that followed look like a cake-walk.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.