Reading a Balance Sheet

Post on: 30 Май, 2015 No Comment

A balance sheet communicates the state of your business to you and to others, and is key in business valuation and assessing the financial health of your company. The balance sheet uses a standard accounting format showing the same categories of assets and liabilities no matter the size or type of business. The reason for this standardization is the ability to compare the financial statements of different companies and to compare the financial strength of your company from quarter to quarter. It is one of a business’s most important decision-making tools.

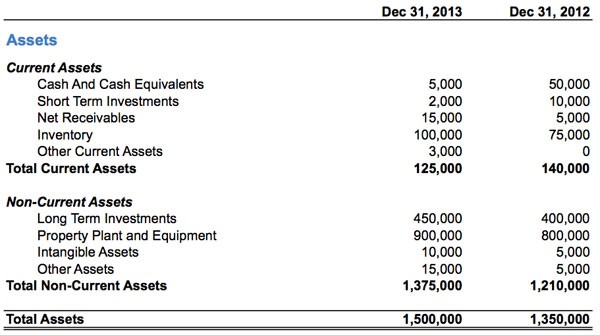

In the Assets section, each type of asset is listed. Assets are arranged in order of liquidity—how quickly they can be turned into cash. The goal of the Assets section is to determine the total worth of all the company’s assets.

Current assets include cash, accounts receivable, securities, inventory, prepaid expenses, and anything else that can be converted into cash within one year or during the normal course of business.

- Cash includes cash on hand, in the bank, and in petty cash.

- Accounts receivable are the amount of money that customers presently owe the company. Because every company will have some bad debts, the amount of bad debts known and expected should be deducted from the accounts receivable as reserve for doubtful accounts. The net receivables are calculated as:

Accounts Receivable — Reserve For Doubtful Accounts = Net Receivables.

- Inventory consists of goods ready to be sold, raw materials, and partially completed goods that will be sold. The balance sheet should reflect the value of inventory as the cost to replace it.

- Prepaid expenses are a current asset because they represent goods or services already paid for but not yet fully used or consumed. For example, prepaid insurance premiums and prepaid rent are prepaid expanses.

Fixed assets are also called long term assets. Fixed assets are assets that produce revenue. They can include such items as office furniture, vehicles, real property, building improvements, and factory equipment. They are considered long term because they are not intended to be sold. The value of a fixed asset might include installation, shipping, and expenses for preparing the asset for service. The depreciation on fixed assets should be deducted from the asset values to prevent overvaluation. Net fixed asset value is calculated as:

Cost — Depreciation Taken To Date = Net Book Fixed Asset Value.

Other assets are generally fixed assets that are intangible. These assets may include patents, royalty arrangements, copyrights, goodwill, and life insurance on officers and key employees. Often, intangibles are not included on a balance sheet because of the difficulty of valuing them. However, in some cases where intangible values are significant, they are broken down by type just as was done when listing inventory.

All assets are totaled in the line item Total Assets.

Liabilities are the business’s debts. Just like assets, there are two types of liabilities—current liabilities and long-term liabilities. Liabilities should be arranged on the balance sheet in order of how soon they must be repaid. For example, accounts payable will be listed first because they generally must be paid within thirty days, while notes payable are usually due within ninety days to a year, loans may be due over many months or years, and mortgages may extend as long as thirty years.

Current liabilities include accounts payable, notes payable, accrued expenses such as wages and salaries, taxes payable, and the portion of long-term debts due within one year from the date of the balance sheet.

- Accounts payable are amounts owed to creditors for services or goods the company has received but not yet paid for.

- Notes payable and loans are money due to lenders within the next year.

- Accrued expenses are payroll and payroll taxes which are due for the work done by employees but which have not yet been paid.

Long-term liabilities are any debts that must be repaid more than one year from the date of the balance sheet. They may include start-up financing or mortgages.

All liabilities are totaled in the line item Total Liabilities.

The Net Worth is calculated as:

Total Assets — Total Liabilities = Net Worth.

So, What Does It All Mean?

By looking at a balance sheet, a business owner can use several simple benchmarks to analyze the health of a business and help make good decisions in managing the company.

Working Capital = Total Current Assets — Total Current Liabilities.

Working capital simply shows whether a company is making or losing money, and is used by lenders to evaluate whether a company can survive hard times. It should always be a positive number. Loan agreements often specify how much working capital the borrower must maintain.

Current Ratio = Total Current Assets/Total Current Liabilities.

The current ratio measures financial strength. The number of times current assets exceed current liabilities shows the company’s solvency. It answers the question, Does my business have enough current assets to meet the payment schedule of current liabilities with a margin of safety?In general, a strong current ratio is two or more. Of course, this will depend on the type business and the type of the current assets and current liabilities. A very high current ratio might mean that cash on hand isn’t being used efficiently. For example, it might be a good time to invest in updated equipment for greater productivity.

Quick Ratio = (Current Assets — Inventory)/Current Liabilities.

The quick ratio measures a company’s liquidity by looking only at a company’s most liquid assets and dividing them by current liabilities. It helps determine whether a business can meet its obligations in hard times. Quick assets are cash, stocks and bonds, and accounts receivable (i. e. all current assets on the balance sheet except inventory). Quick ratios between. 50 and 1. 0 are usually considered satisfactory if receivables collection is not expected to slow.