Real Estate Investment Trusts (REITs)_1

Post on: 1 Апрель, 2015 No Comment

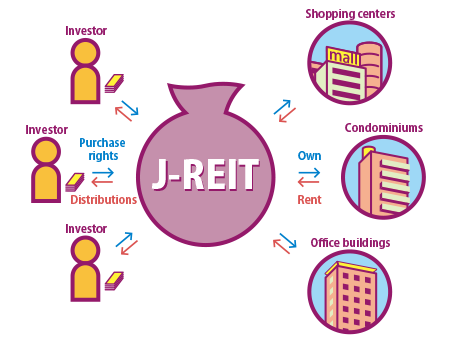

A real estate investment trust (REIT) is a fund that buys and manages real estate and real estate mortgages. REITs offer individual investors the opportunity to invest in real estate without having to own or manage an individual property.

REITs were very popular in mid 1996 when inflation was expected. During 2001-2002 when stock markets dropped investors went back to REITs as a way to safeguard their investments.

A REIT is as a closed-end mutual fund because they invest their incomes from initial share sales in real estate. REITs buy, develop and manage real estate properties, to later give shareholders the incomes from rent and mortgages as dividends.

REITs do not pay corporate income taxes but they must, by law, distribute 95% of their income net to shareholders. Consequently, there is not much left from incomes to finance future real estate acquisitions.

Following we show you 3 basic types of REITs:

- Equity REITs buy, operate and sell real estate such as hotels, office buildings, apartments and malls. Mortgage REITs build and offer mortgage loans to developers. Hybrid REITs are combination of equity and mortgage REITs and they buy, develop, and manage real estates. They also provide financing through mortgage loans. Most part of hybrid REITs have a stronger position concerning equities or debts. There are very few balanced hybrid REITs.

Risks are not the same for each kind of REIT for what you should evaluate each one very carefully before investing on them. Equity REITs generally tend to be less speculative than mortgage REITs although the level of risk depends on how trust assets are formed.

Mortgage REITs lend money to developers what involves a higher risk. As a result mortgage REIT shares tend to be more volatile than equity REIT shares. Particularly during recession. Equity REITs have recently become very popular. Their 55% accumulative performance of total returns from late 1999 until August 2002 have surpassed the Standard and Poor?s (S&P) 500 Index which dropped a 35% for the same period.

Equity REITs get incomes form collected rents over properties that they carry on their portfolios and the constant price increase of these. Mortgage REITs are more sensitive to interest rate changes in the economy than the equity REITs. The reason is that mortgage REITs keep mortgages whose prices move on the opposite direction than interest rates.

Mortgage REITs generally better their performance when interestrates drop. This because they keep in their portfolios different types of properties and this makes their objective be more oriented to receiving incomes and that is why they emphasize on current rents. Equity REITs on the other hand offer a potential in profit capital in addition to common incomes.

For example, Annually Mortgage Management Inc. (a mortgage REIT) paid dividends with a 9% yield in the first 2005 trimester which was a great dividend rate for stock and bonds yield.

REITs can have a finite or perpetual life. The Finite-life REITs, also known as FREITs, are of autonomous liquidation. In the equity?s REITs case properties are sold at the end of a specific period.

In mortgage REITs earnings are paid to shareholders when mortgages are paid off. There is little relation between performance of REITs and the stock market. Therefore investors should keep a small percentage (no more than 5%) of their asset investments in REITs.