Reader Case Study – Early Retirement with Municipal Bonds

Post on: 16 Март, 2015 No Comment

Hey Everyone,

Today, we’ll take a look at an early retirement case study. Adam wrote me a couple of weeks ago to see if he can get a second opinion on his family’s early retirement plan. Let’s go over their info and see if we can help them make up their mind.

The Current Situation

- Adam is 49 and his wife Jane is 48.

- They do not have kids and no one is relying on them financially.

- Adam and Jane are ready to leave their corporate jobs. Their jobs are stressful and Adam has been assigned to 247 support for a long time.

- They have pensions with their jobs, but if they quit before 55, then the pension payout will be 50% less. The company will also help with healthcare ($9,000 each per year) if they can hold on until they are 55.

- Home is paid off .

Early Retirement Plan

Adam and Jane have been saving for retirement for many years and they are in a good position to quit their jobs now. They tracked their expenses closely and have a good idea of how much income they will need each year. Here is their tentative plan.

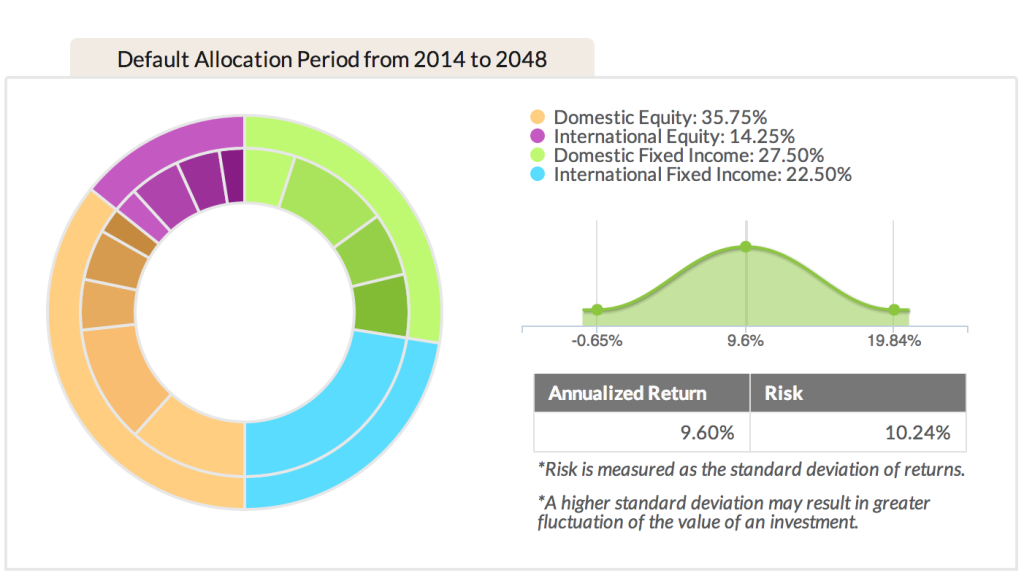

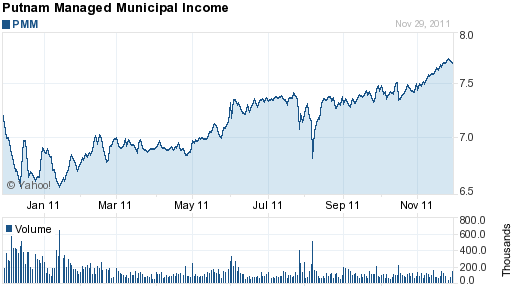

Age 49 to 55 They have municipal bond income to cover their basic expenses including health insurance and one to two vacations/year. As a municipal bond matures, even beyond age 55, Adam will try to get another 5% individual bond.

They also have about 3.5 years of expenses saved up in a saving account that they can use to supplement their expenses. They will probably need to dip into this savings to account for inflation.

Age 55 When they turn 55, they will collect their pension and add $64,000 (pretax) per year to their income. This is 50% of the full pension they would get if they stay with their employers until 55.

Age 59 ½ Adam projected that they can start withdrawing from their 401k for an additional $70,000 (pretax) per year. They hope that they can do this without depleting the principle. Total extra income $134,000/year (pension + 401k).

Age 62 They will start collecting social security benefit valued at about $36,000 pretax. Total extra income $170,000 pretax from pension, 401k, and social security.

Age 65 They will be eligible for Medicare and will save about $20,000 from health insurance.

RB40’s take

Now, I am not a financial planner and I am biased toward getting out early. so everyone will have to take my advice with a grain of salt.

To me, it looks like the sticking point is leaving 50% of their pension and the company sponsored healthcare coverage on the table. However, 5 years is a long time to endure a stressful situation especially if you don’t have to.

