Recommendation Go beyond traditional stocks and bonds Market Realist

Post on: 30 Апрель, 2015 No Comment

5 things for every investor's to-do list as 2014 draws to a close (Part 8 of 8)

Recommendation: Go beyond traditional stocks and bonds

Finally, it’s worth considering incorporating non-traditional, or alternative, strategies into your investing arsenal. With such investments, you can potentially enhance diversification and amplify your portfolio’s growth potential.

Market Realist – Pigeonholing investments in only stocks and bonds doesn’t work during periods of high volatility (VXX ). A traditional “diversified” portfolio can be found lacking in times of high stress.

Alternative investments can help you attain more diversification in your portfolio. Alternative assets can be risky investments on a standalone basis. But they can prove to be great investment opportunities in a balanced portfolio. The following are some advantages of alternative investments as an asset class:

1. Diversification benefits: Alternative assets fewer correlations with equity and bond markets compared to other asset classes. You can see this in the graph below.

The above graph shows the correlation of various asset classes with the S&P 500 (SPY ) from September 30, 2004, to September 30, 2014. As you can see above, commodities have less correlation with the S&P 500 than other asset classes like emerging market equities (EEM ), emerging market debt (EMB ), high yield bonds (HYG )(JNK ), and developed markets (EFA ). REITs are at par with EM equities, but they exhibit less correlation than developed markets.

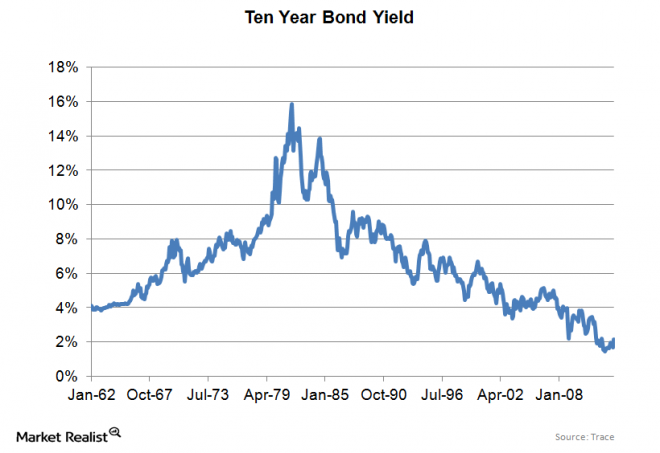

2. Hedge against inflation: Some classes of alternative assets are often considered good inflation hedges. These include commodities like gold and silver as well as infrastructure investments, which provide low but stable returns.

3. Higher returns: Alternative investments have been known to give higher returns than traditional asset classes even during periods of high financial stress. They can help smooth out the returns from a portfolio. But you must be cautious because adding alternative asset classes could expose your portfolio to higher volatility (VXX ).

You can access alternative asset classes by investing in ETFs like the SPDR Gold Trust (GLD ), the iShares Silver Trust ETF (SLV ), the Market Vectors Gold Miners ETF (GDX ), the iShares U.S. Real Estate ETF (IYR ), the Alerian MLP ETF (AMLP ), and the Vanguard REIT ETF (VNQ ).

It’s important that you adopt a balanced approach while constructing your portfolio. In the final quarter of 2014, investors need to look for relative value and not overreach in their search for income. Asset class deception may trick investors into purchasing asset classes that don’t provide diversification benefits and expose them to greater risk. Read our series Overview: Why investors should watch for asset class deception to learn more about this phenomenon.