Rebalance & Review Your Investment Portfolio

Post on: 4 Апрель, 2015 No Comment

A tough lesson for young automobile owners can come when they buy a car, drive it for months on end, never giving a thought to looking under the hood only to run out of oil and ruin the engine. For the lack of an oil check, the car will no longer run.

Once you have a designed and implemented investment strategy, your portfolio is like that car: To keep everything running well, its a good idea to go in for periodic maintenance.

Rebalancing is the professions term used for performing tune-ups of your investments. Either on a calendar basis such as once a quarter or once a year, or as specific conditions change, you should check on your portfolio, see what has happened, and adjust the asset allocation and fund selections as needed. The Mutual Fund Store recommends you perform a personal quarterly review of your portfolio and bi-annual visits with your investment advisor.

Market changes

Life has unlimited and unpredictable variables and investment markets do change, sometimes quickly. Even if you have bought high-quality mutual funds or other investments after diligent research, these should be monitored regularly to see if your portfolio needs rebalancing.

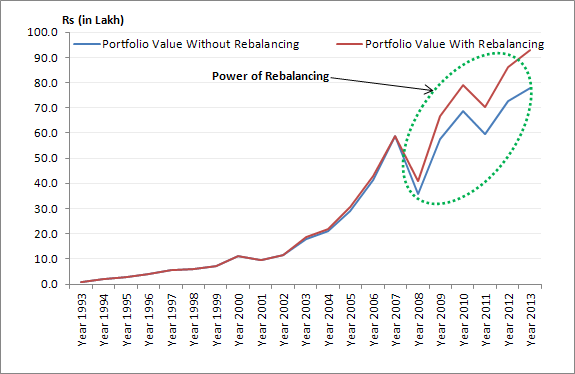

Changes in market prices of assets are probably the most common reason for needing to rebalance accounts. You have designed an asset allocation plan to achieve your long-term financial goals like retirement or your childrens education. When one asset increases in price or another declines, your allocation can get off balance.

For example, suppose your allocation is 60 percent stocks, 30 percent bonds and 10 percent cash. If stocks rise significantly, your portfolio could shift to 80 percent stocks. But your goals and investment strategy remain the same. So its time to rebalance shifting assets into bonds and cash to bring the allocation back into line with your target of 60 percent stocks.

Other market changes that suggest possible rebalancing include increases in volatility that alter the risk profile of assets, higher inflation that requires an increase in returns to keep up, or new tax laws that may impact the returns on some assets. In addition, your mutual funds may need to change if there are changes in those funds management.

How to rebalance

When changes in the market cause an imbalance in your portfolio that overweights or underweights one or more asset classes, restoring the original mix will keep your plan on track to help accomplish your long-term goals. This is why a personal quarterly review of your portfolio and meeting with your investment advisor at least twice a year is such a good idea.

Rebalancing begins with a review of investments in your portfolio, looking for any changes and how the allocation has shifted. To get back to the targeted allocation, a combination of these three approaches is used:

- Sell some of the portfolio investments in asset classes that are now overweight, and use the proceeds to buy investments in underweighted asset classes.

- Buy additional investments in asset classes that are underweight compared to the target allocation, using cash from the portfolio.

- Add money to your savings, using these regular or special contributions to buy additional assets in the underweighted categories until your allocation is back in line.

Changing your targets

Your portfolio review may also cause you to consider changing your asset allocation targets. Such a change in long-term strategy should be based on significant changes in your personal situation and not the short-term twists and turns of the market.

Among the personal changes that suggest a rethinking of asset allocation are changes in time horizon for your goals for example, retirement is drawing near or in family structure such as getting married, getting divorced or having children. These changes may alter your level of tolerance for risk or your need for returns in a certain time frame.

In general, as retirement or other major goals get closer, you will want to reduce risk in your portfolio because you will need to draw out money in the near term. Conversely, a large influx of cash such as an inheritance may reduce your need for higher risk-higher return approaches and allow you to increase the allocation to more conservative investments.

In reviewing your portfolio, it is important not to change allocation strategies on a whim or based on emotions. The market can play with an investors emotions, and if you alter your allocations with every turn in stock prices, youre not any better off than an investor with no long-term strategy.

Rebalancing and taxes

In tax-deferred accounts such as an IRA or 401k, if you sell an investment that has appreciated in value in exchange for another, you wont be taxed on the capital gain that you realize when you sell that investment. However, depending on the type of IRA, there may be tax consequences if you withdraw money from the account while rebalancing. It’s a good idea to contact a tax advisor for specific tax-related questions.

In taxable accounts, however, you must pay taxes on the capital gains that you realize when you sell an investment that has appreciated in value. We believe that rebalancing should still be done, even though some taxes may have to be paid.

However, there are ways to minimize the amount of taxes that you will pay as a result of rebalancing, including:

- Holding an investment for a long period of time rather than a short period — Whenever possible, it is best to hold an investment for a long period of time before selling it. Realized gains from long-term investments are taxed at a lower rate than gains from short-term investments.

- Buying a mutual fund for your portfolio after a distribution occurs — Mutual funds make periodic distributions of income and capital gains, and if you are a shareholder as of the record date and therefore receive a distribution, then you are taxed on that distribution. It is therefore best to buy a mutual fund after the distribution.

- Tax-loss harvesting — This involves selling investments that have decreased in value, below your purchase price, and replacing those sold assets with a similar type of investment. This generates capital losses that can be used to offset capital gains. If you are able to cancel out your capital gains with capital losses, there are no capital gains left to pay taxes on. And because you replaced your investment that fell in value with a similar investment, your portfolio continues to hold the proper mix of investments.

- New cash — If you continue to contribute new cash to your portfolio, you can use that cash to buy more of those investments that are below your initial asset allocation targets. By using cash to bring those investments up to proper levels, you may not have to sell any of your investments that have appreciated in value. If you can rebalance your portfolio with newly contributed cash versus using the proceeds from selling an investment that has appreciated, you wont generate any taxable capital gains.

What to do next

- First, be sure you have a well-designed asset allocation plan in place.

- Review your portfolio quarterly and schedule portfolio meetings with your investment advisor at least twice a year.

- Make sure rebalancing is a discipline applied to your plan to keep you on track with financial goals for the long run.