Here are some ideas

- Call and talk to the retirement department and see if there are any other options. Some companies will occasionally vest pensions early to reduce their workforce. For example, Intel is cutting 5,000 people this year through attrition, buyouts, and early retirement offers. Adam might want to let his manager and HR know that he is really stressed out and would be open to an early retirement offer. (Adam responded that some employees were able to collect their pension at 50, but the company is trying to save money and he doesn’t think they will give any additional early buyout packages.)

- Try to transfer to a less stressful position so he doesnt have to be on call 247. A change of scenery might be what Adam needs to hold on a little longer.

- Take a sabbatical to see if they can really handle early retirement. Early retirement really isnt an easy transition. I think they should try to take a 3 month sabbatical or something like that to see if they can adjust to not working. At my old job, you can take 1 month off unpaid and it wouldnt interrupt any of the benefit or vesting schedules. This is a good option if they need to stretch out a little time to meet bonus deadlines or other vesting schedules. Check with HR.

- One spouse works full time a little longer. This worked really well for us because we all signed on with Mrs. RB40’s health insurance and we have one stable income. Adam responded that his wife said NO WAY will she stay until 50. They are both ready to go out the door so this option isnt realistic for them.

- Work part time after retirement. I’m self employed part time in an enjoyable hobby and I think that’s a great option for anyone. Adam doesnt want to do this because he wants to spend more time on home projects. Jane wants to pursue her baking hobby and take some classes. She may consider getting a minimum wage job having something to do with baking.

- Financial Samurai’s book. I think Sam’s book, How to Engineer Your Layoff. is a great fit for Adam. You can read my review here. It shows that working with HR and your manager can be mutually beneficial and the payoff can be huge in Adam’s case. An early retirement package at 50 would set their minds at ease and make life very comfortable for them.

After a little more back and forth, it became clear that Adam and Jane will not be able to keep working in their stressful jobs until 55. The focus then became how much longer they should work.

Adam’s Exit Strategy

Milestones one step at a time.

- Both will definitely try to work through March 2014 to get the bonuses. This will increase the saving to 4x annual expense.

- Both will try to work through May or June 2014 to increase savings. This will increase the saving to 5x annual expense.

- I will try to make it to my 50th birthday in 3rd qtr of 2014 to protect my current pension.

- Will try to work through December to double savings. By then we will have the equivalent of 6.5 years of expenses if both work until then. (Jane will NOT commit to this!)

- I f we make it to December 2014, then we should stay until March 2015 to collect the bonus. If Jane makes it this far then she will work a couple of months to reach her 50th birthday in the 2nd quater in 2015.

RB40’s take on Adam’s exit strategy

Working until March sounds like a good plan to me. It’s not long and they should be able to make it without irreversible physical and mental anguish. Adam probably should encourage his wife quit after they get their bonus. He can try to stay a bit longer if he’d like to be more secure. I think they are in a very good position already. It might be a bit tight with just the muni income for a few years, but they already have an additional 4 years of expense stashed in a saving account assuming they work until March. They can dip into this backup fund as needed. They might want to build some CDs or I bonds ladder to at least get a little interest from this liquid saving.

If I was in their position, I would leave earlier rather than later. Thats just my personality, though. I know I can make a little money on the side to cover any shortfall. I also dont mind a little uncertainty. Adam is worried about the amount of saving they need, but I think they already have plenty at 4x annual expense. The municipal bond payout and saving should be more than enough to carry them through 55. After that, they will start collecting their pensions and should have plenty of income to play with.

Parting words from Adam and Jane

Several years ago, we went to Hawaii and it was a life changing experience for both of us. We realized how much we can do without and how much simpler life could be. All we had were two backpacks and we were HAPPY! We even spoke of possibly retiring there one day. When we returned home, we simplified our life by putting a stop to non-essential purchases that would make us happy just in that moment. We practiced living on just basic necessities (give or take a few splurges after stressful incidents). We tracked our expenses for the first time EVER and we brought our expenses down to less than 25% of net income changed over to pay as you go cell phones; dramatically reduced clothing purchases, etc.

Hawaii is still just a pipe dream unless we can retire at 55 in order to buy a home there but it made us see how different life could be. We cant see us working for another year or until 55.

If we stop working before 55 then we need to sell our home in order to move to Hawaii. For now, we will just plan to stay put to be near our family.

Adam: I DO NOT want to work EVER again. I have been doing 247 supports for close to 25 years and I hate the stress. Being called after hours and on the weekends burnt me out. Ive had enough of getting up at the crack of dawn; working weekends/week nights.

Jane: 10 years ago I had informed Adam Ive had enough. I continued to put up with this for the past 10 years since I promised him I would stay as long as I can to build up the pension and personal savings. I am at my limit. Part time in minimum wage position purely for enjoyment is fine by me as long as we do not need to rely on it for income.

What do you think? Do you have any advice for Adam and Jane? Personally, I think congratulations are in order. They worked hard and saved for many years. It’s time to live a more fulfilling lifestyle and enjoy the fruits of their labor. Thank you to Adam and Jane for sharing their inspirational story!